The foundation of a “transformed Maxeon Solar Technologies” is nearly in place, according to the company’s CEO, after it addressed its logistical failures, experienced strong demand for its products and landed a supply contract with US residential installer SunPower.

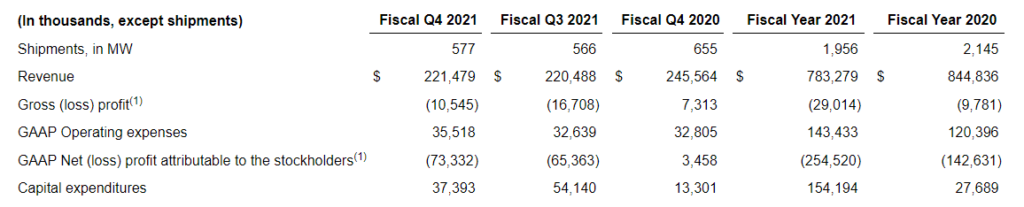

Maxeon reported Q3 module shipments of 577MW, above its guidance range of 540MW to 570MW but below the 655MW it shipped in Q4 2022.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In November, Maxeon announced it was revamping its logistics strategy after a shipping “logjam” made it miss its Q3 shipping guidance. By the end of Q3, 37% of the company’s modules remained in transit and could not be counted in its shipment results, contributing to its missed guidance, it said at the time.

The Singaporean company has now built out its interdigitated back contact (IBC) module line in Malaysia and “can now ship product to Asia customers in less than four weeks compared to our previous reliance on Mexico, which took more than 10 weeks for delivery,” said its CEO Jeff Waters during a conference call with analysts.

In North America, Maxeon’s newly upgraded performance line capacity in Mexico “can deliver product to US customers via truck in one to two days compared to most solar companies taking at least 10 weeks shipping on the water from Asia,” said Waters.

“On a more tactical level, we’re also renegotiating contracts with shipping partners in Asia, concentrating more volume and fewer partners to secure better pricing,” he added.

Sky-high shipping costs have been a thorn in the side of the industry since the COVID-19 pandemic began, with some couriers now charging ten-times more than they were in February 2020, contributing to the increasing cost of modules. PV Price Watch, however, has reported that delays in the shipping industry have likely peaked, with prices also edging slowly down.

Meanwhile, customer demand for Maxeon’s performance line modules reached around 700MW of incremental orders with more than US$70 million of prepayments.

“Since our last earnings call, we executed contracts with two customers to supply over 700MW of our bifacial performance line panels through 2024, bringing our contracted backlog to over 2GW,” said Waters.

A ROTH Capital note on the results said Maxeon’s “bookings momentum remains solid as it is effectively sold out for 2022/2023 and is now booking into 2024.”

“We expect demand to remain strong given the company’s exposure to the EU distributed generation (DG) market, which management cited as a strong growth driver in its Q1 2022 guide,” it added.

“In our DG business, European channel partners continue to set new sales records and are responding with great enthusiasm to our new product launches – AC modules, Maxeon 6, 40-year warranty and additional products coming soon,” said Waters.

Meanwhile, Maxeon has finalised a supply contract with US residential solar installer SunPower, “which not only reset pricing for our products to current market levels, but also enhanced and accelerated our ability to more broadly address the US market,” said Waters.

The contract also provides Maxeon with “the opportunity to launch our own US DG channel, starting with commercial this year and including residential next year,” said Waters, adding that SunPower doesn’t address 90% of the US market meaning more space for business expansion.

Indeed, ROTH Capital believes the agreement with SunPower sets Maxeon up for higher ASPs and margin expansion, with the company’s ASP up from US$0.39/W in Q4 2021 to US$0.44/W in Q1 2022 based on the midpoint of the guide.

Maxeon designs and manufactures Maxeon and SunPower brand solar panels, and has sales operations in more than 100 countries, operating under the SunPower brand in certain countries outside the United States.

Analyst call information taken from Seeking Alpha