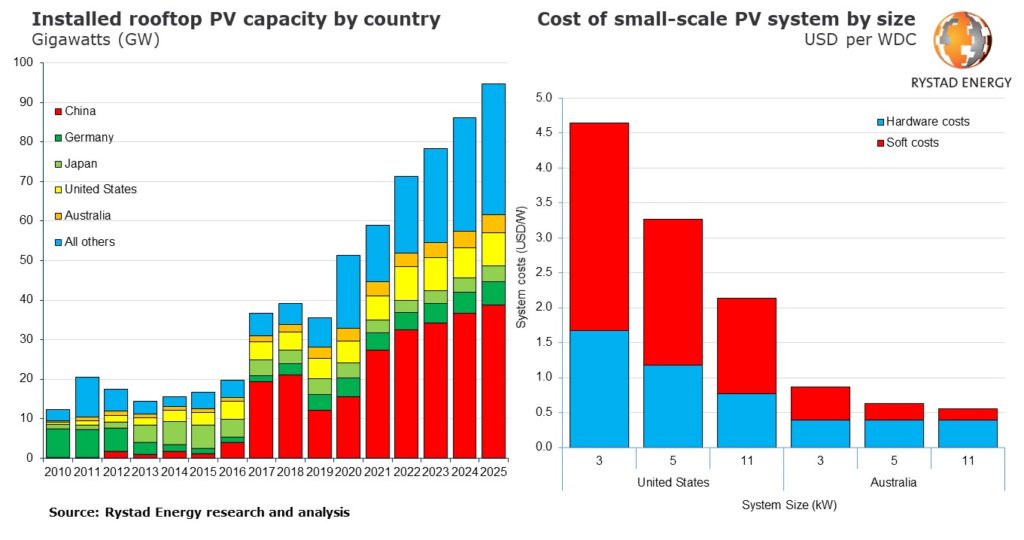

Installed rooftop solar capacity globally is on track to increase 61% between 2021 and 2025 as policy support encourages deployment and homeowners look to mitigate high electricity prices.

That is according to consultancy Rystad Energy, which put global rooftop PV capacity in 2021 at 59GW, with growth in recent years driven by rising adoption in China, which accounts for around half of the total capacity.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Residential PV deployment in China reached 21.5GW last year, with the segment’s share of total solar installations in the country topping 40%, China’s National Energy Administration announced in January.

Rystad said almost 95GW of rooftop solar is expected to be operational worldwide by 2025, with deployment backed by incentives and policies to promote adoption, especially feed-in tariffs (FiTs) that guarantee an above-market price for producers.

Residential, commercial and industrial (C&I), and off-grid projects are all gaining momentum, supported by policies and economics, said Gero Farruggio, Rystad Energy’s head of renewables research.

“Key drivers for the high uptake in the residential sector include high retail electricity costs, low system costs, high FiTs and the available roof space,” he added.

Alongside China, the key markets for rooftop solar deployment include Japan, Germany, the US and Australia.

Residential solar deployment in the US reached a new high of 4.2GWdc last year, with more than 500,000 systems installed for the first time, according to research published last week by the Solar Energy Industries Association and analyst firm Wood Mackenzie.

Homeowners in states such as Texas are increasingly installing both rooftop PV and battery energy storage systems to counter the threat of power outages as a result of extreme weather.

The US, Australia and the UK dominate the residential solar segment, Rystad said, with three being the only markets in the consultancy’s list of top-ten countries for installed rooftop capacity where most of the systems are dedicated to powering residential properties. This is due to factors such as FiTs and grants, a high proportion of homeowners in those countries and a prevalence of suitable rooftops.

Rystad’s analysis also reveals that rooftop PV in the US can be almost five times higher than in Australia due to significant soft costs associated with purchasing a system, including sales tax, permitting, inspection and interconnection. While a 3kW system in Australia costs US$0.96/Wdc, it costs US$4.6/Wdc in the US.

The consultancy said that in addition to higher soft costs, the economics of residential systems are less favourable in the US given that retail electricity prices (costs being offset) are substantially lower.