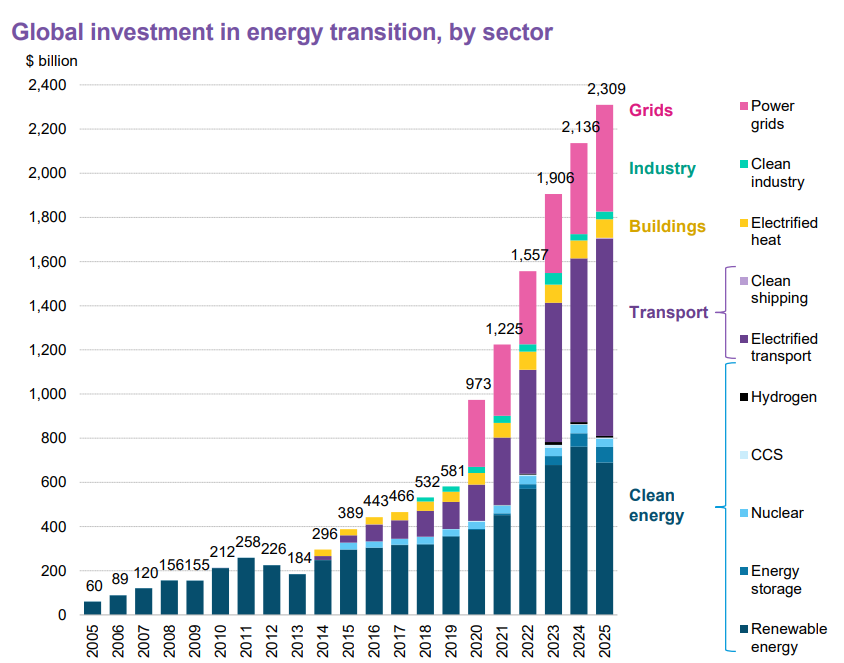

Global clean energy investment reached a record US$2.3 trillion in 2025, an 8.1% increase over the previous year, despite policy and market headwinds in a number of countries.

This is the key takeaway from Bloomberg New Energy Finance’s (BloombergNEF) ‘Energy Transition Investment Trends’ report, published today. The report says that supply chain investment, climate-tech equity finance and energy transition debt issuance all increased year-on-year, demonstrating interest in a range of investment types and tools across the sector. Equity finance in particular increased 53% year-on-year, following three years of continual decline.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“This past year has showcased that despite policy and trade headwinds, the global energy transition is resilient and provides a number of opportunities for investors,” said BNEF deputy CEO Albert Cheung. “ As many economies look to strengthen energy security and build domestic supply chains, clean energy investment will continue to rise, especially as it relates to global data centre buildouts.”

The US saw more overall clean energy investment in 2025 than in 2024, encompassing renewables like solar and wind, batteries, electric vehicles and other energy transition investment. While Trump’s sweeping anti-renewable policies have made the investment landscape more challenging in the US, the fact that US clean energy investment hit a record US$378 billion in 2025, up 3.5% over the previous year, shows that financial support for the broader energy transition has not evaporated.

However, investment in renewable energy generation alone fell year-on-year in the US to US$108.7 billion. By contrast, investment in grids and electrified transport has increased annually since 2021, part of a global trend where more money than ever before is being poured into grids and transport.

The US remains the second-largest investor in the energy transition behind China, which hit US$800 billion in 2025. While China’s total investment is a slight decline from 2024, it still accounts for 34% of global energy transition investment, and its investments account for more than 4% of total GDP, the only “top ten economy” listed by BNEF to do so.

The US, Germany and the UK accounted for the second, third and fourth spots, as they did in 2024, while India rose above France to become the fifth-highest energy transition investor in the world, with US$68 billion invested in 2025. India’s clean energy investment increased 15% year-on-year and PV Tech has asked BNEF for a more detailed breakdown of the country’s clean energy investment trends.

EVs and batteries drive investment trends

Globally, clean transport, including EV purchases and building charging infrastructure, has become the largest contributor to clean energy investment. The sector saw US$893 billion of investment in 2025, a 21% year-on-year increase.

Our colleagues at EV Infrastructure News reported earlier this year that, in 2025, EVs accounted for nearly one-in-four cars sold in the UK, a year-on-year increase in raw sales of more than 20% that reflects growing interest in EVs across the world. The contribution of the transport sector to global clean energy investments is shown in the graph below.

Batteries accounted for the most investment across the global clean energy supply chain, with more than US$50 billion committed in 2025. This is ahead of battery metals, wind and solar, and BNEF expects battery investment to reach almost US$100 billion by 2028.

This will drive total clean energy supply chain investment of US$146 billion by 2028, an increase over the US$127 billion in 2025, but still lower than the record US$152 billion investment reported in 2023, when solar supply chains alone accounted for around US$100 billion.

The report notes that the “most established areas” of the energy transition, including renewable power generation, battery storage, EVs and grids, are expected to attract the most investment in the coming years, as these are “relatively mainstream technologies with little risk and increasingly well-established business models”.

Leading European renewable energy investors will meet at the 13th edition of the Solar Finance & Investment Europe event in London on 3 – 4 February 2026, hosted by PV Tech publisher Solar Media. This event annually attracts infrastructure funds, institutional investors, asset managers, banks and development platforms at the forefront of European renewables. For more details, visit the website.