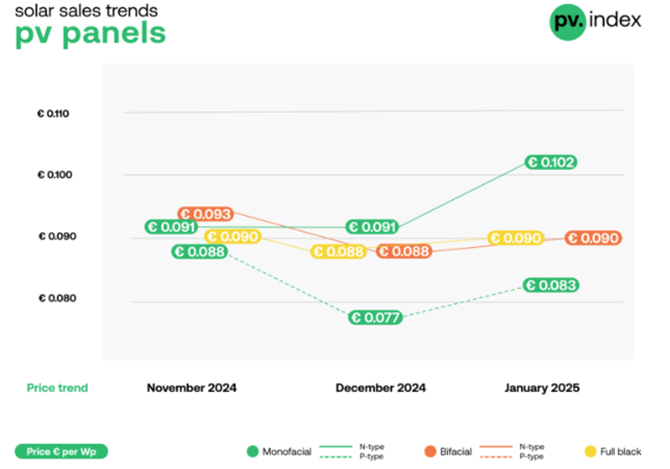

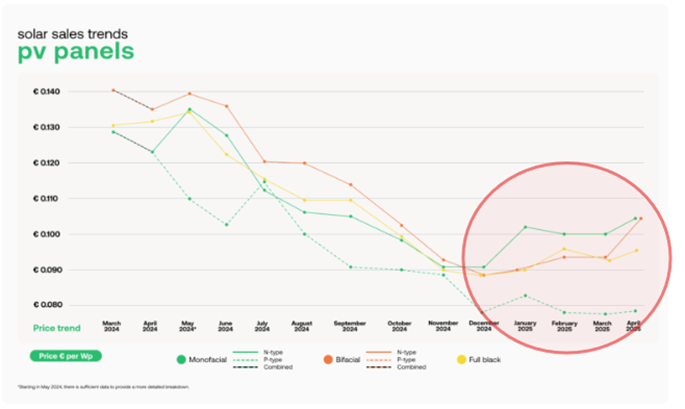

Last year, the European photovoltaic market experienced one of the most intense oversupply cycles in its history. Chinese manufacturers shipped far more modules than the market could absorb, pushing prices to unprecedented lows and triggering an aggressive price war. According to the sun.store PV index from January, module prices in late 2024 and early 2025 dropped to as low as €0.085-0.095/W (US$0.098-0.109), forcing distributors and installers across Europe to offload inventories rapidly just to maintain liquidity.

As this situation unfolded, the Chinese government began implementing measures aimed at restoring discipline within the industry. One of the most significant signals was the reduction of the export VAT rebate for unassembled solar cells (HS Code 85414200) and assembled PV modules (HS Code 85414300) from 13% to 9%, a move widely interpreted as an attempt to cool excessive export volumes and stabilise pricing.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Despite continued stock liquidation in the early weeks of the year, the first quarter of 2025 already showed a modest upward adjustment in n-type module prices. This shift was driven in part by Chinese manufacturers deliberately restricting deliveries to their European warehouses. Most of the major producers chose to keep local inventories at minimal levels throughout the first half of the year. Distributors that had secured material earlier benefited temporarily from improved market conditions. Many streamlined their product portfolios to avoid being caught with excess stock. What had previously been large warehouse surpluses gradually evolved into more disciplined inventory management or extended lead times for new deliveries.

At the same time, signals from China suggested further steps toward stabilising the industry. Mid-year, representatives of the Ministry of Industry and Information Technology held discussions with leading sector players on potential measures to support the market. Increasingly, these conversations focused on consolidation, with major manufacturers exploring mergers and acquisitions as a means of absorbing smaller competitors and restoring balance to the supply chain.

The topic of the VAT rebate reduction – from 9% to 0% – remained in the spotlight for most of the year. Beginning in Q2 2025, module manufacturers repeatedly warned of potential price increases, even for ongoing orders that had not yet left China. These announcements initially contributed to a short-term acceptance of slightly higher pricing; however, the absence of any actual policy change, combined with uncertainty regarding its timing, likely influenced purchasing decisions in the months that followed. As a result, prices largely stabilised mid-year, with a slight downward trend continuing through the end of Q3 2025.

A shift in this trend has become visible in recent weeks. As early as Q3, numerous manufacturers reported significant volumes of modules being shipped from China to Europe, and additional producers have since joined this wave of accelerated outbound deliveries. It is widely assumed that this surge in stock allocation is driven by expectations of a reduction in VAT rebate levels at the beginning of the new year, although the absence of official confirmation still leaves room for uncertainty.

This pattern bears resemblance to last year’s oversupply situation, which resulted in substantial losses for many industry players.

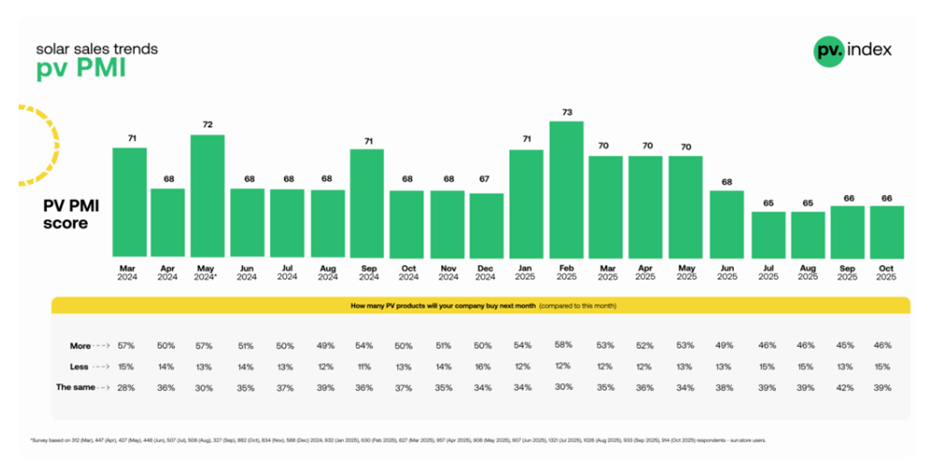

While not all manufacturers have accumulated inventory on the same scale, and distributors today are generally less heavily stocked than they were a year ago, the combination of increased inbound shipments and lower demand, also reflected in the sun.store PMI score, may still be sufficient to trigger noticeable price fluctuations. With several indicators already signalling change, the coming months are likely to be highly dynamic and require close, data-driven observation. For both manufacturers and distributors, disciplined stock management and careful timing of procurement will be critical.

Filip Kierzkowski is head of partnerships & trading at sun.store.