India has the potential to replace Southeast Asian countries as the leading solar PV exporter to the US, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

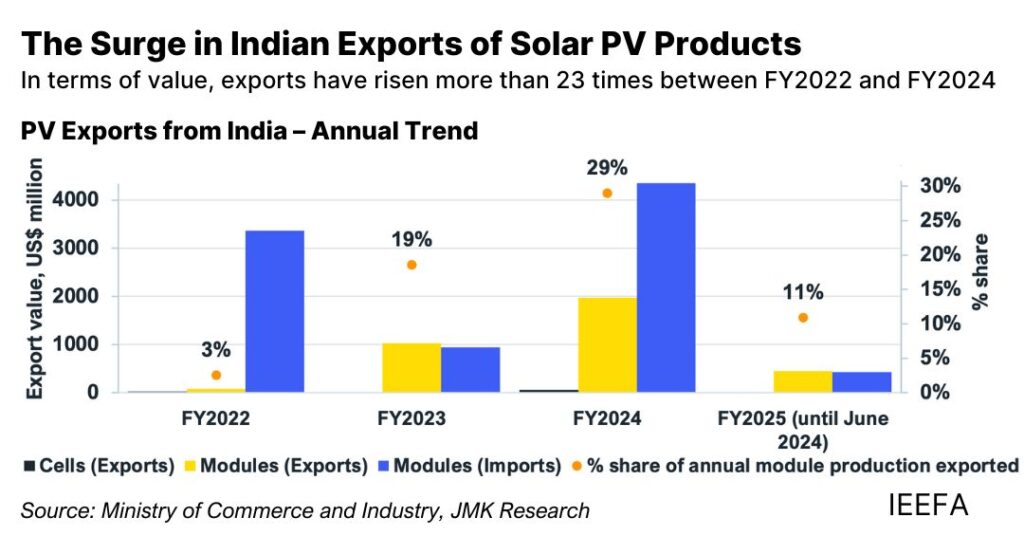

Between fiscal years 2022 and 2024, India increased its import of solar modules 23-fold, primarily to the US. In FY2024 alone, Indian solar manufacturers exported nearly US$2 billion worth of modules.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

This rapid increase is due to several factors, one of which was the delayed implementation of the Approved List of Models and Manufacturers in April 2024 – which requires tenders to use only modules on the list – and, consequently, lower demand for domestic solar modules during the transition period. Another key factor was the opportunity for Indian solar manufacturers to diversify their revenue and sell their products at a higher rate.

IEEFA estimates that profit margins could be between 40-60% higher when exporting modules to the US, despite increased logistics expenses. Exports to the US have rapidly increased in the past few years, with India growing fourfold between 2021 and 2023, from 2.2% to 9% share. Last year the country surpassed South Korea to be the fifth largest exporter of solar PV components to the US.

In 2024 that share dropped to 6.1% – as of the first quarter of 2024 – due to the US election and the implementation of the ALMM, however the report highlights that Indian manufacturers expect imports to increase after the election.

Additionally, delays from US solar manufacturing plants for modules, cells and wafers further improve Indian manufacturers’ optics to export its modules in the coming months.

Until recently, the majority of exports were concentrated between Indian solar manufacturers Waaree Energies, Adani Solar and Vikram Solar. Each of the manufacturers exported over half of its annual nameplate capacity in FY2024.

Not only have these companies exported their domestic capacity to the US, but many Indian manufacturers target to build plants in the US, such is the case of Vikram Solar and Tata Power, among others. In Vikram Solar’s case, the company aims to build a vertically integrated plant, from ingots to modules, with an annual nameplate capacity of 4GW and an investment of up to US$1.5 billion.

Ongoing AD/CVD investigation

The US Department of Commerce (DOC) unveiled last month its preliminary findings regarding countervailing duties (CVD) on solar cells imported from Southeast Asia, with the DOC set to apply duties to manufacturers with plants in Thailand, Cambodia, Malaysia, and Vietnam.

This is only the first determination reached in the ongoing antidumping and countervailing duty (AD/CVD) investigation, which was launched in April 2024, into imports of crystalline silicon solar cells, whether or not assembled into modules from the four Southeast Asian countries mentioned above.

With the optics of more tariffs being applied through the AD/CVD investigation, but also Donald Trump’s presidential election victory earlier this month and a call to increase trade tariffs, India has a more favourable outcome to further increase its exports of solar panels to the US.

“Focussing on the US market can benefit the Indian PV manufacturing ecosystem. The exposure to the US market will enable Indian PV manufacturers to attain economies of scale, ultimately enhancing their product quality and competitiveness,” said the report’s contributing author, Vibhuti Garg, Director – South Asia at IEEFA.

However, the increase in module exports to markets such as the US or Europe could affect the availability of domestic supply in India in the next couple of years. IEEFA estimates that 21GW (FY25) and 25GW (FY26) of PV capacity will be available for the domestic market, which would fall short of the country’s target to add 30GW of capacity annually to meet its 2030 renewable energy target. This is despite annual module production of 28GW and 35GW, respectively.

Furthermore, India continues to grow its installed manufacturing capacity with 11.3GW of modules and 2GW of solar cells added in the first half of the year, according to market research firm Mercom India. Since the Indian government called for comments on its proposed addition of cells to the ALMM – which would come into force on April 2026 – last September, there has been a spike in solar cell and module capacity announcements. In less than two months, Indian solar manufacturers have announced over 20GW of new solar cell capacity.

Distributed renewable energy, such as rooftop solar, needs to be considered, too, as the smaller order sizes could make the domestic supply of solar panels in India difficult for that segment.

“The supply-demand gap also affects solar module prices, which is a critical factor for the price-sensitive residential rooftop solar segment,” added the report’s co-author, Jyoti Gulia, Founder at JMK Research.