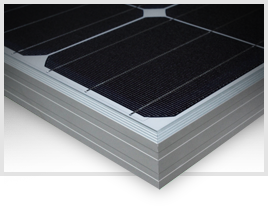

During the past few years, the PV industry has shifted almost exclusively to p-mono PERC modules (mono-facial and bifacial). During 2021, more than 90% of shipped modules will be based on the same technology (mono PERC), setting up the industry to finally make the move from p-type to n-type from 2023 onwards.

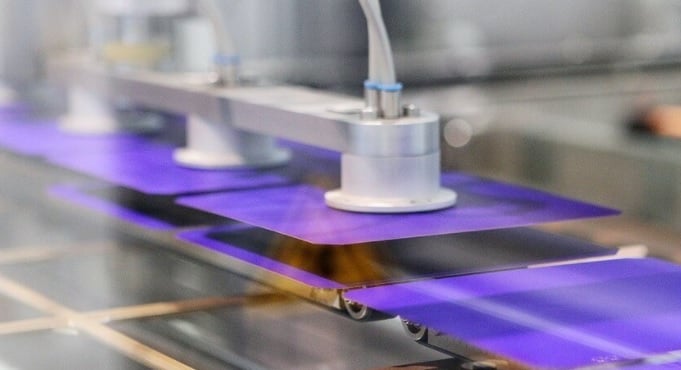

While there are three main n-type cell architectures (n-PERT/TOPCon, IBC and heterojunction), the shift to heterojunction could be the most attractive option, lending itself also to the use of significantly thinner wafers, further driving down the production costs in the long term.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

PV-Tech will host the first ever dedicated, commercial heterojunction conference (PV HeterojunctionTech) online later this week, over the two-day period 17-18 March 2021. The event has been in the making for many years, but the timing is perfect now given the fact that almost all c-Si module suppliers are shipping largely similar product to the market.

This article explains why the timing may be ideal for n-type variants (in particular heterojunction) to finally make the necessary steps to become standard in the PV industry, how many of the module assembly improvements being advanced today will be applicable to any c-Si option, and why the mono-PERC mainstream landscape of c-Si production in 2021 will be short-lived.

The following sections summarise the main themes at large today; to get a full understanding of which companies are at the forefront of heterojunction mass production this year, and the key stakeholders helping drive new process flows and efficiency gains into mass production, the best thing to do is to attend PV-Tech’s dedicated two-day PV HeterojunctionTech Online event on 17-18 March. The full agenda, including details on how to apply to register (free-of-charge) can be found at the event website here.

Mainstream p-mono PERC will likely be a short-lived phenomenon

In recent years, nothing has been happening gradually or slowly in the PV industry. Few things typify this more than the rapid transition from multi to mono (all p-type based) over the past 3-5 years.

Mono PERC cells and modules are now mainstream offerings. Any new entrants adding GW-levels of capacity can go straight to this option, with almost no prior industry experience or R&D knowledge. Supporting all these new p-mono PERC cell and module labs is a polysilicon/wafer supply-chain that is almost entirely commoditized.

The only way c-Si module suppliers are differentiating today is through the use of different sizes of wafers (166, 182 or 210mm), decisions on how to cut these cells (by 2, 3, 4, etc.), and how big to make the modules (panel ratings). While massively helpful in making PV modules more beneficial in situ, these module assembly changes are not specific to p-type mono cells being produced. It is just by default that everyone is using the same cell technology now.

In fact, almost all of these cell-to-module and module assembly improvements could be applied to any c-Si technology (n-type or p-type).

Therefore, while it is easy to get absorbed in a module rating competition (how big the panel dimensions are), everything comes back to the fundamental properties of the substrate type and cell process flow.

Over the years, many people have tried to forecast when, and at what rate, n-type technologies will be adopted by the industry as a whole. Until now, all these forecasts have been incorrect.

In the next section, I will attempt to explain why all previous forecasts have been incorrect, putting a more commercial-driven angle on what has historically been a scientific-led discussion.

Market-leaders cannot survive with mainstream product offerings

Until now, there has been no inherent commercial advantage for market-leaders to move to n-type technologies.

The two companies that originally tried to carve out a business model with n-type cells/modules (Sanyo/Panasonic and SunPower) have now excited PV manufacturing, either shutting down fabs or carving-out/selling-off fabs to third-party or affiliate operating entities. A few others have created n-type sales channels through adaptations of the n-PERT/TOPCon architecture, such as Yingli Green, LG Electronics and, more recently, Jolywood.

Despite the valiant efforts of these companies, the market-leaders have barely needed to change course; their efforts have been in shoring up 10-30 GW of in-house p-mono PERC cell and module capacities, while issuing the occasional (and largely inconsequential) R&D or pilot-line announcement to the outside world.

So long as there was no fundamental need for the market-leaders to change technology, there was never going to be any meaningful market-share gains by n-type products. In short, this is what made all the legacy third-party n-type share gain forecasts incorrect; there was no basic need for the technology.

Attempts to carve out a higher-ASP rooftop business model have notoriously been short-lived, and miss the point that a successful PV model should work regardless of the end-market segment; not simply avoiding the ones (ground/utility) that expose the manufacturing entity to losses.

Furthermore, the only technology change that has mattered since 2015 has been the move from p-type multi to p-type mono (PERC). This has dominated everything, and the change, as noted above, has been dramatic, so much so that multi is essentially gone from the PV industry now. (During 2022, only India will be consuming multi-based cells, but in very low numbers.)

Now, there is a commercial driver for n-type, and this is coming from every c-Si module supplier (with the exception of a small percentage of the market) selling the same technology, only packaged in different ways.

For the first time ever in the PV industry, during 2021 and 2022, it is time to talk about n-type market-share gains, ultimately leading to p-type being another transition-phase mainstream industry technology.

Among the three n-type options (n-PERT/TOPCon, IBC, HJT), there is a growing belief that the smart money will be on heterojunction. Therefore, let’s look now in more detail about what we really know is happening today, and what will need to change in the next few years to allow massive capacity and production growth.

Heterojunction mass-production in 2021; who is leading the way?

Currently, HJT mass production can be viewed as in its second phase of commercial activity, with the first phase belonging almost exclusively to Sanyo and Panasonic.

While some companies had been producing HJT modules (in very small quantities) in the past (other than Sanyo/Panasonic), there was a clear fork in the road 2-3 years back. At this time, the industry saw a few new entrants, most notably Hevel Solar, move production equipment to mass-production status.

The differentiation between R&D (academic or joint-funded projects), in-house pilot-line builds and (proper) ramped mass production has to be emphasized at this point. This is because many companies put out press releases stating ‘ambitions’, as opposed to raw manufacturing data that backed up running production lines seriously (and by default having a sales pipeline for HJT cells or modules).

The list of companies that falls into this final category is large today, when it comes to HJT. In particular, this includes the deluge of Chinese companies that have merely issued press releases based on tentative new-market entry plans. Often, it turns out the plans are simply to add module capacity, with the ‘possibility’ that TOPCon or HJT technologies could be part of a roadmap.

Outside China, REC Group is in the early stages of ramping up its first HJT line; Meyer Burger is planning to go into production this year in Germany; 3Sun is understood to be mainly engaged in a European research programme ahead of full mass production ramping.

This leaves three companies that are probably the current group to watch today: Hevel Solar, Jinergy and Risen Energy. Running in the background here of course are the activities of Tongwei; since Tongwei is a cell-maker, their role is important, but not in the same way as companies selling HJT modules based on sales channel pipelines.

Note that the opening session of PV HeterojunctionTech Online is set to feature presentations of HJT in mass production from the three key players mentioned above: Hevel, Jinergy and Risen. In this session, I will also give a forecast of HJT adoption under a technology-driven 5-year market scenario.

The need for a dedicated annual HJT event, focused on real-world manufacturing

The timing now for the first annual PV HeterojunctionTech event is ideal, as touched upon above. Until now, all HJT events, workshops and gatherings globally have been driven mainly from the research community, and this has been entirely appropriate given the status of the technology in the market.

Moving forward however, if the technology is to emerge truly as the winner in the next phase to replace p-type mono-PERC, the need for a global community across the whole value-chain is imperative. What cannot happen is that the fate of HJT lies in the hands of a bunch of cell makers in one country (e.g. China) where the goal is largely on making sure upfront capex is low, rather than identifying what is needed to create a sustainable industry in the long run.

The issue of upfront capex for HJT equipment has to be addressed. When one asks almost any of the leading p-mono PERC module producers what needs to happen for HJT to become a mainstream technology in the PV industry, there is normally one very quick answer that goes along the lines of: ‘the equipment costs have to come down’.

This summary is completely incorrect. It basically suggests naivety in what is needed to move from R&D to pilot-line to mass-production, in a methodical and systematic manner. The barrier to entry for HJT today is NOT merely a tool capex issue, and the fact that Chinese equipment suppliers can’t offer ultra-low cost equipment like they now can for p-mono PERC cell lines.

Once we have accepted there is a need for the technology at the 100-200 GW level, then the barriers to entry have to be listed, discussed, and then solved. Within this envelope of challenges, upfront capex is one of many things.

Of course, the world would be great if people could just press a button, order equipment from China for new cell lines aligned to costs today on mono-PERC, and ramp up GW fabs within 2-3 months. But this is not reality. And this is why a global annual forum of equipment/materials suppliers, R&D/technology-transfer institutes and current HJT mass-production leaders, needs to get together to solve these problems collectively.

This is why PV-Tech has launched the annual PV HeterojunctionTech event now. It is to create this forum and look at exactly what needs to be addressed (across the whole HJT value-chain, through to downstream technology acceptance and state-of-the-art panel reliability testing), to create the basis for a truly mainstream offering going forward.

Then by default, the outcomes of the event essentially create the actual PV Technology Roadmap, specific to heterojunction. After the event takes place this week, this is surely a topic I will be returning to in blogs on the PV-Tech.org platform.

But first, there are two days packed full of talks and live feeds, to explain all the key challenges that need to be addressed and overcome if heterojunction is to move from the GW-level today by more than two orders of magnitude by the end 2025.

The PV HeterojunctionTech event is one of the most eagerly-awaited events that the team at PV-Tech has organized in recent years. We hope as many of you, keen to understand how heterojunction makes the next giant leap in production, can participate in the online proceedings this week, on 17-18 March. The full agenda can be view at the web page.

Click the ‘Enquire to Attend’ link here to register to attend.