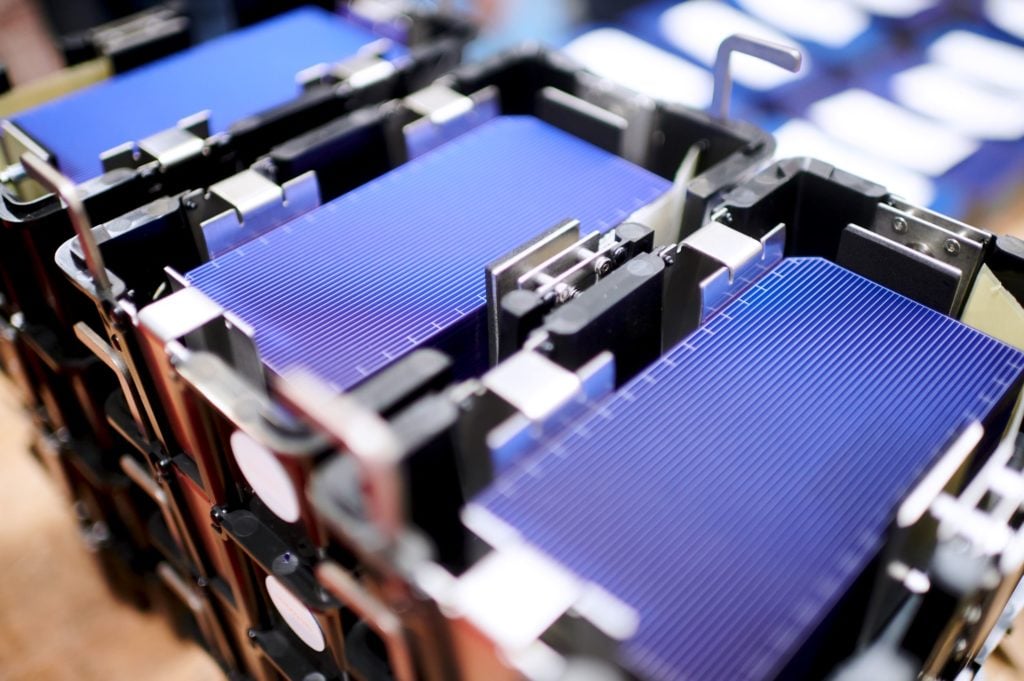

Heterojunction cell and module producer Meyer Burger has secured European-made silicon wafers through a new supply agreement with Norwegian Crystals.

With the polysilicon used to manufacture the wafers of European and US origin, Meyer Burger said the deal will strengthen the resilience of its supply chains while also providing wafers with a low-carbon footprint.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Norwegian Crystals produces monocrystalline silicon products, such as bricks, wafers and ingots. The company told PV Tech earlier this year that the energy mix where its production plant is located in northern Norway is 99% hydropower and 1% wind.

Building on the initial supply deal, Meyer Burger said it is in ongoing discussions with Norwegian Crystals about an expansion of wafer supplies for the coming years.

“With the delivery of first quantities of wafers from European production, Meyer Burger closes the last gap in the strategic reestablishment of a European supply chain for the production of solar cells and solar modules,” said Daniel Menzel, chief operating officer at Meyer Burger.

According to Switzerland-headquartered Meyer Burger, the company already sources components such as solar glass, foils, cell connectors, chemicals and process gases used for solar cell and module production partly in Europe.

Earlier this month Meyer Burger lowered its production plans for 2022 and 2023, in part due to the challenging supply chain environment. Having previously expected to produce 500MW of modules this year, the company now expects to manufacture 320 – 370MW.

Its plant in Freiburg, Germany, will start ramping up capacity to 1.4GW in September and is expecting a production volume of 1 – 1.2GW in 2023, down from a previous target of 1.35GW.

Meyer Burger will publish its 2022 first-half results on 18 August.