A significant decline in the cost of PV modules and project construction, as well as a shift from small-scale projects to cheaper capex utility-scale projects, is a main driver for an clean energy investment slowdown in 2016, says Bloomberg News Energy Finance (BNEF).

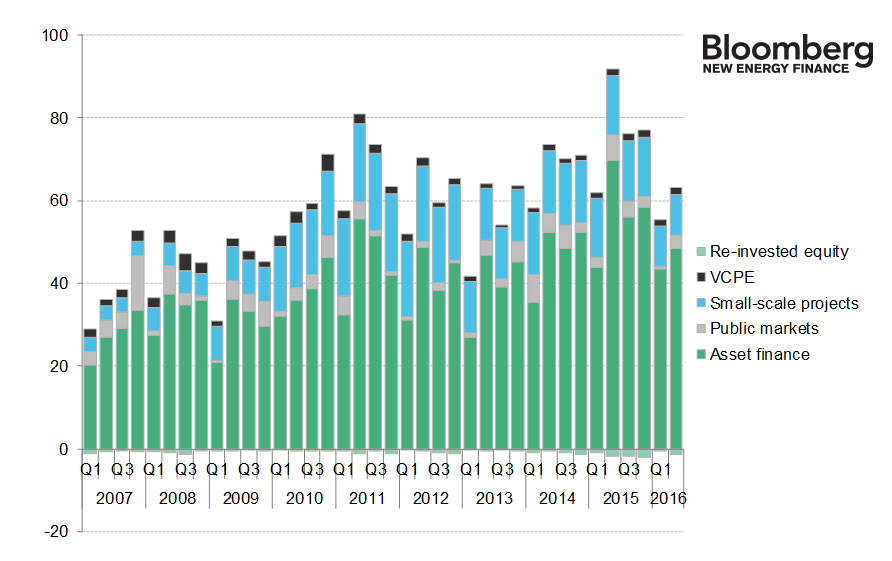

Total investment for this year is expected to fall “well short” of 2015’s upwardly revised US$348.4 billion; with investment in the Q2 totalling US$61.5 billion – and while this is up 12% from the previous quarter, it is some 32% below the US$90 billion in Q1 2015.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In addition to falling prices, regulatory changes and “weak electricity demand” were pinpointed as further reasons for this year’s poor turnout.

“It is now looking almost certain that the global investment total for this year will fail to match 2015’s runaway record. China’s financing of wind and solar projects was even higher last year than previously estimated, and the hangover this year caused by weak electricity demand and policy changes in that country will therefore be all the greater,” said Micahel Liebreich, chairman of the advisory board at Bloomberg New Energy Finance.

However, Abraham Louw, associate for economics at BNEF, noted that the low Q2 figures should not be looked at too negatively, given that last year’s investment was “really quite groundbreaking”. Q2 2015 investment figures were indeed up 11% over 2014 and 30% over 2013.

Regardless, the turnout for the first half of this year was US$116.4 billion, down 23% on the opening half of 2015. Many of the big players in clean energy investment were down; China was down by 34% to US$33.7 billion, and the Americas (excluding the US and Brazil) were down 63% at US$2.3 billion. India was down 1% at US$3.8billion, the rest of Asia Pacific down 47% at US$12.1 billion, Middle East and Africa down 46% at US$4.2 billion, and the US down 5% at US$23.1 billion.

H1 2016

Small scale solar projects attracted US$19.5 billion in the first half of 2016, down 32% on H1 2015 figures. BNEF attributes much of this to lower costs, but also a “marked slowdown” in Japan, a principal player in such projects, with deployments in the country totalling US$4.6 billion in H1, down 66% on the same period of 2015.

Asset finance of renewable energy projects brought in US$92 billion worldwide – a decline of 19% on H1 2015 figures. The biggest asset finance deals of this segment were in offshore wind in Europe. Other standout investment projects included the 100MW concentrated solar (CSP) Kathu project in South Africa, the 400MW Enel Cimarron Ben onshore wind installation in the US, and the 300MW AZTE Quaid-e-Azam PV plant in Pakistan, at an estimated US$363m.

The public markets' investment in specialist clean energy companies declined 56% from H1 2015, bringing in US$3.8 billion in the first half of 2016, despite a sharp pick-up between Q1 and Q2 this year. Tesla came out on top with the largest public market funding in Q2 2016 with a US$1.7 billion secondary share issue, and two secondary issues by Chinese digital energy companies, Ningbo Sanxing Electric and Genimous Investment, worth US$457m and US$432m respectively.

There was a 2% increase in H1 2016 in investment from venture capital and private equity firms, totalling US$2.8 billion.