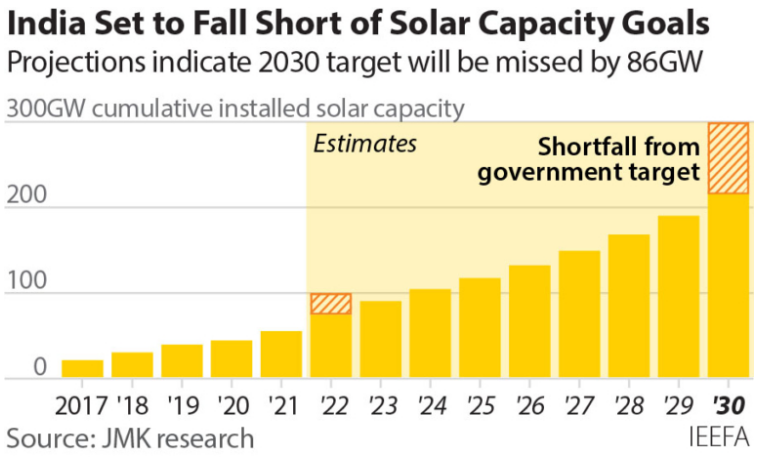

India is set to fall well short of its 2022 solar target of 100GW of installed solar capacity due to the slow uptake of rooftop solar, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research.

India’s 100GW target for the end of this year is broken down into 60GW of utility-scale solar and 40GW of rooftop solar, with the latter proving a significant growth area in the past but not living up to expectations in recent deployment statistics.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“There will be a shortfall of 25GW from the 40GW rooftop solar target, and 1.8GW from the 60GW utility-scale solar target, indicating the need for a concerted effort towards expanding rooftop solar,” said the report.

As of December 2021, India’s cumulative installed solar capacity stood at 55GW, with roughly 19GW expected to be added this year – 15.8GW from utility-scale and 3.5GW from rooftop solar – bringing the total expected capacity at the end of the year to 74GW, well short of its 100GW target.

The figure, however, is higher than research firm Bridge to India’s (BTI) prediction, which expects 65GW to be installed by the end of this year.

“With just eight months of 2022 remaining, only ~50% of the 100GW solar target has been met,” said the report. “Headwinds ranging from pandemic-induced supply chain disruption to deeply rooted policy restrictions impede market growth.”

Looking further ahead, under the current trajectory, India’s will miss its 2030 solar target of 300GW by about 86GW, or 29%, said the report.

It put the shortfall in current deployment down to multiple factors and has suggested both short and long-term measures to get the country’s deployment rate back on track.

IEEFA and JMK Research said the missed target can be attributed to “multiple challenges including regulatory roadblocks”.

These include net metering limits, the “twin burdens” of basic customs duty (BCD) on imported cells and modules and issues with the Approved List of Models and Manufacturers (ALMM), unsigned power supply agreements (PSAs) and banking restrictions and financing issues as well as delays in or rejection of open access (OA) approval grants.

India’s BCD has proved highly controversial. The National Solar Energy Federation of India (NSEFI) has called on the Ministry for New and Renewable Energy (MNRE) to grandfather the scheme or risk up to 10GW of projects and concerns have been raised that some solar plants under development in India could be put on hold due to the tariffs.

The report called for the BCD to “be reduced considerably or deferred to curb a probable price hike in domestic solar modules in the near-term”.

Working alongside the BCD is India’s Production Linked Incentive (PLI) scheme, which has recently seen its budget quadrupled and is expected to add up to 40GW of additional cell and module manufacturing capacity in the country when coupled with the BCD, according to Indian rating agency ICRA, a Moody’s Investors Service company.

The report also called for three short-term measures to address the deployment gap, including uniform policies to apply nationally for at least the next five years, consistent regulations for net metering and banking facilities and restrictions on banking removed at least until rooftop and OA state targets have been achieved.

Long-term recommendations include a stricter enforcement of the renewable purchase obligation (RPO), improved financial health and potentially privatisation of distribution companies (discoms) that are in perennial financial trouble, reduced cross-subsidy surcharge (CSS) for commercial and industrial (C&I) consumers and a capital subsidy for battery energy storage systems (BESS).

“Central and state government policies and regulations must be aligned to support the solar sector overall, and especially the ailing rooftop and open access segments of the market,” said report co-author Akhil Thayillam, senior research associate, JMK Research.

Of the 55GW commissioned solar capacity, nearly 42GW comes from the utility-scale segment and Jyoti Gulia, founder of JMK Research suggested the government, in the short-term, is likely to “push aggressively for expediting solar capacity addition to achieve the 100GW target by 2022 by re-allocating some of the unmet rooftop target to utility-scale generation.”