Leading polysilicon and solar wafer producer GCL-Poly Energy Holdings reported lower revenue and profits than expected in the first half of 2017, primarily due to wafer price erosion, only partially offset by higher wafer production volumes and stable polysilicon prices.

Although new solar PV installations in China exceeded 24GW in the first half of 2017, GCL-Poly could not financially benefit from the boom directly.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

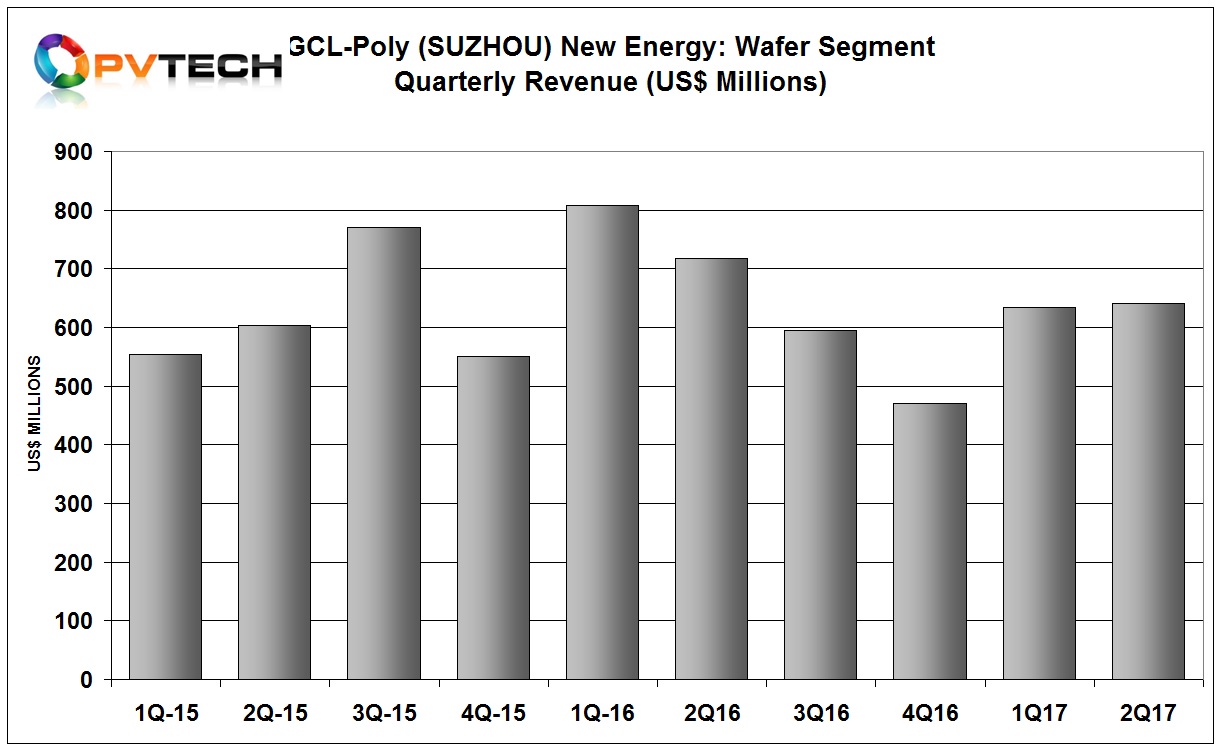

PV Tech had previously highlighted that GCL-Poly’s wafer division, GCL-Poly (Suzhou) New Energy, which is the main revenue generator had reported first quarter revenue of approximately US$634.4 million, down over 20% from the prior year period but the polysilicon purchase price on a year-on-year basis had increased more than 20%, while wafer selling prices in the same period had decreased more than 20%.

The result was a collapse in net profit to around US$12.8 million in the first quarter of 2017, compared to around US$169.3 million in net profit in the first quarter of 2016.

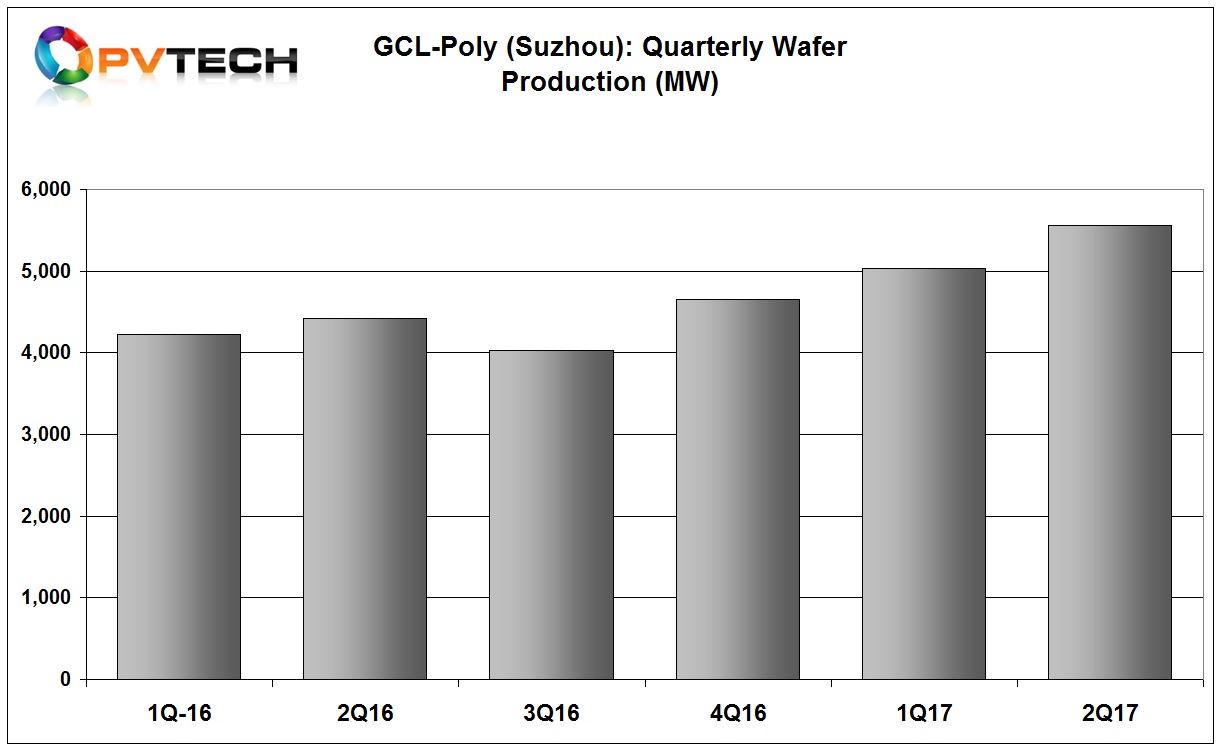

Profitability would have come under even higher pressure if it was not for wafer production volumes in the first quarter of 2017 increasing by approximately 19.2%, compared to the prior year period.

The majority of polysilicon production is consumed in-house for the production of multicrystalline wafers, despite its average polysilicon prices remaining stable at US$15.1/kg in the reporting period, external polysilicon shipments were 4,888MT, down from 6,380MT in the first half of 2016, limiting revenue generation from this business unit.

GCL-Poly’s polysilicon operations also remain capacity constrained at 70,000MT per annum. Given a 2GW increase in in-house wafer capacity in the first half of the year, less polysilicon was available as external sales. The company had previously announced a major expansion in polysilicon production but this will take several years to come on stream.

GCL-Poly reported polysilicon production of 38,747MT in the first half of 2017, up from 36,328MT in the prior year period, productivity and debottlenecking activities contributed to the slight increase, which in turn eased pressure for external sales, which increased from 1,896MT in the first quarter of 2017 to 2992MT in the second quarter of 2017. External polysilicon sales in the first quarter and second quarter of 2016 were 3,348MT and 3,041MT, respectively.

GCL-Poly reported wafer production capacity had increased to 20GW in the first half of the year, up from 18GW at the end of 2016.

Production in the reporting period was a new record of 10,599MW of wafers, representing an increase of 22.6% from 8,643MW in the prior year period and sales of 10,611MW.

Despite the increase in wafer production and shipments, wafer ASP’s declined significantly from US$0.187/W in the first half of 2016 to US$0.130/W in the first half of 2017, due to overcapacity.

Financials

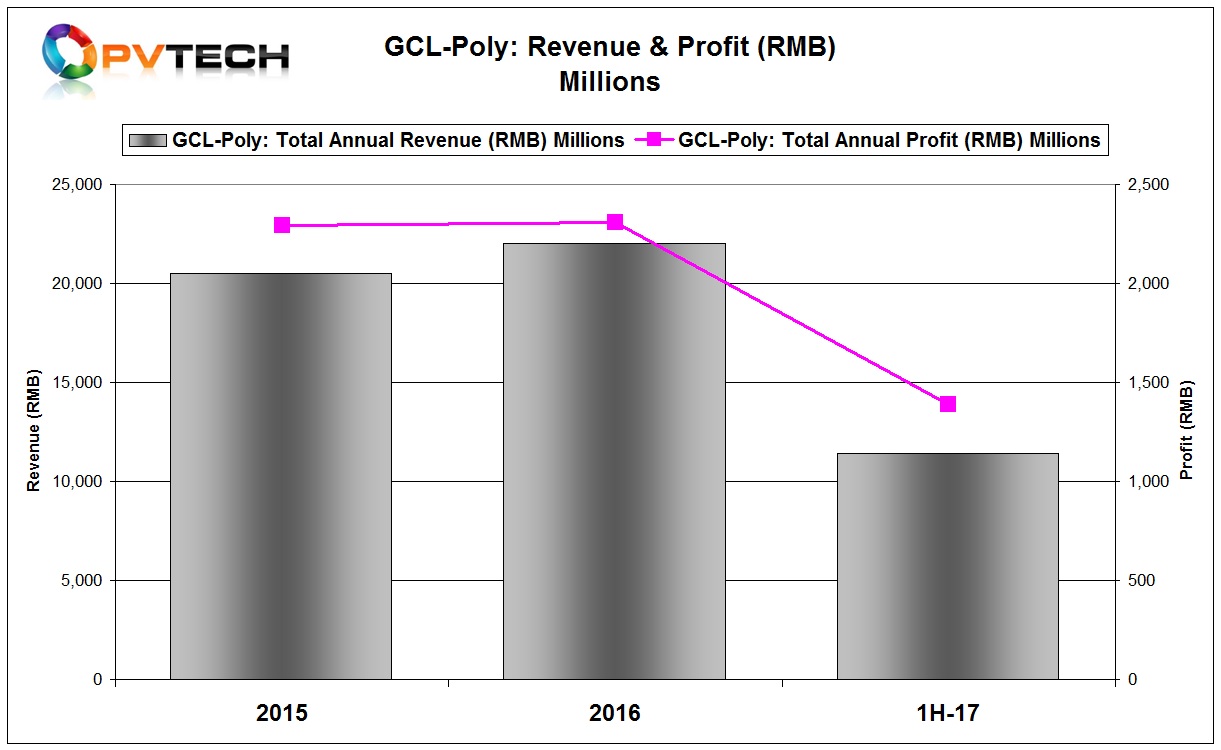

GCL-Poly reported first half 2017 total revenue of RMB11.4 billion (US$1.72 billion), a 8.2% decrease compared with the same period in 2016, but an 18.6% increase as compared with the second half of 2016.

Group profit in the first half of 2017 was RMB1.2 billion (US$181.9 million), compared to RMB2.19 billion (US$331 million) in the prior year period.

Materials segment (Polysilicon & wafer) revenue was RMB9.31 billion (US$1.41 billion). Gross margin was 24.6%, down from 31.7% in the prior year. EBITDA was

RMB2.85 billion in the Materials segment, compared to RMB4.78 billion in the first half of 2016.

Wafer sales were releatively flat quarter-on-quarter, despite wafer production and shipments higher. This was due to ASP declines.

The net profit margin of Material segment was 8.5%, compared to 15.6% in the same period in 2016.