French management firm Mirova has fully acquired solar finance business SunFunder in a push to expand its investment platform in emerging markets.

Following the total acquisition, the first joint objective will be to launch a US$500 million solar energy debt financing fund to support around 70 projects in Africa, Asia and Latin America, with the possibility to close the first project by the end of the year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Both companies’ objectives align as they intend to become “global leaders” in energy transition financing, with Mirova’s office in Singapore, created in 2021, to be integrated in its emerging markets investment platform.

Moreover, the acquisition will not change SunFunder’s team and the company will be able to expand its emerging markets platform dedicated to renewables and climate investments.

Philippe Zaouati, CEO of Mirova, said: “In order to thoroughly address the challenges that come with the fight against global warming and social inequalities, having a local presence in emerging countries is critical. We are delighted that SunFunder’s teams, with their proven experience and expertise, are joining us.”

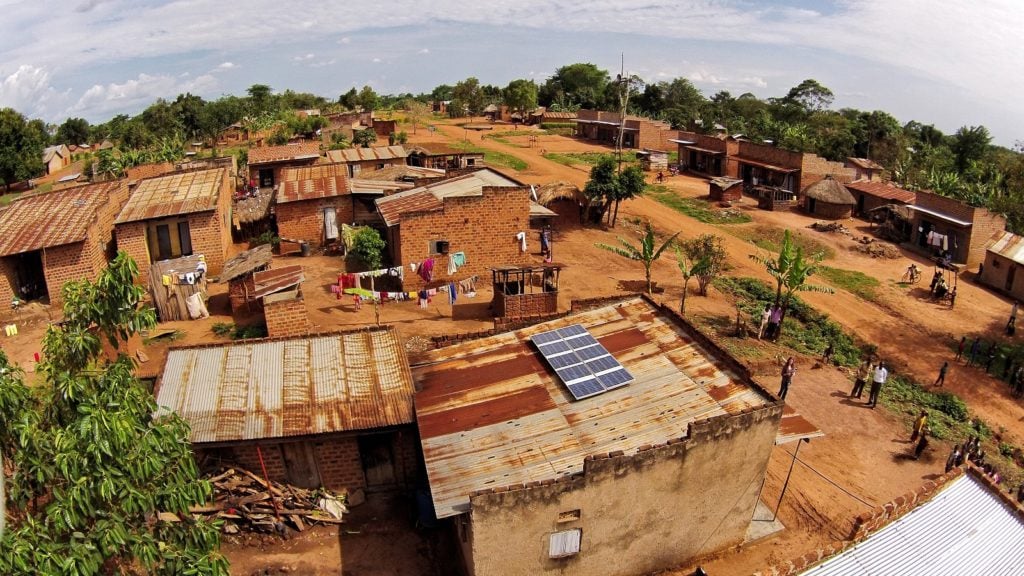

Started as a crowdfunding platform ten years ago, SunFunder has managed US$165 million in clean energy investments across 58 companies in Africa and Asia and has included off-grid solar home solutions, mini-grids and commercial and industrial (C&I) rooftop solar PV projects.