While solar has been the backbone of Japan’s renewable energy push, deployment has been stalling in recent years. Chris Wilkinson of Rystad Energy details the benefits of the country’s feed-in premium scheme, the potential for corporate PPAs and the importance of battery storage.

Solar energy in Japan will undoubtedly take a prominent role in helping the country address its three most pressing energy concerns: energy security, energy supply and a net-zero carbon society. However, meeting their targets of 36-38% of electricity generated from renewable sources by 2030 will not be as easy as simply building more solar and wind farms. There are a multitude of challenges and issues Japan must first overcome in order for the land of the rising sun to achieve these.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

While the world saw a record amount of new solar PV capacity installed in 2022, mainly coming from a large uptick in new projects in countries like China and India, Japan saw flat growth continuing with a trend which started in 2019. Since then, Japan has been installing approximately 1GW of utility-scale solar PV each year, which looks to drop to 0.86GW in 2023. Which begs the question, is Japan’s rising sun still a promising market to enter?

Current market situation and major players

A look at players in the market shows a steady increase of foreign investment, namely from Thailand, India and Spain; foreign companies now account for almost 40% of the market share in new annual solar PV capacity additions, an increase from only 12% in 2015. This suggests that companies such as Vena Energy, BayWa r.e. and Sonnedix certainly believe in the prospectivity of Japan’s solar market going forward. However, when comparing with Japan’s peers in Asia, the rate of penetration from foreign players into the solar PV market remains fairly low. With Japan’s offshore wind industry still in its infancy and with over-burdened grids surrounding ideal onshore wind locations, investment into the solar market from players both home and abroad seems indispensable if Japan hopes to achieve its carbon-neutral targets.

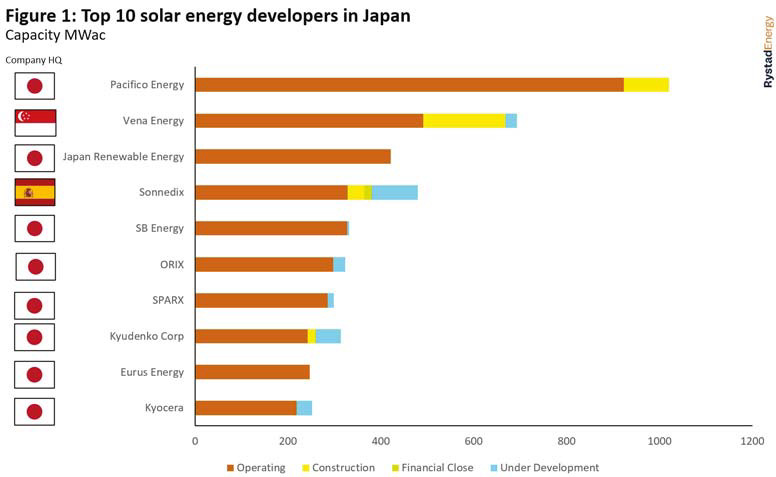

If we look within the utility solar PV market (approximately >1MW) in Japan (Figure 1), currently Pacifico Energy has the most meaningful capacity (operating and under construction) with just over 1GW to come online by the end of this year. Other players such as Sonnedix and Kyudenco Corporation also have reported projects under development due to come online in the coming years.

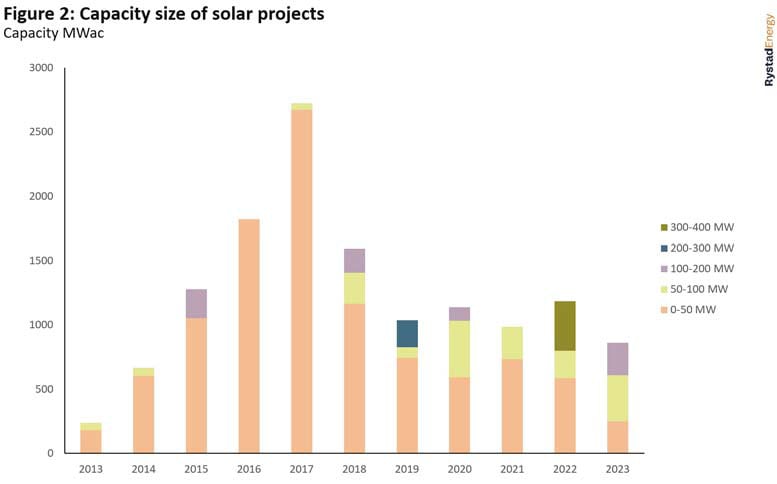

Over the last few years one noticeable change has been the progression from smaller capacity projects to larger scale projects (>50MW). 98% of the new utility-scale solar projects to come online in 2017 were below 50MW in size, compared to 2022, 49%, and 2023, 29%, which sees fewer but larger projects. These projects tend to have the economy of scale and are more appealing in terms of garnering investment and power purchase agreements.

A typical entry point for foreign players into new markets is via joint ventures or through mergers and acquisitions. Globally, 2022 saw 340GW of solar energy capacity trade hands, however only 1GW of this occurred in Japan. Despite multiple foreign players having invested into inorganic growth in Japan over the last decade, the amount of capacity per deal tends to be on the lower end of the scale, suggesting foreign investors still prefer to acquire equity in assets with Japanese developers to learn the market, rather than outright company acquisitions. Additionally, the foreign companies that do tend to buy into the Japanese solar market are well-established renewable generators abroad and there seems to be a distinct lack of large-scale investment from traditional oil and gas exploration and production companies as they try to divest their portfolios to include green energy, as has been the case in Australia and the US.

Feed-in tariffs and feed-in premiums

Solar energy has been the backbone of Japan’s renewable push especially since the feed-in tariff (FiT) scheme was introduced in 2012. This stimulated investment into renewable generation technologies, as intended, and kicked off the journey towards a greener power mix. However, end users took the brunt of payment for the scheme and so the government has decreased the subsidy prices year on year, although they still remain some of the highest in the world. The nature of the FiT allowed generators to receive a stable flow of revenue regardless of power market prices, however, it meant they were un-linked from electricity demand.

To incentivise companies to generate more during peak hours and less during off peak, the government has now switched to a feed-in premium (FiP) scheme for >50kW capacity projects. The FiP scheme will tie generators to market prices and hence should encourage them to generate electricity during peak demand times when the price is high, however, it does also expose companies to price volatility and imbalance risks. The Japanese government hopes the FiP scheme will encourage the development of new solar farms to capitalise on high market prices in the short term and bridge the gap from the FiT phase to a standalone market where developers no longer need to rely on subsidies in the long term.

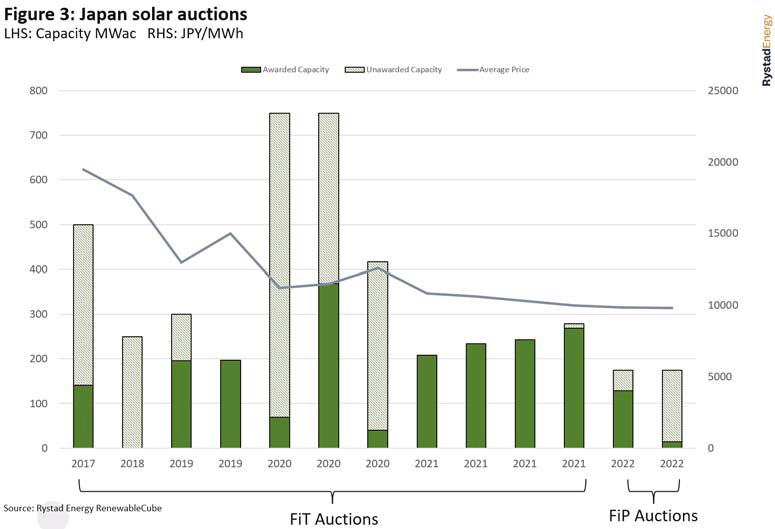

However, thus far, the FiP scheme has yet to meet the government’s expectations. There have been two auction rounds since the introduction of the FiP and both have been undersubscribed, woefully so in the latest round. As seen in Figure 3, the subscriber rate of the FiP auction rounds have seen similarly low winning bids as compared to the early FiT rounds from 2017 to 2020.

This may seem like a bad omen for the solar industry going forward, however, another emerging trend may be partly responsible. As of 2021, developers are no longer required to sell their generated electricity to a utility company, rather they are able to directly tie a contract with a consumer via a corporate power purchase agreement (CPPA). With solar energy’s affordability having vastly improved over the last decade, and with the added bonus that developers can still receive a FiP, these agreements have led to CPPAs rapidly taking off in Japan.

These reforms indicate the government’s willingness to change to reach its net zero targets. Many Asian countries have made similar reforms over the last few years but Japan has taken to them the strongest. Retail companies, such as Aeon and Lawson, have contracted the most green energy in Japan, as they look to act on their own net zero commitments and as developers look to seek a steady supply of revenue. We believe that the introduction of CPPAs will boost solar, and wind, development as Japanese companies seek to follow their peers in markets such as the US and Australia which are dominated by rapid development underpinned by CPPAs.

BESS

The FiP scheme is all well and good in encouraging companies to generate electricity during peak hours, but when the sun tends to shine during the off-peak hours, then this poses a problem. This is where battery energy storage systems (BESS) come in; a standalone battery connected to a solar farm could minimise imbalance costs for the developer.

The BESS industry is still nascent in Japan, however, the government has understood its necessity in supporting a grid powered by intermittent renewable sources. As such, it recently tweaked legislation to allow standalone BESS business to connect to the power grid and subsequently announced a JPY 13 billion (US$95.4 million) budget to fund subsidies to help battery development where a standalone 1-10MW battery would be entitled to receive up to one-third of the total construction cost and >10MW batteries would receive a subsidy of up to half of the construction costs. However, the budget allocated to the initial round was quickly expended with no subsequent rounds announced as of yet.

One of the main benefits of this subsidy is that it can be used alongside the new FIP scheme; this would allow developers the flexibility to generate electricity during high-demand hours but also be profitable while doing so. However, for the BESS industry to really develop and cultivate more flexibility of generation on the grid, more subsidies will need to be announced to incentivise the growth of BESS in Japan. There are signs of progression as currently there are already a few announced projects which plan to utilise BESS such as Orix and Kansai Electric Power Co.’s 40MW battery in Wakayama and Mitsubishi and Kyushu Electric Power Company’s joint development plan to develop grid-scale batteries across Kyushu.

Supply chain

Even with all new policies, subsidies and technologies, an industry still won’t bloom without a robust and affordable supply chain. The good news is that in the international market, the cost of solar panels will likely come down after a few years of inflated prices. This is mainly due to China, where 95% of supply comes from, drastically increasing its polysilicon production capacity to surpass that of global demand. This can be seen reflected in global solar PPA prices which are forecasted to drop over the coming few years. Japan is no different in that solar panel manufacturers source the majority of their ingots and wafers from China and hence lower manufacturing costs of solar modules will likely lead to more projects being developed.

Despite this, there are still supply chain issues at home. Governmental incentives have promoted rapid development of renewable energy, however, the grid’s capacity hasn’t been able to keep up. In January this year, the Okinawa Electric Power Company announced it would have to apply curtailment measures due to high solar radiation levels and low energy demand. Other regions, such as Kyushu, Tohoku, Shikoku, Chugoku and Tokyo and especially Hokkaido also face similar curtailment. In Kyushu, where renewable energy accounts for roughly 50% of the energy supply, solar energy is the third in line energy source to be curtailed during power crunches, after thermal and biomass. Here the average curtailment rate is increasing, up from 3.8% in 2021 to 4.4% in 2022, however, some companies are looking to capitalise on this excess supply via the development of grid-scale batteries on the island.

To make matters worse, Japan’s electricity grid is split into two frequencies. The north of Japan operates at 50 hertz while the southwest operates at 60 hertz and hence when energy demand peaks, especially when exacerbated by natural disasters, only a limited amount of electricity can be supplied to different regions via the inter-grid connectivity points. However, Japan’s Agency for Natural Resources and Energy (ANRE) has outlined plans for major investment into transmission line infrastructure and the electrical grid which should minimise some of these constraints, such as the Hokkaido-Tokyo transmission line.

Furthermore, connecting to the grid still proves troublesome and costly. Not only is it difficult to get the rights to agricultural land to build solar farms in the first place, consent for grid connection is needed before applying for development approval. ANRE has also started accepting non-firm connection and local connection types to alleviate some of the developers’ stress here.

Costs and investments

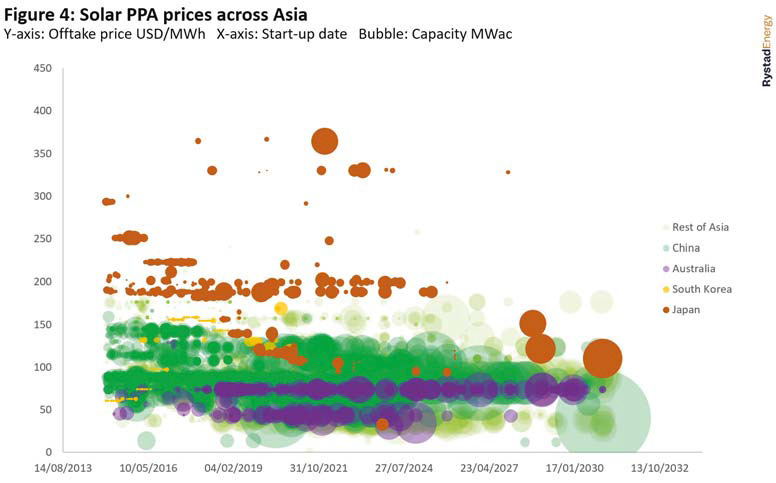

Another concern investors looking to enter Japan may have is cost. Japanese quality is renowned around the world, but with high quality comes a premium. Compared to other countries, labour and construction costs are notoriously high and this affects overheads. In general, PPA prices are decreasing globally; however, when compared with Figure 4, it is clear to see that PPA prices in Japan are still higher than other countries in Asia. As projects increase in size they will benefit from the economy of scale and such a trend can be seen within Japan, however, despite this the total cost of developing solar assets is higher than Japan’s peers.

This is also reflected in the levelised cost of electricity in Japan. Compared with other key countries, Japan’s average cost to generate solar energy is still much higher. This must be taken into consideration with the relatively high power market prices, which could still induce a healthy profit.

Final thoughts

As a country with some of the most densely populated cities in the world and a firm commitment on supplying electricity from renewable sources, the solar industry in Japan has large potential. To fulfil this potential and in order to significantly reduce its current reliance on foreign fossil fuel imports, a fully developed BESS industry will be necessary to provide developers the flexibility they require to avoid curtailment, earn revenue and further promote development of not only solar but all renewables.

This, in conjunction with FiP subsidies and CPPAs, should support the development of more large-scale solar farms, thus also attracting investment from international players. The sun in the east looks to rise, but just how high will depend on further government intervention.

Author

Chris Wilkinson has been working at Rystad Energy for four years where he covers the Northeast Asia renewable market, excluding China. He studied geophysics at the University of Southampton and later worked at oil and gas companies before deciding to focus on green energy.