On May 1, 2020, Ms. Wen Zhou was appointed president of Heraeus Photovoltaics, with overall responsibility for the company’s global businesses. Historically, this position has been held by either a German or an American, so Heraeus' decision to appoint a Chinese president this time is a significant move, revealing its commitment to localisation efforts in China and its willingness to stay close to this key market.

The company had reshuffled its PV executive team in China last year and, at the same time, had increased resources allocated to the Chinese market. Having inaugurated a multi-million-euro PV Innovation Centre in Shanghai in 2019, Heraeus doubled its R&D investment in the market, including expenditure on R&D team expansion and the purchase of advanced equipment.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As a well-established leader in the PV paste segment for more than a decade, Heraeus is keenly aware of the value of the Chinese market. “The PV manufacturing chain is mainly concentrated in Asia, especially in China. Chinese PV manufacturers have well-planned business strategies, some covering Southeast Asian countries like Korea and Japan, the Middle East as well, but on a much smaller scale. We also stay in touch with companies like Hanwha Q Cells, which has a strong presence in Germany,” Ms Zhou told PV Tech in an interview.

“At the group level, Heraeus is prioritising its solar business. The group's entire focus is now on getting closer to its core markets, so we will shift more R&D and production to China and other Asian countries.”

Rising to the challenge and eyeing the opportunity

Wen Zhou is confident about boosting domestic business given the supportive attitude of head office. Shortly after taking on the president role, Ms Zhou and her team visited many of the company’s key customers to undertake a series of fact-finding discussions. Heraeus has been one of the industry’s mainstream suppliers, holding a proven track record in front conductive paste. The rapid development of the PV industry, ever-expanding cell manufacturing volumes and rising market value has led to a booming paste market, attracting more and more newcomers. The intensified market competition has also impacted Heraeus.

Talking about the tough job ahead, Wen Zhou noted, “From what I’ve seen in the PV industry and from my observation of top companies during this period, everyone is confident about the future. The PV industry is offering an exciting and challenging career, and that’s what makes it interesting.”

“Heraeus is never afraid of any competition because we have confidence in ourselves. When I first came over, I made it quite clear to my team that, while Heraeus is already a leader in the industry, we need to always be alert to possible crises, as PV is a fast-changing industry. Not moving forward simply means being left behind. So it is necessary to constantly improve ourselves to stay ahead.”

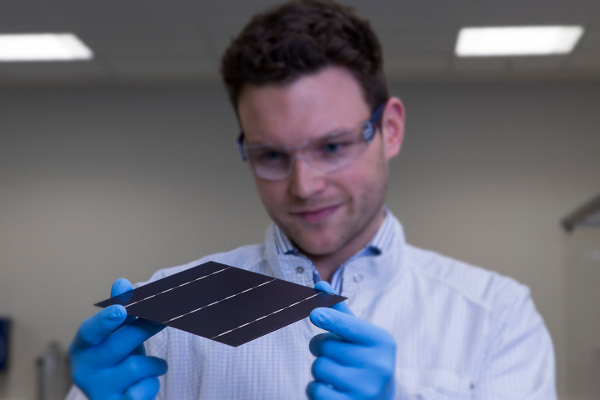

In addition to support from the head office, Heraeus’ power and experience over the years is lending strength to the new president. Heraeus is a German family company founded 168 years ago. The company’s state-of-the-art technology can be found not only in the PV industry, but also in the automotive, semiconductor, electronics, steel and medical fields. Innovation and technological breakthroughs are the secrets to Heraeus' continued growth for more than 160 years. The company owns many core technologies, such as the highly-demanding processing technology for high-value precious and specialty metals and R&D technology for front side conductive pastes.

“Our customers recognise our strengths in areas such as paste R&D, technology upgrades, capacity investment and service. Products and solutions that contribute to problem solving are what our customers are looking for. Our team and R&D experts have great experience in this regard. Some used to work in the cell factory and are very familiar with cell production lines. Their professional understanding of paste is enabling Heraeus to deliver better cooperation and technical support.

“What’s most impressive about the PV industry is its speed. The industry has to constantly boost efficiency and upgrade products, which places a high demand on paste – the critical component for improving conversion efficiency and reducing costs. As the top company in this field, we've made a lot of technical adjustments to stay ahead, as we did with new products released some time ago that were designed according to state-of-the-art technology.

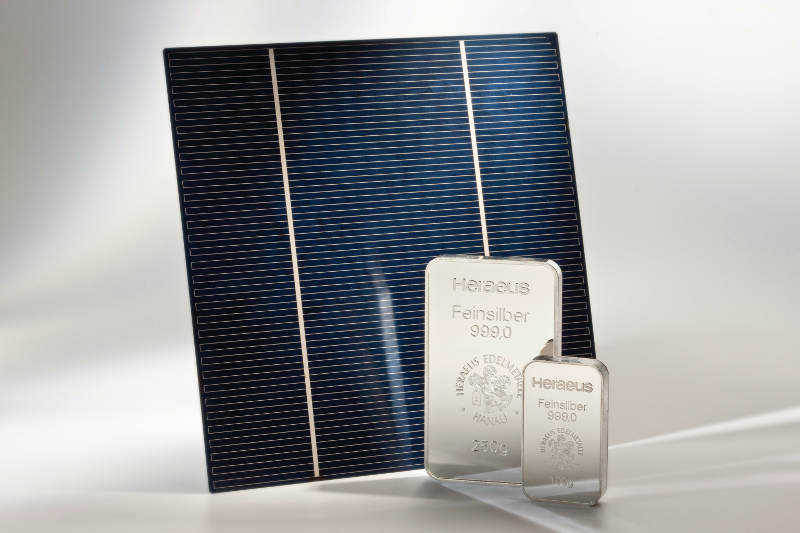

On 10 June, Heraeus launched its new SOL7 silver paste, consisting of five types of high-performance efficiency paste. This series basically covers all types of mainstream cell technology on the market today, such as the latest PERC+SE, N-type TOPCon and HJT. These products can help increase output and conversion efficiency for cell manufacturers.

A new round of competition: Elimination and development

As a critical step in c-Si cell production, metallisation resorts to conductive screen printing and sintering to produce metallized electrodes on the front and back of wafers, thereby exporting photon-generated carriers from the cell.

Conductive paste is the key material in this process. It is a high-tech product mostly composed of silver and glass powder and an organic carrier. R&D and production of glass powder and organic carriers are the central core, necessitating continuous investment and experience.

In the past few years, paste companies have made certain technology breakthroughs to enter the front silver paste market. There are still gaps between domestic manufacturers and internationally-renowned players in terms of experience and systematic understanding of paste performance, and all these factors will directly impact the performance of mass application of paste on production lines.

When the market is good, every paste company has orders in hand because of the robust demand. Triggered by China’s 531 policy released in 2018, the PV industry was on a downward curve and was then stricken by the COVID-19 epidemic this year. The falling demand led to discontinued production and price reduction. The significant fall in cell and module prices has also had a negative impact on material suppliers.

Paste companies are now confronted with many epidemic-induced risks and it is predicted that some weaker organisations might be eliminated this time.

“The epidemic has impacted various industries in different ways and the PV industry is no exception. But for Heraeus, our production, supply and our clients are all operating as usual. There’ve been no supply chain issues so far,” continued Ms Zhou.

“That’s because our customers are the leading cell manufacturers within the industry, such as LONGi, Tongwei and Aiko. The pandemic has had minimum impact on these companies. They are continuing with manufacturing and we are supplying them with pastes non-stop. Outside China, installations will be impacted by the pandemic and production will slow down somewhat, but we remain fully prepared. When the customer is back on track, we can supply immediately.”

According to Wen Zhou, compared to last year Heraeus has exceeded its growth expectations this year, with the double-digit growth in factory production through the first quarter to May outperforming the market average.

“We are growing together with our customers, many of whom have developed their own capacity expansion plans. The pandemic is both a crisis and an opportunity, because it is a test of company strength. As a technology and capital-intensive industry, the PV industry is far more challenging for small businesses. Our strengths in technology and finance have allowed us to respond more efficiently in a period of crisis.“

Cost reduction trends

In the past few years, the global PV industry has been growing at dozens of GWs annually. In 2018, the new installed capacity reached the 100GW milestone and is expected to exceed 110GW in 2020. The rise of the end market is driving the whole PV manufacturing industry forward and initiating a multi-billion dollar paste market.

“In terms of development prospects, the PV industry undoubtedly has a very broad market space. In the future, the PV manufacturing sector will be more concentrated. For Heraeus, our customers are extremely important and we will further deepen our cooperation with these top companies.” According to Wen Zhou, Heraeus is very optimistic about PV’s growth potential.

Starting from next year, China's PV industry is about to go subsidy-free. With more and more countries embracing grid parity, the industry's demand for cost reduction is becoming all the more urgent. One of the main cost reduction methods used by the industry over the past 20 years has been improving cell conversion efficiency. In recent years, high-efficiency cells topping 20% have been the target of cell and module manufacturers.

How to achieve such targets? For conductive paste suppliers, it is imperative to develop new products that follow current trends. The history of mono-PERC cells reveals that, behind its widespread application, the primary force has been the rapid progress in conversion efficiency and cost reduction. In the case of PERC technology, paste has made a significant contribution to efficiency gains.

“New technology has been driving down costs. This is a value-based route, much more efficient than simply waging price wars. We’ve been pursuing this route in our business dealings. Our primary customers also endorse our faith in value and sustainability. We are a great fit. The paste value is not just measured by kilos, but by new technology and process optimisation.”

To develop more efficient cells and be prepared for next-generation technology, many cell manufacturers will invite equipment and material suppliers to participate in their R&D activities, which is quite demanding on these suppliers.

It is well known that Heraeus participated in the R&D of many record-setting high-efficiency cells. LONGi, JinkoSolar and Trina have all benefited from Heraeus products in setting their efficiency records.

“As a leading enterprise in the paste segment, we must look ahead to make technical preparations and, in addition, we must talk with our clients to discuss their needs. We must be very familiar with their requirements to find out the ‘pain points’ before deciding on any counter measures.

“Some of our customers have individualised demands. To cater for such needs, we must be technically capable and able to respond quickly to offer products that they require. I think that's the only way forward,” concluded Ms Zhou.