“Compared to previous years, the biggest change in China’s PV industry this year has been a significant deceleration in capacity growth of various manufacturing segments, along with a slowdown in capacity addition.” Wang Bohua, honorary chairman of the China Photovoltaic Industry Association (CPIA), said at the 2024 Annual Conference of the Photovoltaic Industry last week.

According to data released by the CPIA on 5 December, in the first ten months of 2024, the output of related products in China’s four major manufacturing segments – polysilicon, wafers, cells and modules – was 1.58 million tons, 608GW, 510GW and 453GW respectively, an increase of 42%, 33%, 25% and 21% year-on-year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“In the first ten months, the market demand continued to grow, and the output of the four major PV manufacturing segments all increased by more than 20% year-on-year. However, compared to the same period in 2023, the growth has slowed down significantly, and the capacity growth of the aforementioned four segments all exceeded 70%, ”said Bohua

He added that, in the first ten months of this year, in terms of capacity, the number of projects for which planning began, were put into production or started commercial operations fell by more than 75% year-on-year, which is also a significant slowdown.

Tumbling Chinese export value

The CPIA, citing customs data, stated that in the first ten months of this year, China’s exports of major PV products – wafers, cells and modules – totaled about US$28.14 billion, down about 34.5% year-on-year.

“Judging from the export data, in the first ten months of 2024, China’s PV industry continued to expand in general, and the export volume continued to grow. However, due to the decline in prices, the export value decreased year-on-year,“ said Bohua.

According to statistics from the CPIA, in the first three quarters of this year, 39 of the 121 listed Chinese PV companies fell into losses. “Long-term loss will seriously affect a company’s research and development investment and technological progress, damaging the long-term competitiveness of the industry,” added Bohua.

Talking about the challenges facing the current PV industry, Bohua pointed out that as domestic market resources are becoming more and more restrained, new application scenarios need to be further developed. Policy adjustments have brought new changes to the development of distributed PVs, and new energy entering the market is facing uncertainties in terms of both quantity and price.

“In addition, there are increasing uncertainties in international markets,” said Bohua, who noted that, at present, Europe is still the largest market for China’s PV module exports, but its share has declined significantly. The proportion of localised supply in markets such as the US and India has increased significantly.

To this end, Wang Bohua suggested that PV enterprises should carefully navigate their overseas expansion, pay attention to diversified business planning, avoid clustering in overseas markets and explore new models of “cooperation to go overseas”. For example, PV manufacturers could benefit from aligning testing applications and standards with international practices, which, in turn will promote the construction and planning of overseas capacity.

Strengthening industry self-regulation

“The PV industry must pursue a path of high-quality development and not engage in vicious price competition.” said Bohua, in this environment of tumbling prices.

During the annual conference, the CPIA held a symposium on high-quality and sustainable PV industry development, which was attended by 33 PV companies, including Canadian Solar, AikoSolar, JinkoSolar, Tongwei, Trina Solar and LONGi Green.

After nearly a year of losses, the leading PV companies have reached a consensus on industry self-regulation. At the meeting, executives of these companies discussed how enterprises can strengthen self-regulation to prevent harmful competition, including self-regulation measures, such as reducing and limiting production to shift the industry away from irrational competition and prevent dumping at low prices.

Cao Renxian, chairman of Sungrow, stated that: “The industry should form a consensus on high-quality development and strengthen self-regulation. It is necessary to enhance product quality management, optimise the industry layout, strengthen intellectual property protection and promote industrial transformation and upgrading to achieve breakthrough.”

Zhong Baoshen, chairman of LONGi Green, indicated that as there are too many entities in the PV industry, it is extremely challenging for coordination and self-regulation across the industry. Mergers and acquisitions may be an effective means to solve the problem.

Qian Jing, vice president of JinkoSolar, also expressed her “concerns” over the feasibility of self-regulation, saying, “while Middle Eastern oil producers can create an OPEC, it is difficult for Chinese companies to form an alliance. I hope that our peers can overcome difficulties and reach a consensus, instead of waiting for ‘regulation from others,’ by which time it would be too late.”

‘Competing at prices below cost’

“At present, many PV companies are competing at prices below cost.” Xu Zhiqun, chairman of Gokin Solar, added, noting that product quality is the first lifeline of a company, and industry self-regulation should highlight product quality. At the same time, enterprises should strengthen self-regulation in terms of capacity utilisation and strictly control product inventory.

“Leading companies have taken actions and are not accepting orders whose prices are lower than the cost.” said Lv Jinbiao, deputy director of the silicon industry expert group of the China Nonferrous Metals Industry Association. He noted that the polysilicon segment has started to adjust, and it is expected that the polysilicon output will drop to 105,000 tons in December, which is lower than the feeding volume of wafer manufacturers for that month, allowing gradual destocking.

At present, the PV industry is in a critical period where challenges and opportunities coexist. Despite multiple problems, downstream installation demand is expected to set a new record this year.

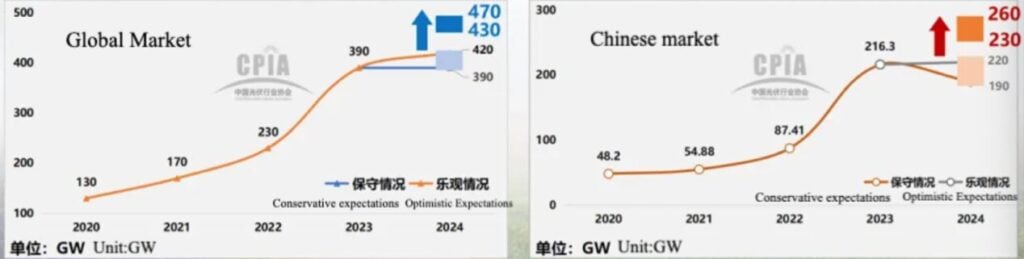

At the annual conference, the CPIA announced an increase in its forecast for global PV capacity additions in 2024, from the previous forecast of 390GW-430GW to 430GW-470GW, as shown in the graph above. The forecast for new PV installation in China for 2024 has been adjusted from the previous 190GW-220GW to 230GW-260GW.

CPIA cited several reasons for the increased forecast for new PV installations. Over 85% of the first batch of large-scale base projects has been completed, and the construction of the second and third batch of large-scale base projects has accelerated.