US renewables developer Longroad Energy has secured US$600 million in debt financing to grow its renewables portfolio.

The credit facility consists of a US$275 million term loan, a US$175 million revolving credit facility, and a US$150 million letter of credit facility.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Longroad Energy CEO Paul Gaynor said the additional capital will fund the expansion of the company’s operational capacity to over 9GW by 2027, and support the company’s 30GW pipeline of development projects.

“We appreciate the continued confidence of our investors and banking partners in Longroad’s platform and execution. We are excited to welcome and thankful for the institutions who have come into this new financing,” he said.

The latest debt financing followed the US$500 million equity investment in August 2022, supporting its business model shift from a “develop to sale” strategy to the ownership of renewable projects in the US. Longroad Energy would further accelerate its portfolio growth from 1.5GW of owned assets to more than 8.5GW of solar, wind and energy storage in the next five years after securing the funds.

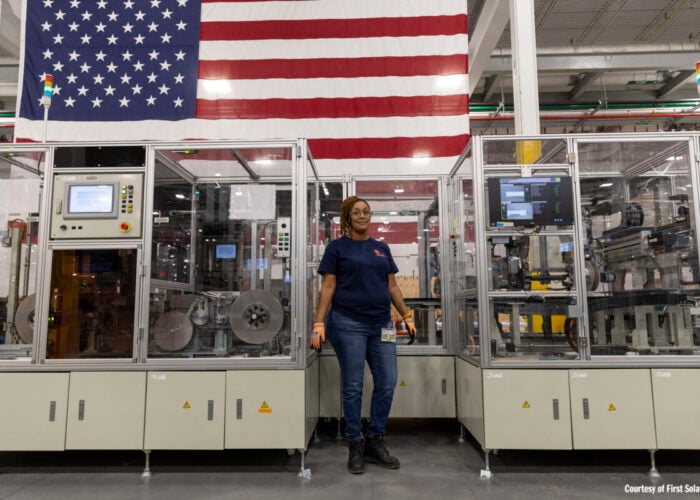

Apart from financing, Longroad Energy also extended a module supply agreement with US cadmium telluride (CadTel) thin film manufacturer First Solar in September. The company expected to acquire an additional 2GW of First Solar modules.

The deal built on a 3.7GW supply deal already in place between the companies, and will bring Longroad’s total acquisitions of First Solar modules up to around 8GW since 2017. First Solar will deliver the modules to Longroad between 2027 and 2029.