German technology group and PV component manufacturer Heraeus has acquired an undisclosed stake in French PV manufacturing startup Holosolis to support the development of its planned 5GW module assembly plant in Hambach, France.

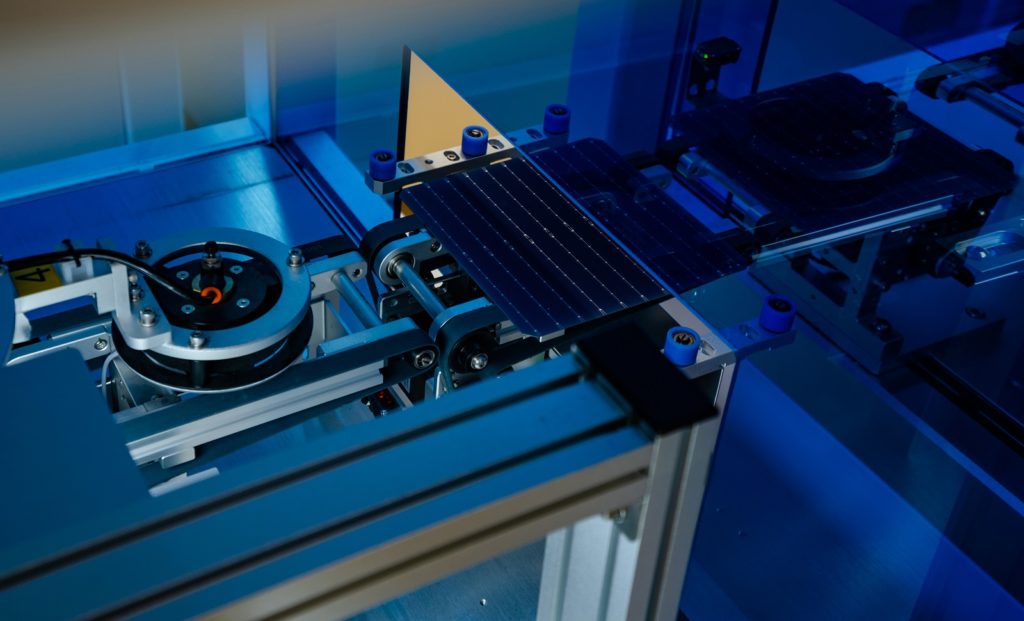

The facility is set to open in 2025 with a ramp-up to full capacity in 2027, producing modules based on tunnel oxide passivated contact (TOPCon) cells. Heraus said that it will supply Holosolis with its silver metallisation pastes, a key component in the manufacturing of solar cells.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Plans for the assembly plant were announced in May this year along with partners IDEC Group, areal estate company which specialises in the rooftop market, and French solar developer TSE, which specialises in agrivoltaics. In September Holosolis announced a research partnership with Fraunhofer ISE to aid in technology choice and planning the factory at the concept design and construction phases.

“Heraeus will supply HoloSolis with the latest metallisation technologies, a key element in the production of a photovoltaic cell. We will also play an active role on the board of directors, providing advice, experience, and expertise”, said Christian Neumann of Heraeus.

He continued: “The photovoltaic industry has become a pillar of Europe’s energy transition. Its rapid growth requires a multiplication of supply chains, both globally and locally. We are proud to contribute to this strategic investment and strengthen our position in a market that is crucial for CO2 reduction.”

Recent months have seen concerns mount in the European PV manufacturing sector around supply chain diversity and durability. An open letter from the European Solar Manufacturing Council (ESMC) called on the EU to introduce protective measures to shore up the industry against the pressure from low-priced Chinese imports.

“At our Hambach site, the economies of scale and the automation of the lines will enable us to achieve costs that are globally competitive”, said Jan Jacob Boom-Wichers, president of Holosolis.

The ESMC also issued another letter calling for the prohibition of solar modules made with forced labour from entering Europe. Two EU committees have since submitted a draft regulation on banning products associated with forced labour from entering the European market.

Manufacturers are increasingly acknowledging that they will need to compete on more than just price in order to set themselves apart in Europe, as environmental, social and governance (ESG) concerns like sustainability come to the fore, as well as larger issues around traceability and removing forced labour from supply chains.