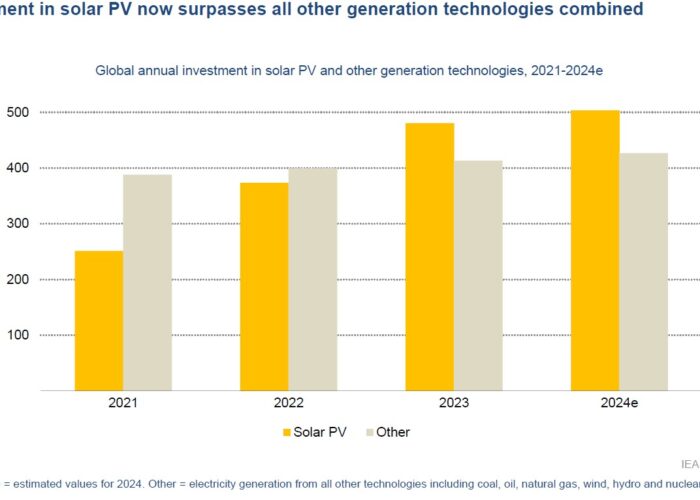

Global capital investment on renewables is expected to return to pre-pandemic levels in 2021, with solar PV set to account for the majority of clean energy capacity additions in the next five years, according to IHS Markit Energy Advisory Service.

Following a 2020 that has seen the sector hit by supply chain issues as well as financing and project completion delays, partly as a result of COVID-19-related lockdowns and mobility restrictions, the research firm forecasts global capex spending on renewables to bounce back in 2021, rising 8.5% to US$255 billion – in line with 2019 levels. IHS Markit expects 2020 global non-hydro renewables capex to be US$235 billion, down 7% year-on-year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Annual spending is expected to remain at next year's level until 2025, which would total a US$1.3 trillion cumulative 2021-2025 spend, representing a 9% increase over cumulative capex in 2015-2019.

Meanwhile, the firm says “sharply declining” capital costs across renewable technologies mean that a 9% rise in spending will be associated with a 45% increase in cumulative gross renewable capacity additions in 2021-2025 compared with 2015-2019.

“The recovery of capital investment to pre-pandemic levels, coupled with falling costs that will give added weight to every dollar invested, is bringing renewed momentum as we head into the new year,” said Roger Diwan, vice president, financial services at IHS Markit.

IHS expects the global benchmark capital cost for both utility-scale and distributed solar PV in 2025 to be 40% below 2017 levels, while the technology is forecasted to account for around 54% of cumulative investment in the renewables sector between 2021 and 2025.

The growth in capex and capacity additions is projected to push combined global solar PV and wind capacity beyond that of global installed natural gas-fired capacity in 2023 and installed coal-fired capacity in 2024.

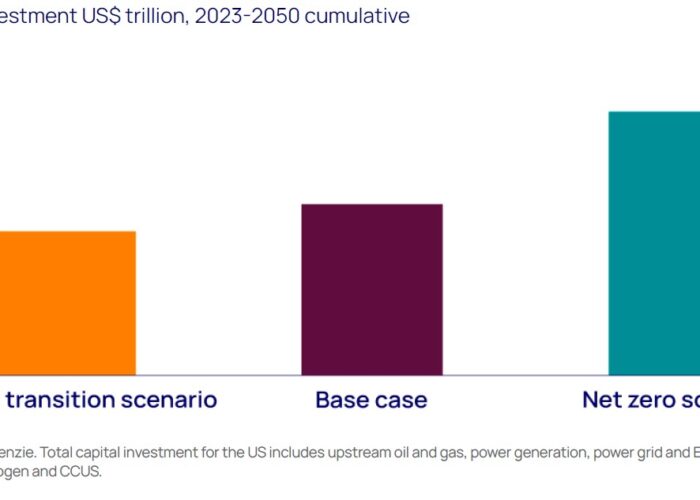

This new surge in capital spending for renewables “could still exceed expectations”, Diwan said.

“Countries and companies are accelerating their renewables ambitions, often anchored in net-zero emission targets, and a number of key countries are likely to focus post-COVID crisis spending on new green initiatives.”

The positive projections for PV follow IHS Markit’s prediction earlier in the year that global solar installations in 2020 would fall 16%, with the hardest-hit regions being Europe, India and the rest of Asia.

However, figures published this week from trade association SolarPower Europe anticipate that 2020 will be the strongest growth year for solar in Europe since 2011, with 18.7GW of installations, driven by the performance of countries such as Germany and the Netherlands.

The US, meanwhile, has seen “little to no slowdown” in new utility-scale solar project announcements this year, as confidence in the market has “surged back”, a new study from Solar Energy Industries Association and Wood Mackenzie says. Despite the coronavirus-related impacts, their joint report forecasts a record 19GW of solar installed in the US this year.