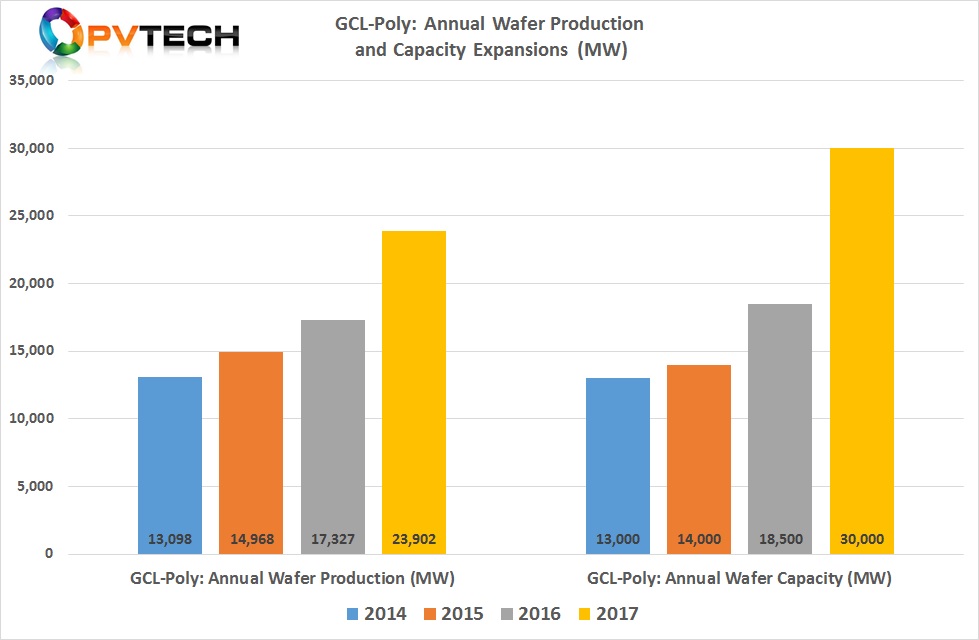

Leading polysilicon and solar wafer producer GCL-Poly Energy Holdings has reported a significant increase in nameplate wafer capacity in 2017, going from 18.5GW in 2016 to 30GW at the end of 2017, a 62.2% rise.

GCL-Poly had previously highlighted in its first half 2017 financial report that annual wafer production capacity has increased to 20GW by 30 June 2017, while production reached 10,599MW, a 22.6% increase from 8,643MW produced in the prior year period.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

A further 10GW of wafer capacity was therefore added in the second-half of 2017 and the largest nameplate capacity expansions in the history of the company.

Actual wafer production in 2017 was approximately 23,902MW an increase of 37.9% from 17,327MW produced in 2016.

The company also made a major transition from G7 sized ingot castings to G8 without purchasing new equipment. The company noted that the ingot crystalline structure was had also been optimized through thermal field optimization.

As a result, ingot production costs were reduced and wafer conversion efficiencies were enhanced. The company also migrated to diamond-wire sawing technology and ‘Black Silicon’ texturing technology, further reducing production costs.

PV Tech has already highlighted the significant investments made in R&D activities in 2017 to improve the quality and lower production costs of its polysilicon and ingot/wafer operations across its production lines.

Polysilicon production and capacity expansions

GCL-Poly produced 74,818MT of polysilicon in 2017, a 7.9% increase over the prior year, while nameplate capacity remained at 70,000MT. The higher production rates than nameplate capacity were due to a number of technical upgrades and productivity enhancements implemented throughout the year.

The company also updated it next phase of major polysilicon expansions, highlighting that construction began on its planned 60,000MT facility in Xinjiang, China, which includes 40,000MT of new-built facilities and 20,000MT of existing Xuzhou facilities to be removed and relocated to the Xinjiang facility.

GCL-Poly said that it expected construction of the first phase of a 20,000MT facility would be completed by the second quarter of 2018 and the second phase of a 20,000MT facility would be completed by the end of 2018.

The relocation of the 20,000MT plant in Xuzhou was scheduled for the end of 2020, should market conditions allow for polysilicon production disruption.