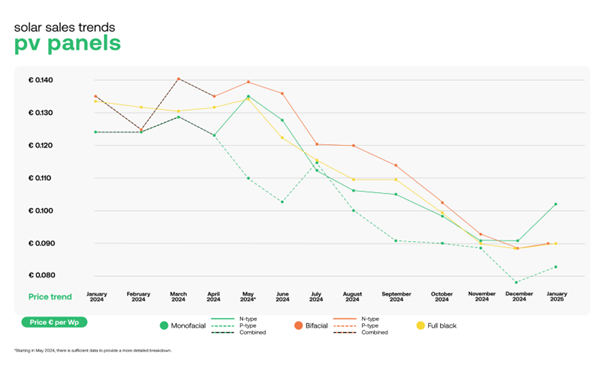

Solar module prices in Europe have risen after months of decline, driven by price increases from Chinese manufacturers and a tight supply of popular modules in the European market.

The January edition of the PV.index report from European solar trading platform Sun.store showed that n-type monofacial module prices increased by 12% in January, which sun-store said reflects “a shift towards higher-efficiency modules…as buyers prioritised performance over purely cost-driven decisions”.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Lower performance p-type monofacial prices rose by 8%, which “suggests that the downward pressure on standard module prices may be easing as stock levels for lower-cost alternatives gradually tighten”, the report said.

N-type bifacial modules rose by a “modest” 2%, which also reflects a trend towards higher efficiency products in large-scale solar installations.

Major Chinese solar manufacturer JinkoSolar emerged as the leading module brand among European buyers across monofacial, bifacial and all-black products.

“This overall price shift marks a departure from the prolonged declines seen throughout 2024, suggesting that the market may be finding a new pricing balance as demand stabilises and strategic procurement decisions drive transactions,” sun.store said.

“While it’s too early to call a full trend reversal, the slowing pace of price declines and renewed demand for premium products suggest a more balanced dynamic between supply and demand. With distributors adjusting pricing strategies and supply constraints emerging on key models, the next few months will be crucial in shaping 2025’s trajectory. One thing is clear—buyers are acting more confidently, and the European solar market is starting the year on a stronger footing.”

Sun.store also releases a monthly PV Purchasing Managers’ Index (PMI) which collates the “purchasing intentions” of over 900 users of its platform.

The PV PMI score increased in January from 67 to 71, which represents “growing confidence among buyers” and an intention to increase purchasing of PV modules in the future.

Sun.store said this shift was down to both supply changes and the reaction to price changes from Chinese manufacturers:

“China’s recent changes to tax incentives for solar manufacturers led to a slight price increase in newly produced modules, which, in turn, influenced distributor behavior in Europe. While these changes primarily affect new production, some European distributors raised prices on existing stock, further reinforcing the sense of a market-wide stabilisation.”

Chinese PV manufacturers themselves have begun to collaborate on price stabilisation following massive capacity expansions beyond demand and a subsequent crash in solar component prices.