Struggling Swiss solar manufacturer Meyer Burger has extended its loan bridge facility until 21 February 2025.

This is the second time the company has extended the bridge facility, which was first announced in December 2024 and was due to mature on 17 January 2025. However, the company managed to extend it a few weeks ago and has now extended it a second time on the same day (14 February) it was meant to mature.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

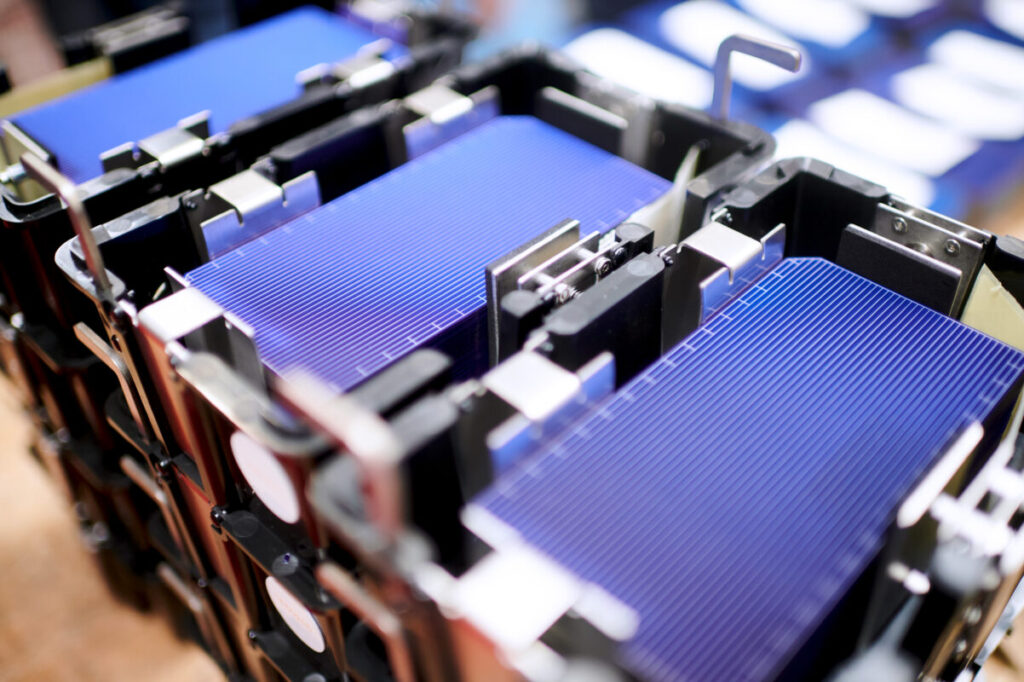

The heterojunction (HJT) solar cell and module manufacturer secured the bridge facility not long after US developer D. E. Shaw Renewable Investments (DESRI) terminated a 5GW module supply agreement between the two companies. According to Meyer Burger, both companies recently were negotiating a new master agreement.

At the same time as announcing the latest extension of the loan, Meyer Burger said it was continuing discussions with “select interested parties” that have provided indicative proposals on a possible acquisition of the business. It said it hoped to progress to binding proposals “as soon as possible”.

2024: a year of hurdles

These latest developments come after a complicated year for the HJT manufacturer, which started 2024 with the announcement of the closure of its module assembly plant in Germany. At the time, the company said the closure of that plant would allow it to focus on its US manufacturing footprint.

However, a few months after that decision the company scrapped its plan to build a solar cell processing plant in August 2024. Meant to be built in Colorado, the solar cell plant was supposed to have an annual nameplate capacity of 2GW.

Soon after that announcement, the company unveiled job cuts, while its CEO at the time, Gunter Erfurt, stepped down. Less than a week after this announcement, the company named Franz Richter as its new CEO.

Aside from these manufacturing setbacks, the company has also suffered from financial hurdles last year, with a fivefold increase in net loss registered during the first half of 2024, while results for the second half have yet to be released.