Europe’s solar buyers are showing increased optimism for the sector, in spite of fluctuations in module prices across technologies.

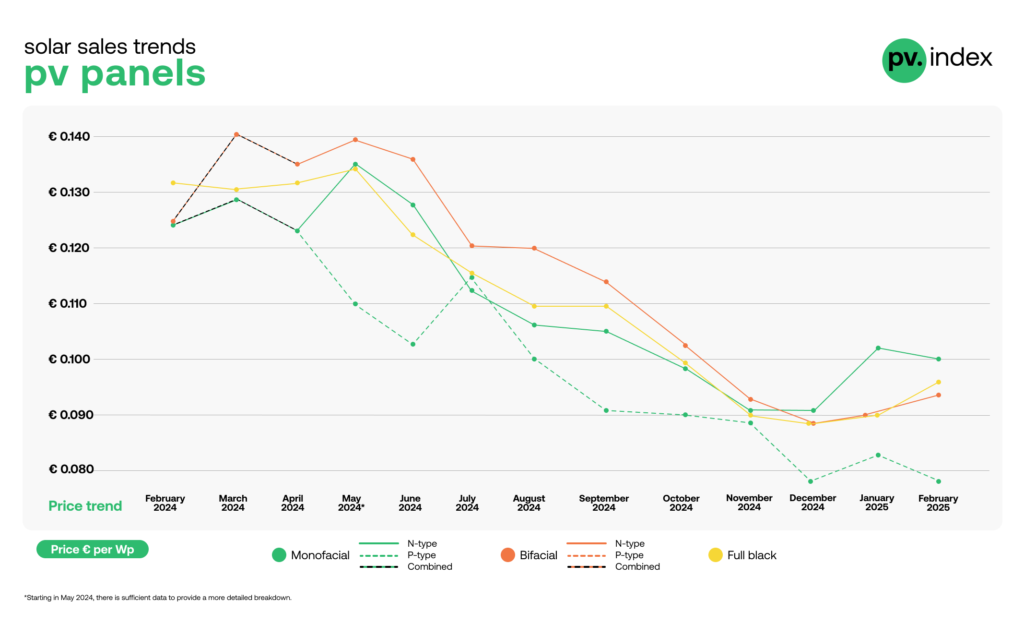

These are the main takeaways from sun.store’s latest pv.index report, published today, which covers solar product prices, and industry sentiment regarding those prices, in Europe. While module prices, on the whole, have consistently declined over the last 12 months – a trend that was evident in sun.store’s end-of-2024 report – both bifacial and full-black modules saw an increase in price from January to February of this year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Bifacial n-type modules saw prices rise from €0.09/W (US$0.095/W) in January to €0.094/W in February, while full black modules saw a price increase of 7%, from €0.09/W to €0.096/W, over the same period. While these increases are small in scale, this marks the second consecutive period that the prices of these modules increased, month-on-month, and both technology types saw greater price increases between January and February of 2025 than they did between December 2024 and January 2025.

Meanwhile, other technologies saw prices fall, with monofacial n-type modules seeing a decline in price from €.0102/W to €0.1/W, while the price of p-type modules fell from €0.083/W to €0.078/W. These represent declines of 2% and 6% month-on-month, respectively, and these trends are shown in the sun.store graph below.

Michał Kabała, business consultant at sun.store, noted that the fall in price of n-type modules, in particular, was driven by the “competitive pricing” of popular modules from JA Solar and AIKO, with the average price of the latter’s modules falling by 16% between January and February.

“Buyers are prioritising availability, especially on premium models, as they prepare for a busy Q2,” added Filip Kierzkowski, head of partnerships and trading at sun.store. “The slight dip in some module prices hasn’t slowed activity—it’s actually spurred strategic buying.

“This heightened interest in modules may also stem from news of legislative changes in China, where recent pricing reforms for grid-connected renewable power are redirecting production to meet local demand. As a result, this shift could significantly impact delivery schedules to the EU in the coming months.”

Growing buyer confidence

These positive pricing trends are reflected in a high ‘PV PMI’ figure, sun.store’s metric for calculating buyer optimism regarding product pricing in Europe. A score over 50 indicates a general sentiment that the industry will grow in the coming months, and February’s score, which includes the survey results of 630 buyers, hit 73, an increase over the 71 reported in January, and the highest score reported since February 2024.

The improvements in the PV PMI score are shown in the graph below, in the black line, while the growing percentage of the red bar indicates that, in February, more respondents said they planned to purchase “more” modules in the coming month than they had in the prior month.

Indeed, February 2025 returned a high of 58% of respondents planning to increase module purchases, the highest percentage reported since the same month of the previous year, and is the second consecutive month of growth in positive purchasing outlook percentage.

With this increased appetite in mind, a marginal decline in inverter prices will also likely be welcomed by the market. Figures from sun.store show that, from January to February, the price of hybrid inverters smaller than 15kW dropped 2% to €121.27/kW, while inverters larger than 15kW saw their prices fall by 1%. Similarly, on-grid inverters smaller than 15kW saw a 2% price drop, month-on-month, while on-grid inverters larger than 15kW saw prices fall by 3%.