Dwight Eisenhower famously said that “plans are useless, but planning is indispensable”. I can think of no better way to characterise the transition from an exceptionally tumultuous 2022 into a year of uncertainty for 2023 in the solar and energy storage industries. A new normal has yet to be defined, and standard bearers of the energy transition must navigate strategic dilemmas driven by ever-changing, often conflicting geopolitical and macroeconomic forces.

The goal of this discussion is to ensure industry participants develop strategic measures to maximise the opportunities and mitigate the risks associated with the following major market trends.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

- The regional and sectoral expansion of forced labour laws such as the Uyghur Forced Labor Prevention Act (UFLPA)

- Re-globalisation of solar PV and energy storage system (ESS) supply chains

- Government intervention with polysilicon and critical minerals markets

- Opportunity for early mover advantage in the e-mobility sector

- Validation (or not) for long-duration storage and green hydrogen projects

Expansion of forced labour laws

Strategic questions – Where are my batteries and the raw materials that go into them coming from? Is my EU supply chain compliant with proposed forced labour laws? How can I diversify my supplier portfolio to best hedge against geopolitical risk? Should I begin supplier traceability studies now?

The US solar sector, following significant import challenges from the 2021 Hoshine Withhold Release Order (WRO), saw further supply chain challenges in 2022 as the UFLPA brought PV module imports to a standstill. US Customs and Border Protection (CBP) detained massive quantities of PV modules, resulting in a forecasted 23% year-on-year reduction in US installation volume. There are signs of progress though, with equipment releases beginning to trickle out to anxious developers [1].

Despite early warnings, government agencies were unable to provide clear guidance to the US solar industry, leaving stakeholders unprepared for the rigour of the vetting process undertaken by CBP. Buyers and sellers should not allow the same mistake to be repeated in the energy storage sector. The impact this could have has already been noted in the release of Driving Force [2], a paper written by authors at Sheffield Hallam University that paints a grim picture of what the UFLPA could do to the US automotive sector. ESS supply may become caught in the crossfire given the growing popularity of electric vehicles (EVs) and the heavy linkage between EV and ESS supply chains. US Senate finance committee chair, Ron Wyden, has already begun inquiries into US automotive manufacturers’ links to forced labour in Xinjiang, China. The newly elected leadership in Congress may be quick to extend those inquiries to the ESS market.

Beyond the US, the geographic expansion of similarly structured bans on products utilising forced labour is all but assured. The EU Commission issued a proposal [3] that envisions a UFLPA-like ban on imported products using forced labour throughout the bloc while upping the ante by extending the purview of that ban globally. Critical mineral supply from at-risk countries such as the Democratic Republic of Congo and its rich supply of cobalt represents low-hanging fruit for regulators.

Re-globalisation of solar PV and ESS supply chains

Strategic questions – Where should I invest? How am I competitively positioned? How should I structure my RFPs? Am I ready for increased supplier risk from junior OEMs? What is my plan if tariffs are eliminated?

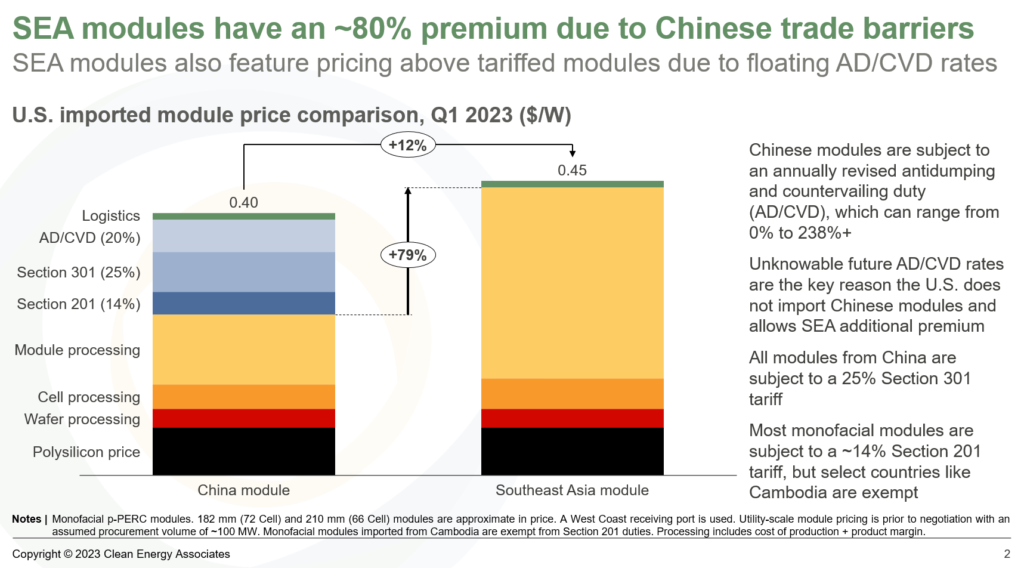

The impact of the labour laws mentioned above coupled with a host of tariffs such as Section 201/301 and the anti-dumping/countervailing duty against China has dramatically increased the cost of imported PV modules. The Biden administration has not indicated any relief from those tariffs, outside of the 24-month holiday on new tariffs expiring in June 2024. The generous support for domestically produced solar and energy storage equipment as a result of the Inflation Reduction Act (IRA) provides further incentives for the cleantech industry to diversify the supply base, including localisation of manufacturing.

India is also working towards increased independence of its PV supply chain. India’s annual solar installation volumes are expected to eclipse 20GW in FY2023, inching closer to its goal of a cumulative capacity of 500GW of renewable generation by 2030. The central government has indicated its desire to control more of the supply chain domestically in reaching that goal and, similar to the US, has deployed a raft of protectionist policies. The production-linked incentive scheme, approved by the central government in April, has a budget of over US$611 million to promote 10GW of integrated solar manufacturing capacity. Import tariffs begin at 14.5% and can exceed 50%.

Indeed, the outlier seems to be the EU, which has yet to formally define an aggressive localisation strategy for PV or ESS. President of the European Commission Ursula von der Leyen made statements at Davos 2023 implying that policy action critical to overcoming the bloc’s structural challenges in establishing a commercially viable domestic supply chain is on the horizon. High labour and energy costs have hindered localisation within the bloc despite it having some of the most ambitious decarbonisation plans in the world. In the end, it is feasible that Europe could make the decision to be the target export market of choice for US, Indian and Southeast Asian module suppliers and instead focus its effort on downstream job creation and equipment deployment.

Government intervention as polysilicon prices plunge with lithium price relief in the offing

Strategic questions – How will global supply and market conditions impact new US polysilicon investments? Where are new lithium resources being developed? What is the policy risk for those nations? How should I structure my RFPs? Can I hedge my indexed battery purchase agreement?

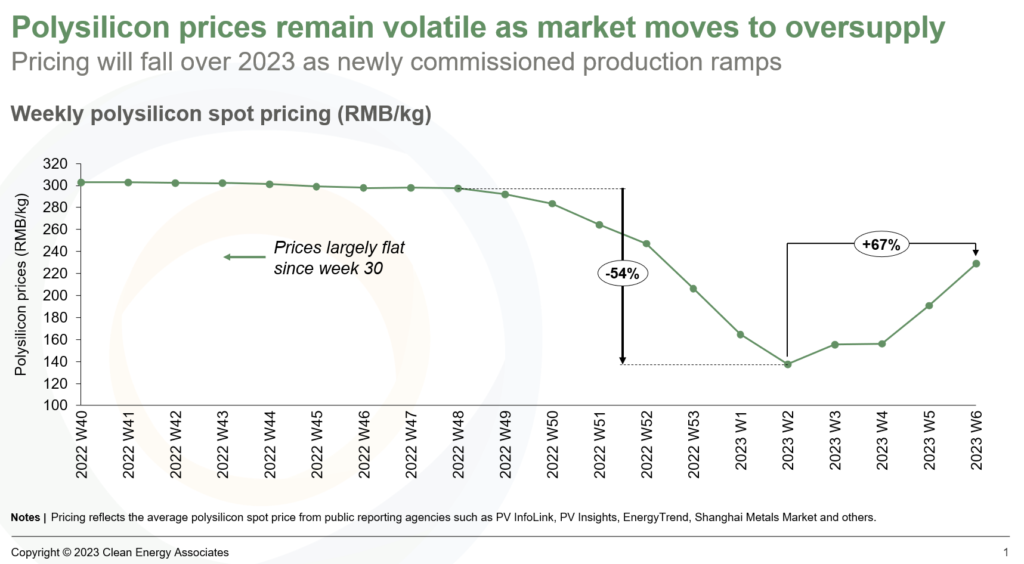

Global trade disputes have overshadowed a seismic shift in global polysilicon supply/demand balance. Following 18 months of tight supply and skyrocketing prices, the early weeks of 2023 produced a dramatic recalibration of polysilicon markets with prices falling 55% from December 2022 to US$18/kg.

The pricing plunge was driven by a massive wave of capacity additions in China, as reflected in Clean Energy Associates’ (CEA) PV Price Forecasting Report. Chinese polysilicon supply is forecast to nearly double in 2023.

However, the dramatic reduction in market pricing abruptly reversed course following a meeting of Chinese polysilicon (aka poly) makers this month with a whiplash increase in poly prices in upwards of 30%. The first quarter of the year is a typically volatile period for materials pricing as buyers and sellers work to test the limits of the market. Nevertheless, this will undoubtedly raise eyebrows and could prompt additional governmental engagement to limit price gouging. Government action has been minimal to date, but a bevy of notices [4] was provided to polysilicon manufacturers to control pricing in 2022 so as not to upend PV module prices.

Lithium pricing has been more consistent through 2022 and into 2023, though this has provided no relief to the global battery energy storage sector as those prices remain stubbornly high. Relief may be on the horizon though, given a rapid rise in production capacity on tap in 2023/2024. The writing on the wall is prompting a different sort of government engagement among the up-and-coming lithium suppliers in Latin America. Cartel formation has been openly discussed among representatives from Argentina, Bolivia, and Chile. The goal of an OPEC-style trade body would be to ensure prices remain high enough to justify the substantial investments required to support new lithium extraction, and at the same time, increase revenues to state coffers from those new operations.

Theoretically, a LATAM-wide, lithium-focused trade group could serve as a potential foil to China’s dominant position in the downstream portion of the market. However, there are few successful examples of government-controlled natural resource companies in LATAM to date. Further, Australia’s clear leadership in the global lithium market would temper any global pricing power a regional cartel could hope to muster. Consequently, in the unlikely event that the governments of LATAM lithium producers formed a cartel, it may only serve to promote supply investments in other free markets like the US and Canada.

Early mover advantage opportunity in e-mobility

Strategic questions – Is the residential or commercial sector more likely to be profitable? What part of the e-mobility value chain is attracting the most investments?

EV sales peaked at 10% of global auto sales in 2022, according to research from LMC Automotive and EVVolumes.com. The milestone is significant, albeit heavily weighted towards subsidised markets in Europe and China. The US is expected to catch up in the near term as new tax incentives from the IRA, coupled with a massive increase in new EV models from traditional automakers, should work to woo potential buyers. 2023 will be a challenge though as consumers continue to struggle with inflation and recession concerns linger.

EV volume uncertainty abounds but may open the door for aggressive firms seeking to capture first-mover advantage in the e-mobility sector. A focus on fleet electrification may be the soundest manner from which to capitalise on generous incentives for EV charger equipment. In terms of volume, the EV charging market is expected to be largely weighted towards residential home charging systems. This market is likely to mimic the structure of the residential PV sector: highly fragmented with exceptionally high customer acquisition costs. Similarly, deployment of public charging stations will happen at the municipal level, and though potentially more lucrative from a pricing standpoint, may face similar fragmentation issues as well as delays.

If clean energy history repeats itself, the commercial and industrial market for fleet electrification will first be led by a limited number of early adopters eager to differentiate their brands with “green” credentials focused on their core business. This was certainly the case over the past decade when companies built on the backs of power-hungry data centres inked some of the first solar virtual power purchase agreements in the US. Their action opened the door for others, but it should be noted that 60% of the total green power usage among the US Environmental Protection Agency’s Top 100 Partners is driven by only 15 companies.

Pilot projects put long-duration storage and green H2 projects to the test

Strategic questions – What is our company’s strategy around deep decarbonisation? What investment opportunities exist for each technology type? How can the technology risk be quantified and managed in the near term? Where will the renewable energy come from to support pilot projects?

Long-duration energy storage (LDES) and green hydrogen (GH2) investors endured an exceptionally difficult 2022. Share prices for SPAC-enabled LDES providers tumbled, while long-time providers of fuel cell and electrolyser equipment also suffered share price losses. Despite these losses, the industry remains upbeat with a wealth of US state and federal government incentives in play to jump-start pre-commercial operations for new technologies. The hype cycle is coming to an end, and 2023 will be the year when early innovators must prove their technology can pass muster.

The pipeline for LDES and GH2 pilot projects is growing by the day, but special attention is being paid to the US$8 billion Hydrogen Hub programme sponsored by the Department of Energy (DOE). There are over 20 projects currently vying for a portion of that funding, covering all manner of conversion and associated feedstocks. Similarly, the DOE is providing US$350 million in funding towards the deployment of 11 LDES demonstration projects to provide early benchmarking of different technology types. Success in accessing these funds will be critical to getting a leg up in the early race for potential investors’ mind space.

A multitude of regulatory and commercial challenges lies ahead for LDES and GH2, increasing the importance of those successful technology demonstrators. One can look at the failure of the billion-dollar Petra Nova coal-fired generation project and the pall it cast over the future of carbon capture utilisation and storage in the US. The project, supported by US$195 million in funding from the DOE, has been offline since May 2020 and was never able to meet specifications pertaining to CO2 capture rates when it was running. LDES and GH2 pilot projects must avoid that fate if they are to maintain investor interest and win the confidence of an eager development community.

References

[1] Although there is no indication that any detained PV module containing polysilicon from China has been released as of 1/17/23.

[2] Murphy, L., Salcito, K, Uluyol, Y, Rabkin, M, et al (2022). “Driving Force: Automotive Supply Chains and Forced Labor in the Uyghur Region.” Sheffield, UK: Sheffield Hallam University Helena Kennedy Centre for International Justice, December 2022.

[3] Commission moves to ban products made with forced labour on the EU market, https://bit.ly/3R7vnrP

[4] Example: “Notice on Matters Related to Promoting the Healthy Development of the Photovoltaic Industry Chain” by the Development and Reform Office Operation [2022] No. 788.