In releasing full-year 2019 financial results, leading PV equipment supplier Meyer Burger has said it is evaluating the feasibility of becoming a volume producer of heterojunction (HJ) solar cells and modules in Europe, notably in Germany.

The company was coy on providing much detail around the manufacturing feasibility during an earnings call with analysts and media, noting the process remains at an early stage. However, a key concern of investors is likely to be Meyer Burger’s ability to raise capital to make such investments, if done on its own.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Due to the R&D investment levels and low margin returns on PV production equipment, Meyer Burger had already invested in Oxford PV and its ongoing plans to volume produce perovskite tandem HJ solar cells. In addition, Meyer Burger has also entered negotiations to become a manufacturing partner with existing customer and HJ manufacturer REC Group.

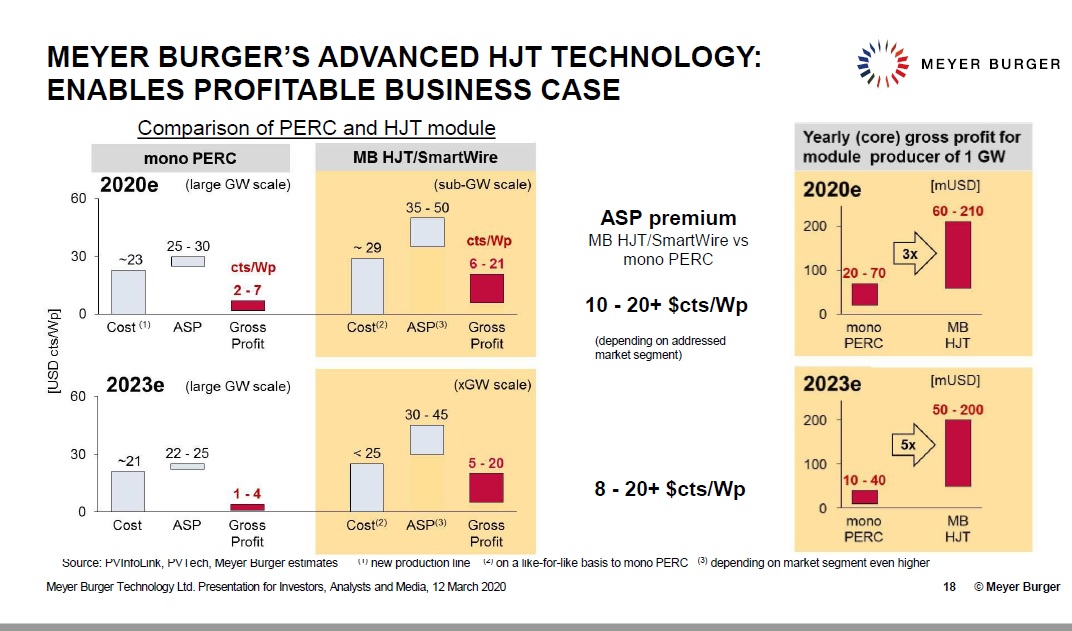

In a presentation, Meyer Burger highlighted the business case for customers adopting HJ technology and so could be applied to the company itself.

Meyer Burger said it was in contact with various leading investment banks to examine strategic and financing options for its own volume cell and module production in Europe.

Leading the strategy change and feasibility study at Meyer Burger has been the CTO, Dr. Gunter Erfurt. However, the company also announced that Dr. Erfurt had taken over as Meyer Burger’s new CEO.

Dr. Erfurt was praised for being instrumental in the development and successful launch of Meyer Burger's HJ technology, since joining the company in 2015. It should be noted that before joining Meyer Burger, Dr Erfurt was the managing director of SolarWorld for 12 years.

In its conference call with media and analysts, Meyer Burger noted that it cost REC Group around US$150 million in capital expenditure to line up HJ cell equipment for its initial 600MW capacity, back in 2019.

REC Group is considering a form of manufacturing partnership with Meyer Burger as it wants to expand HJ capacity further in Singapore. Meyer Burger noted the REC Group expansion would be in the gigawatt range and a profit-sharing agreement was on the cards.

PV manufacturers such as JinkoSolar, Trina Solar and REC Group have recently highlighted the very strong demand for n-type mono high-efficiency products, which are actually in short supply in markets such as Europe, US and Japan.

According to PV Tech’s ongoing tracking of PV manufacturing capacity expansion announcements, at least 14GW of HJ cell and module technology planned expansions were announced in 2019, compared to over 1GW of expansion plans announced in 2018. Since the start of 2020, cumulative HJ-based expansion plans have topped 35GW.

Meyer Burger noted that it was expecting large volumes of HJ orders from multiple customers in 2020.

Financials

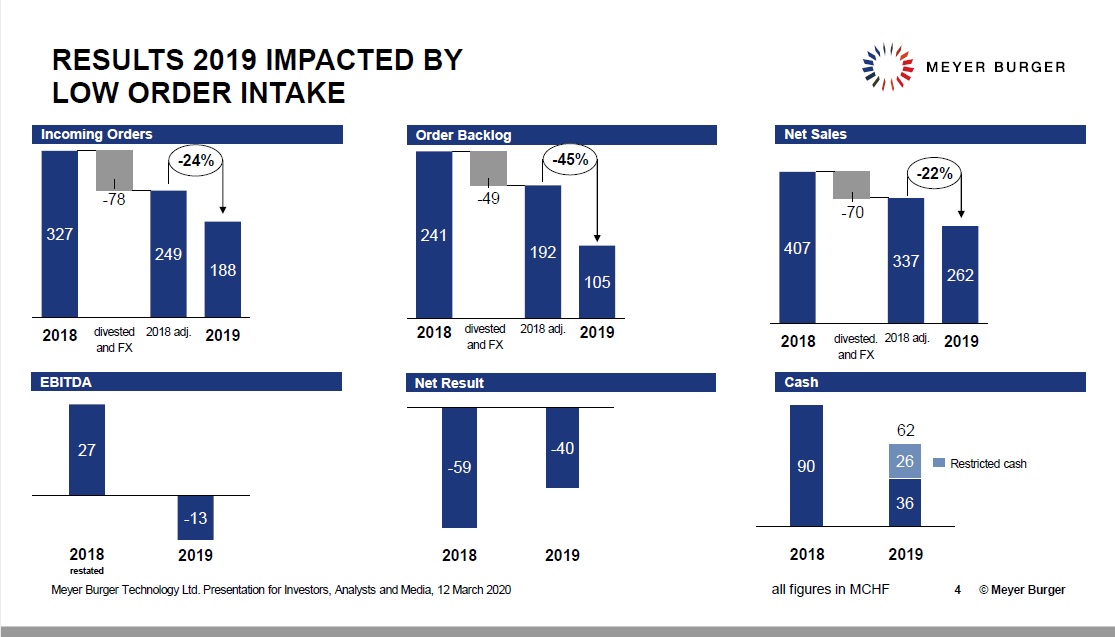

Meyer Burger reported 2019 net sales of CHF262.0 million (US$278 million), down 22% from the previous year.

Incoming orders were CHF188.3 million (US$199.8 million), down 24% year on year, while its order backlog declined 45% to CHF105 million (US$111.4 million).

Despite ongoing and renewed restructuring, Meyer Burger reported a negative EBITDA of CHF13.5 million (US$14.32 million) and a net loss of CHF39.7 million (US$42.12 million). As of 31 December 2019, cash and cash equivalents came to CHF35.5 million (US$37.6 million).

Hans Brändle, retiring CEO of Meyer Burger said, “Business development in 2019 was disappointing. Sales and margins in the bulk business remained below our expectations. This reflects the difficult market environment due to increasingly strong Chinese competition and the Chinese government’s goals set out in the “Made in China 2025” strategic plan.”

“Against the backdrop of these market dynamics, we continued, in the reporting year, to undertake a strategic realignment of Meyer Burger,” Brändle added. “That is to say, we are focusing on the marketing and ongoing development of our own heterojunction/SmartWire connection technologies as well as the highly promising tandem cell technology, a combination of heterojunction and perovskite.”

“As a result of our strategic refocusing, we have restructured and divested business units and assets that no longer form part of our core business,” the retiring CEO went on to say. “Thereby we further reduced our fixed cost base and improved the efficiency of the organization. Our financial key figures reflect the ongoing transformation of the Group and the divestments.”