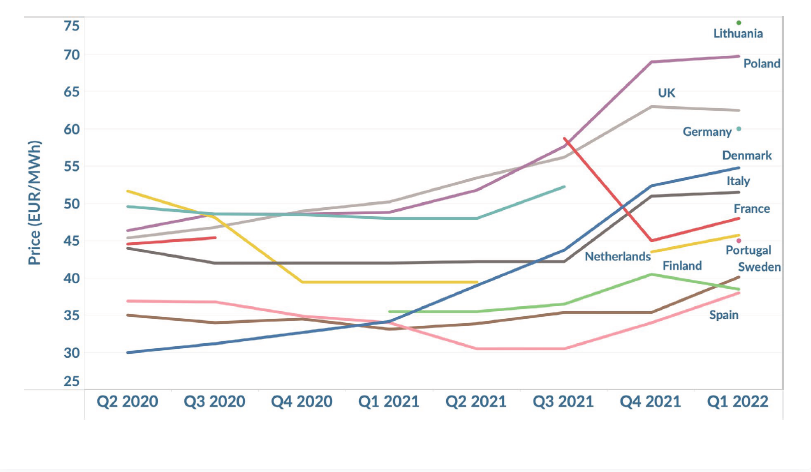

European renewable power purchase agreement (PPA) prices surged 8.1% in Q1 2022 and 27.5% year-over-year as the effects of the war in Ukraine further deepened the region’s energy crisis and caused upward price pressures, according to LevelTen Energy.

European PPA prices, which were expected to level off this year before the Ukraine conflict, have climbed for a fourth consecutive quarter according to the research organisation, with strong demand for renewable power creating a shortage of project options for offtakers.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

European P25 solar and wind prices – an aggregation of the lowest 25% of solar offers – have increased 27.5% year-on-year, exacerbated by “sky-high natural gas prices compounding existing regulatory challenges and supply chain constraints”, said LevelTen’s European Q1 2022 PPA Price Index.

The P25 index for solar offers rose by 4.1% – below the 12.4% for wind – and now sits at €49.92/MWh (US$54.1/MWh), a rise of 20% (€8.32/MWh) year-on-year.

LevelTen said the war in Ukraine, EU governments moving clean energy targets forward, supply chain disruptions and high demand for renewables and have put upward pressure on European PPA prices.

LevelTen Energy’s survey of sustainability advisories found that 20% of renewable energy buyer’s procurement timelines had been accelerated, causing even greater demand for renewable power in the short-term, with 55% remaining unchanged.

“This buyer appetite is quickly creating an imbalance between demand for renewables and supply, as developers struggle to match the pace of demand due to a combination of supply chain, interconnection and regulatory challenges,” said LevelTen.

And as corporate PPA demand reaches all-time highs amid approaching sustainability targets and ongoing energy market volatility, the supply-demand imbalance will likely continue to push PPA prices up, said the report.

One of the key issues inhibiting greater renewables deployment is permitting bottlenecks, said LevelTen. It pointed to Spain, where more than 73GW of solar projects are in the country’s project pipeline to be constructed, but only 18.6% have received appropriate permitting.

“European governments have taken steps to streamline challenging permitting processes, including Germany and Italy, but it will take time for these to be reflected in the market,” said LevelTen.

“As electricity retailer demand rises and government procurements increase, corporate buyers need to understand their goals well, be flexible when contracting, and complete deals with haste to compete in a market that is more competitive than ever,” said the report.

The impact of Europe’s energy crisis on PPA prices and revenue streams will be examined in more depth in the upcoming edition of PV Tech Power, published later this month.