The pressures the solar industry has faced in the first half of 2021 are no secret. Spiking polysilicon costs have combined with freight constraints to put operating margins under serious pressure, resulting in inevitable module price revisions and the consequential dampening of end market demand.

Late last week JinkoSolar reported its performance in the opening quarter of the year, revealing that it had cut its solar wafer, cell and module capacity expansion plans for this year in response to weaker than anticipated demand.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

But that was just one measure that the ‘Solar Module Super League’ (SMSL) manufacturer had taken in response to the crisis, which has sent manufacturer utilisation rates downwards almost universally.

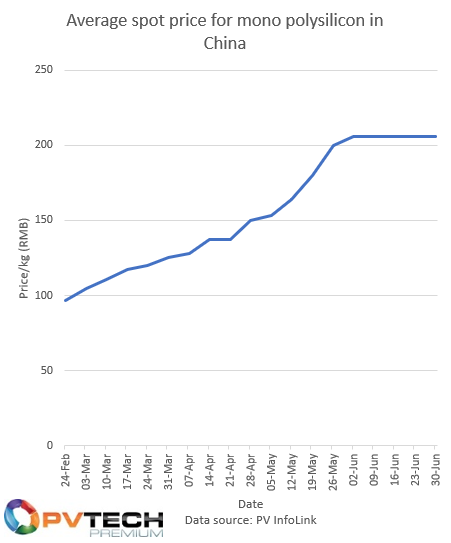

Xiande Li, CEO at JinkoSolar, said given that polysilicon output is sufficient to support around 160GW of installations this year and at least 210GW of installs in 2022 – owing to a number of new polysilicon production facilities slated to come online – there is “no basis” for polysilicon prices to rise further. This is being borne out by how price increases would appear to have stabilised. Average spot market prices for polysilicon, having effectively risen each week from February until June, have now remained flat for the last five weeks.

As industry analysts have noted, echoed by comments made by manufacturers on the sidelines of SNEC 2021 earlier this month, the continued increase of polysilicon has simply been unsustainable. The knock on effect it has had on module prices, which are up ~25% year-on-year anecdotally, has dampened end market demand, resulting in a stand off throughout the solar value chain. With polysilicon costing upwards of RMB180/kg, solar’s price elasticity is evidently at breaking point.

The situation has of course been further exacerbated by the spiralling costs of shipping and logistics. JinkoSolar said during its results disclosure that issues relating to a shortage of freight availability caused by the pandemic had been further impacted by the blockage of the Suez Canal in March this year, with some major shipping lines still reeling from those incidents. In reality Jinko said shipping constraints are likely to last longer than polysilicon pricing volatility, with the manufacturer not expecting freight rates to decline until Q1 2022.

Jinko’s response to the two bottlenecks has been to foster new relationships in those respective fields. A strategic investment has been made into a subsidiary of polysilicon provider Xinte Energy to gain priority access to output from a new facility currently under construction, while the manufacturer has also signed a strategic cooperation agreement with major shipping firm China COSCO, which Jinko said would allow it to provide its customers with long term transportation solutions. Pan Li, CFO at JinkoSolar, told analysts last week that the company was also keen to develop similar relationships with other logistics companies, helping bring down the cost per watt shipped.

But these solutions are unlikely to have an immediate impact on module pricing and, with it, customer demand. As Jinko’s results illustrate, it may be some time yet before the market truly stabilises, and the second quarter of this year could be rockier than the first.

A ‘stronger tolerance’ for higher prices

Also speaking to analysts after the company’s results disclosure, JinkoSolar’s chief marketing officer Gener Miao revealed that while shipments to the US market remained relatively stable in Q1 2021, the aforementioned challenges intensified in the second quarter, leading Jinko to “proactively adjust” its order book strategy and “fine tune the proportion of wafer, cell and module shipments to maintain profitability”.

This, ultimately, resulted in more proactive and consistent communications with the manufacturer’s customers in a bid to find solutions on pricing that both sides of the transaction could accept. Miao said that those discussions had revealed that utility-scale solar investors in China, including state-owned enterprises, have lowered their financial yield expectations from projects this year, albeit moderately. Some projects outside of China had also shown a “stronger tolerance” for higher module prices given their access to higher electricity prices or lower construction costs, and some customers of Jinko had indeed accepted delayed module deliveries in order to hit certain cost metrics.

When pricing volatility was at its worst, Miao said Jinko was updating its price sheets at least every week and occasionally once every two or three days, giving “huge uncertainty” for customers.

Miao added that while site expectations varied from site to site and region by region, overall the market remained optimistic. It can be said with some clarity that imbalances in the supply chain will continue for some time yet, however Jinko is responding to that by maintaining a level of flexibility over its order book and prioritising customers able to develop this year.

As a result of that flexibility, the quarterly split for shipments is likely to fluctuate, Miao said. Having maintained its annual shipments forecast for between 25-30GW – a figure which includes wafers and a small number of cell shipments, for which Jinko offered no formal guidance – Jinko confirmed it shipped 4.56GW in Q1 and is forecast to ship 4-4.2GW in Q2, meaning that the second half of the year is expected to see shipments upwards of 17GW. This would appear to now be heavily weighted towards Q4, with Miao pointing in particular to strong forecast Q4 demand in China.

The module shipments guidance for Q2 is a contraction of 6-10% on the 4,469MW shipped in Q2 2020, indicating the scale of the potential impact of pricing volatility on shipments in the quarter.

That contraction in shipments, balanced against higher raw material prices and the need to accommodate the demands of the end market, has had an inevitable impact on margins. While manufacturers may have originally considered margins would bottom out in Q1, pricing volatility has continued into the second quarter and, if anything, worsened slightly. This is perhaps evident in how Jinko’s Q1 2021 margin stood at 17.1%, down on the 19.5% reported in Q1 2020 but higher than the 12-15% forecast at the start of the year, however the company still expects its full year gross margin to fall within this range.

Miao told analysts that Jinko had the capability to “maintain a reasonable gross margin” in the opening half, with the expectation that margins in the second half of the year would improve owing to an expected stabilisation in polysilicon costs and the company’s efforts to reduce costs elsewhere in the value chain to mitigate that volatility.

And that momentum is expected to carry on into 2022, when projects delayed by cost increases are expected to commence, coinciding with a more stable supply of polysilicon, more available freight at more reasonable prices and, with it, less pressure on margins.