Leading polysilicon and solar wafer producer GCL-Poly Energy Holdings has experienced a rise in polysilicon prices over the last 12 months, while experiencing a similar decline in the selling prices of solar wafers, causing a collision in prices going in the opposite direction that massively impacted its wafer operations profitability in the first quarter of 2017.

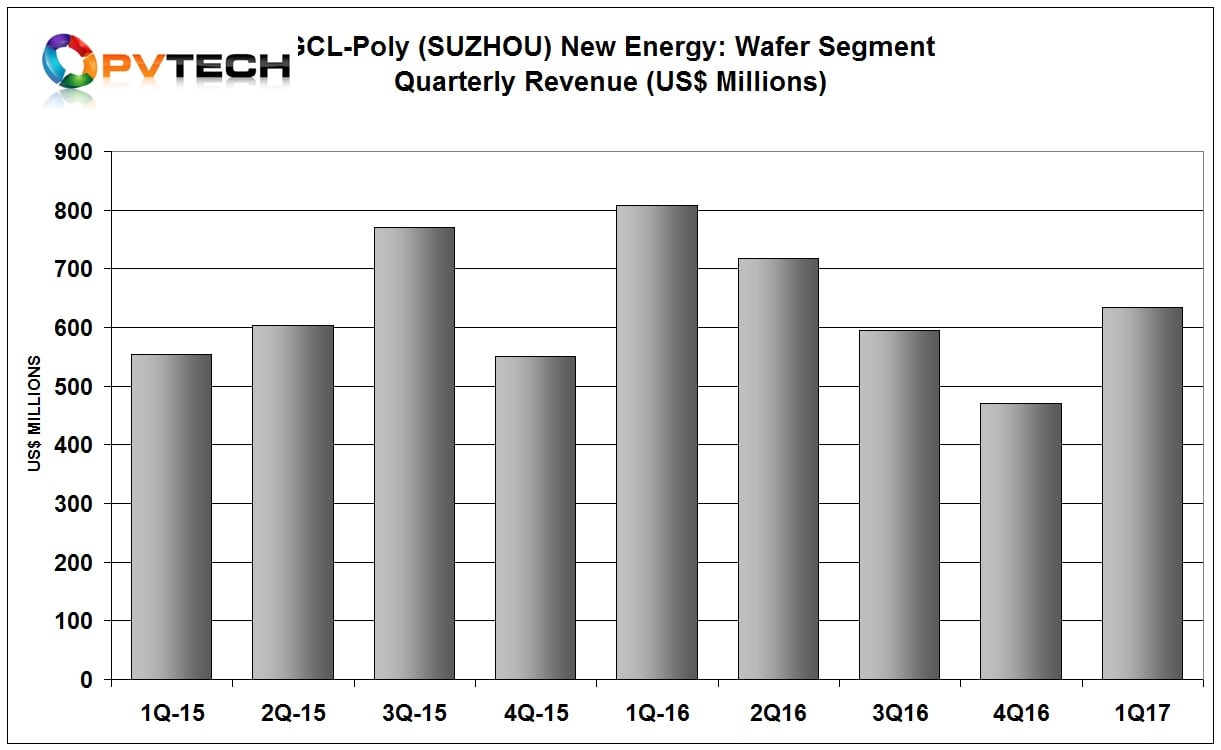

The wafer division, GCL-Poly (Suzhou) New Energy reported first quarter revenue of approximately US$634.4 million, down over 20% from the prior year period but the polysilicon purchase price on a year-on-year basis had increased more than 20%, while wafer selling prices in the same period had decreased more than 20%.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The result was a collapse in net profit to around US$12.8 million in the first quarter of 2017, compared to around US$169.3 million in net profit in the first quarter of 2016.

Profitability would have come under even higher pressure if it was not for wafer production volumes in the first quarter of 2017 increasing by approximately 19.2%, compared to the prior year period.

Wafer production in the quarter was around 5,038MW, compared to 4,227MW in the first quarter of 2016. The average selling price (exclusive of tax) of wafers was US$0.14/W in the first quarter of 2017, compared US$0.19/W in the prior year period.

According to GCL-Poly its annual wafer production capacity at the end of the first quarter of 2017 had been ramped to 20GW. The company had expanded capacity to 18.5GW as at the end of 2016.

Polysilicon ASP’s were US$17.25/kg for the first quarter of 2017, compared to US$13.96/kg in the prior year period.

GCL-Poly’s polysilicon production volume for the first quarter of 2017 was approximately 19,508MT, representing an increase of approximately 6.9%, compared with 18,250MT in the first quarter of 2016. Annual polysilicon production capacity was maintained at 70,000MT.

External sales of polysilicon were 1,896MT during the first quarter of 2017, a 43,4% decline from the prior year period.

GCL-Poly has yet to release first quarter financial results. GCL-Poly (Suzhou) New Energy is obliged to report key financial data separately to its parent company, due to bondholder requirements.