Governments worldwide must ensure that there are sufficient raw materials available to solar and energy storage developers to safeguard the energy transition.

That’s according to a new report from the International Energy Association (IEA) that has warned that there is a “looming mismatch” between global net-zero targets and the availability of critical minerals such as lithium, copper and colbalt that are needed to develop key components and technologies used in power systems.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Faith Birol, IEA’s executive director, said that governments “must give clear signals” to the renewables sector about how they will “turn their climate pledges into action”, and ensure a smooth clean energy transition.

“By acting now and acting together, they can significantly reduce the risks of price volatility and supply disruptions,” Birol said.

Transitioning to clean power generation will “drive a huge increase in the requirements for these minerals,” the report said. However, it is unclear just how rapid growth in demand for raw materials will be. The IEA’s report looked at separate scenarios based on current government policies on renewables deployment (Stated Policies Scenario, or STEPS), capacity growth in-line with the Paris Agreement (Sustainable Development Scenario, or SDS), and achieving global net-zero emissions by 2050. If battery energy storage capacity grew according to SDS, then global demand for lithium could rise by 4000% by 2040, with demand for graphite and nickel showing similar spikes. Cobalt demand, the report said, could be between six and 30 times higher than today’s levels depending on how battery chemistry and climate policies evolve over the coming years.

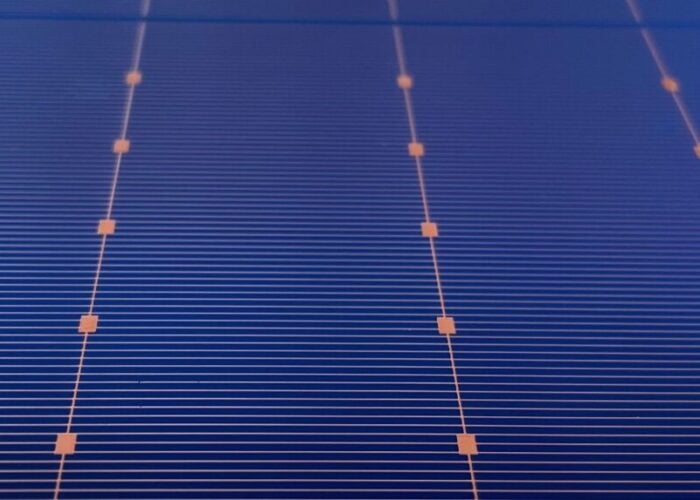

Although wind power would require the greatest proportion of raw materials to sustain growth, solar PV systems follow closely “due to the sheer volume of capacity that is added”, the report said.

The IEA called for governments to lay out long-term emissions goals, support more raw material recycling to ease supply constraints, and foster more partnerships between mining groups and manufacturers worldwide.

Soaring demand for, and shortage of, raw materials in China caused module prices to soar over the past 12 months, with some centralised procurement offers seeing year-on-year price increases of as much as 14% depending on the modules’ type and expected power output.

A smooth energy transition, IEA said, will require “strong growth in investment in mineral supply to keep up with the rapid pace of demand growth.”

The report set out six key recommendations to ensure mineral security for the global energy transition. They include:

- “Adequate investment” in diverse supply chains

- Further research into new technologies to reduce the amount of minerals needed or utilise new ones with lower existing demand

- Scaling up raw material recycling

- Regular stress tests and assessments of existing supply chains to understand how resilient they are

- Work under higher environmental standards to lower emissions in mining itself

- Create “an overarching international framework for dialogue and policy co-ordination among producers”, which would help international stakeholders to share data and expertise to close knowledge gaps or potential issues within supply chains.

Some governments have already moved to safeguard supply chains as the transition heats up. In February, US President Biden signed an Executive Order that identifies the importance of mitigating risks in the supply chain for “large capacity batteries”. The European Union has also moved to establish battery supply chains outside of Asia, where the majority of the world’s production is. The Democratic Republic of the Congo (DRC) and China, for example, were responsible for some 70% and 60% of global production of cobalt and rare earth elements respectively in 2019, IEA said in its report, adding that the concentration is “even higher” for processing operations like refining.

Last September, the European Commission added battery materials such as lithium to a list of mining materials that it deems essential to secure a domestic supply of.