JA Solar has been promoted to AAA-Rating status for the first time, joining LONGi Solar and Trina Solar in this exclusive bankability ratings, now recognised widely across the PV sector as one of the most accurate and detailed ranking systems on offer to PV module buyers when undertaking supplier due diligence.

This article discusses the factors that have led to JA Solar meeting the entrance criteria – both manufacturing and financial health – to qualify as AAA-Rated.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

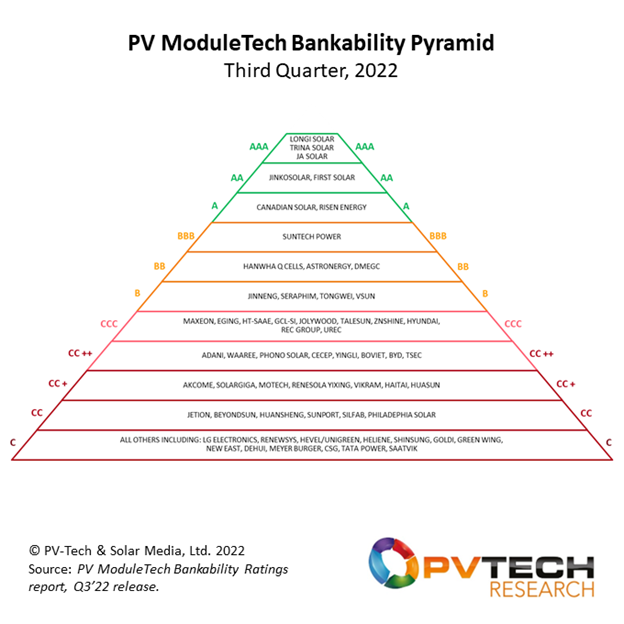

Also revealed for the first time are the relative positions and rankings of the top 60 PV module suppliers today, that account for more than 98% of all PV modules used globally. This is shown below as a Bankability Pyramid hierarchy, ranging from AAA-Rating at the top to C-Rated at the bottom. The pyramid is taken directly from the September 2022 release of the PV ModuleTech Bankability Ratings report.

Finally, I outline some of the key topics set to be discussed at the forthcoming PV ModuleTech EMEA conference in Malaga, Spain on 29-30 November 2022: a regional segment in which JA Solar is one of the top module suppliers.

From Chinese cell leader to global module powerhouse – the JA technology story

Almost 20 years ago, JingAo came on to the scene in China. Outside China, the current brand of JA Solar (and indeed JA Solar as a module producer) was not present. However, the company was highly regarded as one of the first real movers in the Chinese solar manufacturing sector to specialise in cell manufacturing.

In fact, I remember chatting to European R&D experts about 15 years ago at one of the PVSEC conferences in Europe and I kept referring to this company called ‘JA Solar’ and was being met by confused looks. Half an hour later, they worked out I was talking about JingAo!

At this time, JingAo was establishing itself as a credible cell production entity in China: something that had been reserved for early Japanese and European companies (and SunPower) until then. (Taiwan cell makers had joined the mix by then, but R&D was not their forte by any means.)

JingAo and Suntech (the ‘old’ Suntech) were in fact the two major cell makers in the early days of China-Solar. Other household names today (most notably Trina Solar, Canadian Solar and JinkoSolar) started out as module assembly companies. LONGi Solar was yet to be born.

Somewhat seamlessly, JA Solar become the ‘branded’ entity and the company added module capacity, but focused in the early days as an OEM supplier, most notably providing Sharp with modules. Sharp (like other Japanese PV pioneers including Kyocera and Sanyo) was adjusting to PV moving to mainstream status and was mapping out an existence that involved outsourcing manufacturing (to China and Southeast Asia) and relying upon a brand to win business. For a brief period (about 2013), it seemed to be paying off, with Sharp being the leading module supplier annually by volume. However, and not to sound like a broken record, PV leadership is about in-house know-how and production, and Sharp’s plans were soon to see a rapid decline in fortunes.

JA Solar then started to sell modules mostly under its own name, and mostly outside China. This is probably one of the key points in JA’s history and occurred around about 2012-2013.

Then the ‘fun’ starts! As a leading solar cell entity, and by virtue of being listed on a US stock exchange, JA Solar showed the global sector what novel cell architectures were on offer.

Listening to a quarterly investor call from JA Solar at this time was almost an education in cell technology. Process flows – in a host of pilot lines – were discussed and debated: WRACIUM (wrap-through), PERCIUM (no second guesses!), SECIUM (a selective emitter technology based on silicon nanoparticle inks produced by Innovalight in Sunnyvale, soon to be bought by DuPont). I am sure there were more ‘IUM’s at the time, but to get this article done today I am going to resist trawling through the history of JA Solar’s PV cell architecture nomenclature!

Safe to say, JA Solar was absolutely cell technology focused and way ahead of the curve at the time: more so than any other cell producer in Japan, Germany or Taiwan, and not to mention any of the other Chinese companies at that time. China Sunergy made some noises. And Suntech did way more than that.

While JA Solar was promoting the ‘IUM-revolution’, Suntech was pushing the Pluto technology. Pluto was at the absolute cutting edge of cell manufacturing. Laser doping of phosphorous spray to form selective emitter solar cells, as a stellar UNSW-inspired next-generation version of one of the first real-time advanced cell technologies implement in mass production – the Saturn laser-grooved buried contacts, developed by (then) BP-Solar in Tres Cantos, just outside Madrid, following a technology-transfer initiative that was industry-leading in so many respects. Two of my first factory visits to the PV world back then were to Tres Cantos and Wuxi (where Suntech had its HQ and was building out Pluto mass production lines); what an exciting time that was.

Returning to JA Solar now: the company upstream-integrated to making ingots and wafers and by 2014 was truly a technology-driven ingot-to-module based global PV module supplier force to be reckoned with.

By this time, there were other Chinese companies that had done the same ingot-to-module in-house capacity expansions (most notably JinkoSolar, Canadian Solar and Trina Solar). However, JA Solar was somewhat ahead of the game now – maybe by fortune, or maybe having trust in technology winning out in the end. I have written extensively about the importance of starting as a cell-technology entity and adding capacity upstream and downstream after. The next key decision was to bet early on mono.

Almost everyone globally (all other Chinese producers, many of those in Japan that were still making cells, the European pioneers of Q-CELLS and REC Solar, and the Taiwanese me-too workhorses of the sector) were happy with the proposition that p-type multi was offering both rooftop and ground-mount opportunities: at this time, JA Solar was pushing module supply with a much greater mono-based proportion.

The timing of this would turn out to be pivotal. Aforementioned LONGi Solar was starting to change the casting: pulling ingot needle. Companies betting on mono now found themselves in the right place at the right time, and no more so than JA Solar.

The rest of the world backtracked to make the multi-to-mono switch, and then work out how to make PERC cells. PERC enabled bifacial and in short, we have the PV industry in 2022.

Making profit helps

From a technology leadership perspective, JA Solar has probably been one of the most important manufacturers in the PV industry over the last 20 years. However, so were Suntech (the original version), China Sunergy, SunPower and Sanyo.

Of course, it goes without saying that running a profitable business with good liquidity (cashflow) and low levels of long-term debt is a must to sustain market-leading status in the PV industry. Financial health always comes first, ahead of technology leadership or module shipment volumes.

Until 2018, JA Solar was listed on NASDAQ, like most Chinese module suppliers that wanted to position themselves as global organisations. Also listed in the US at the time were many of the above-mentioned Chinese companies (Trina, Jinko, Canadian, Suntech, Sunergy) and others such as ReneSola and Yingli Green.

By the end of 2022, all this will have changed, with US-listed China representation being confined to the project arms of the ‘new’ ReneSola and the ‘new’ Canadian Solar: companies that are not making or selling PV modules, having spun out their legacy manufacturing businesses either to China stock exchanges or to private investors.

About five years ago, it started to become apparent that US listings were not benefiting long-term aspirations. Share price (market cap) was way out of synch given the companies’ turnover and total assets; and raising cash was much harder than being a Chinese company trading in China.

Trina Solar was the first to make the move from US to China-listing, back in 2016. However, it took Trina three and a half years to relist in Shanghai and not surprisingly overlapped with a period in Trina’s past that saw market-share losses and reduced capex spend.

JA Solar delisted in the US at the end of 2017, but took less than two years to be listed in China. This was done by a ‘back-door’ listing: acquiring a company already listed in China (a heavy lifting engineering firm called Qinhuangdao Tianye Tonglian Heavy Industry Co.). The timing of this was perfect for JA Solar and the huge uptick in capex (across the whole value chain, from ingot to module) was likely a direct result of this tactic.

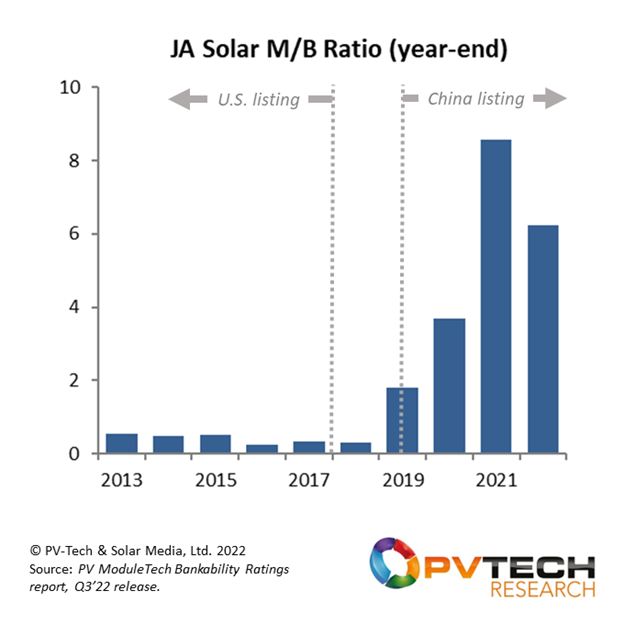

At the end of 2017 (while still listed in the US), JA Solar’s market-to-book (M/B) value (an accounting ratio that gives an indication of how the market perceives the value of stock) was extremely low, and the variant of this (valuation term in an Altman-Z stack) was almost the lowest contributor to the company’s overall financial health. The graph below shows JA Solar’s M/B ratio between 2015 and 2022 (year-end actual and forecast). The change between US listed and China listed is staggering.

Benchmarking JA Solar within the PV ModuleTech Bankability Ratings analysis

Now let’s walk through the latest analysis from the PV ModuleTech Bankability Ratings report (Q3’22) that was released this month (September 2022).

First up, here is the new pyramid that shows the top 60 PV module suppliers in the industry today.

Within each PV ModuleTech Bankability Ratings report release, companies are fully analysed, discussed and benchmarked, revealing the relative strengths of each from a manufacturing (value-chain production, global module shipment profile, capex, R&D spending etc.) and financial (cash-flow, debt, valuation, profitability, turnover) perspective.

However, the most interesting benchmarking is when the top A-Group-rated suppliers are compared. For 2022, we set the benchmarking based on suppliers that had maintained A-Group status (AAA, AA or A-Rated) for a trailing three-quarter period. For 2022, this confined this ‘premium’ benchmarking exercise to LONGi Solar, Trina Solar, JA Solar, JinkoSolar, First Solar and Canadian Solar.

How these six module suppliers rank across the dozens of metrics used to create the final ratings hierarchy is perhaps the most valuable benchmarking within the entire PV industry today.

Let’s look now at JA Solar’s ‘scorecard’ in this regard.

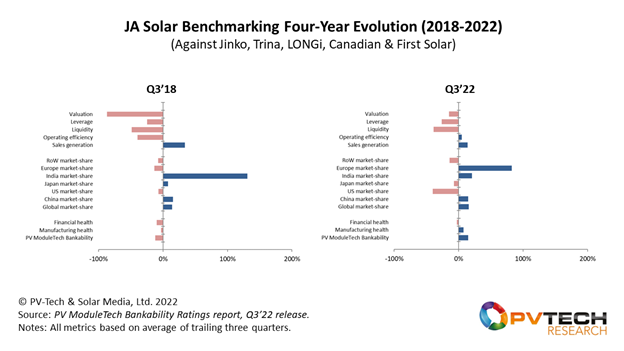

The following figure is priceless. Each quarter, we show these types of scorecards for each of the top six A-Grouping in our Bankability Pyramid. The graphs within the figure show how a company is performing across a range of manufacturing and financial metrics, relative to the other five companies in this elite peer group category. As a snapshot in time (each quarter) it is unbelievably useful as it reveals the areas that each company is strong and weak within the industry, relative to the actual companies that compete within the sector. Bars to the right of the y-axis (in blue) show performance above the weighted average from the top-six companies together: bars to the left (in red) show underperformance. In short, it is a strengths and weaknesses graphic.

However, it is even more valuable when looking at how these graphs have evolved over time. Normally, business decisions (from an operational perspective, capex investment standpoint, technology decision-making and global sales/marketing initiatives) take a few years to show results. Therefore, looking at the relative changes over a three-to-five-year period reveal how successful a company has been against its main competition and truly sector specific.

This is one of those times when a picture is worth a thousand words. In essence, this is a report card on how JA has performed within the PV industry over the past four years.

There are so many aspects of the above figure that could be dissected, analysed and discussed. Let me focus on a few that are of special notice.

The valuation metric is a direct confirmation of the discussion before in this article, and how this has moved so much due to the delisting/relisting process.

Operating efficiency (operating margin based) has also improved more than the company’s competitors, in part from the focus on real in-house component use for modules (own-made ingots, wafers, cells and modules for the most part).

However, when we look at regional ‘presence’ (market-share relative to peers), we see a huge uptick in European market share. This is important. For years, module suppliers from China (and South Korea to a lesser extent) have gravitated to the US market as being the ultimate ‘badge of honour’ in having strong overseas shipment volumes. However, fast-track to 2022, and the US is about 10% of global module supply (and full of administrative red tape). So, we have to put things in perspective. Europe is by far a greater litmus test of overseas strength today and module suppliers that have focused on this market are definitely the ones to pay attention to right now.

The converse to this is India and here JA Solar is net-negative over the past four years relative to its peers. However, market share in India is a double-edged sword: good for offloading product; less good for making profits. So ideally, minimising shipments to India is actually a good thing if you are a global player these days and can pick and choose end-markets as you see fit.

At the bottom of the figure above are the overall manufacturing and financial score comparisons, with these being the factors that feed into the final bankability score in the pyramid. This shows a slight uptick in manufacturing and overall bankability comparisons, and (combined with the financial position today) this is ultimately behind JA Solar’s final nudge from AA-Rated in the past to AAA-Rated today.

But what about traceability and ESG in the climate of module supplier RFQs?

Everything above is key to ranking PV module suppliers, but currently there is another issue taking shape globally: module supplier traceability and ESG/sustainability openness. I use the word openness as this is probably the term that sums up the largest concerns from the module-buying sector right now.

Visibility into current and future module BOM sourcing is massive, and this single topic probably accounts for the vast majority of discussions I have every week with module buyers globally: weighted heavily in the last 18 months to US investors/developers but now seeing the same concerns being raised by European buyers and ‘responsible’ corporates that know their global deployment plans simply have to be accountable to their company owners and shareholders going forward.

For years, the PV industry was happy to buy product from anywhere, including China in the early days of the sector’s growth and more recently out of Southeast Asia (in particular Malaysia, Vietnam and Thailand) into the US; and without any pressing need to track back component sourcing and how much of the module product (cells, wafer, ingots, polysilicon, and almost back to sand) was being made by the module seller or where in fact it came from.

In 2022, the corporate world was forced to get a conscience, and today institutional investment is bankrolling the sector. Driven by US/China import requirements – and now implemented to an extent across EU nations – we have a brand new issue at play; this has utterly changed the terms underpinning module supplier RFQs and due diligence processes by high-volume contract buyers of modules.

The industry is now in a state of confusion. Every week, I have about a dozen chats with developers and investors that are desperately seeking a path forward in resolving this problem.

Personally, I think it all comes back to who makes what and where: not simply polysilicon (or further back in the value-chain), but which module suppliers are in ‘control’ of polysilicon, ingot, wafer, cell and module production by virtue of having in-house capacity and where in the world this is located. For example, if the company only assembles third-party cells into modules, one has to get real about whether this company (and especially if they make just a few hundred megawatts a year) has any control over where the polysilicon is being made.

For years, I thought this mattered from a ‘quality’ perspective. Now it is being manifested by way of traceability. As such, there is a gaping hole in the PV industry today to understand this.

Since this article is largely about JA Solar’s rise to AAA-Rating status, let’s use JA Solar as an example. In fact, JA Solar is one of only two-three major global module suppliers today to have a manufacturing strategy that goes some way to reassuring module buyers.

The story here is somewhat complex. More than a decade ago, JA Solar was one of many companies that committed to long-term polysilicon supply when there was a major undersupply in the market – at about the time when PV overtook semi in needing poly. Two key polysilicon suppliers that were calling the shots then were Wacker and Hemlock. Each of these raw material suppliers locked in companies to long-term contracts.

When the Chinese sector (most notably then led by GCL-Poly) built up significant polysilicon capacity in China, polysilicon pricing fell by about an order of magnitude to around US$30/kg. Companies that were locked into legacy pricing contracts were then in a desperate situation. Some went to the courts and cited force majeure. Some settled by way of cancellation-based one-off payments. Others retained the original order commitment volumes but under different pricing terms.

JA Solar chose the somewhat reconciliation approach (with Hemlock) and this ‘forced’ JA Solar to make the decision to locate ingot/wafer capacity in Vietnam in order to justify polysilicon to be supplied from Hemlock (i.e. avoiding China duties on US-made poly). Although not a factor in the decision-making then, it now seems somewhat full of wisdom and forward-looking!

Global module suppliers that have non-Chinese ingot/wafer and cell/module in-house (and by default BOM authenticated) production – and where the polysilicon comes from one of Wacker, Hemlock or OCI (Malaysia-based former Tokuyama plants) – are traceability/ESG pioneers to an extent.

Today, three major module suppliers are in this elite grouping: First Solar (by virtue of differentiated US initiated technology choice), JA Solar (as reviewed above) and JinkoSolar. In the coming days, we will discuss a new ranking methodology for globally diversified module suppliers that are best positioned to address the new climate of supply-chain scrutiny that is at the heart of supplier due diligence across downstream segments of the PV industry.

Currently, this issue is somewhat regional. Starting with the U.S., now impacting EU buying decisions, and soon to impact on global sectors where module buyers are conscious of internal audits and senior management scrutiny.

This now leads me into the final part of this article, and the role that the PV ModuleTech events are playing in bringing these issues centre-stage.

PV ModuleTech moves to Malaga, Spain to address EMEA module supply issues

Before the pandemic, the PV ModuleTech conferences had taken place annually in Malaysia, as a neutral venue for the global module-buying community. Once we returned to staging in-person events this year, the PV industry looked very different to 2019, both in scale and from a regional module selection due diligence perspective.

We decided that more focused regional events better suited the PV ModuleTech conferences and we held a US-specific chapter of the event in June 2022 in Napa, California. This allowed the topics to be aligned with the issues more important to US developers and investors, in particular buying modules made outside the US, across Southeast Asia and Europe.

Many of these US-specific module-buying themes are now impacting on European-based module buyers, either for projects to be completed in Europe (and the Middle East) or for modules bought by European headquarters and then deployed in projects anywhere globally.

This is at the heart of the forthcoming PV ModuleTech EMEA event, taking place in Malaga, Spain on 29-30 November 2022. The agenda, topics, speakers and attendees will be addressing how European (and Middle East) based module buyers can gain visibility on suppliers, their product availability over the next few years, the module performance and technologies on offer, and – most crucially – how to get visibility on module component manufacturing place of origin and traceability.

To register interest in taking part in PV ModuleTech EMEA in Malaga, please follow the links at the event homepage here.