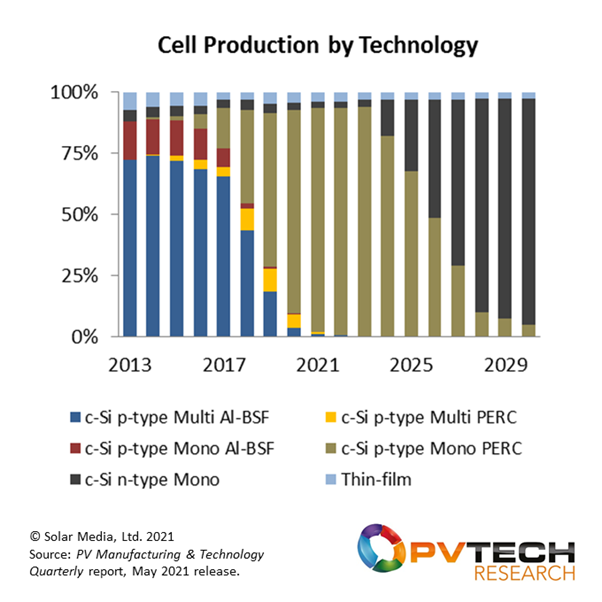

The PV industry is currently in the final phase of p-type dominance, characterised by the use of p-type multi and p-type mono substrates. From 2024 however, all signs point to a dramatic shift to n-type substrates, with this higher-efficiency platform gaining 50% market-share by 2026. By the end of the decade, almost all PV modules produced will be using n-type wafers.

These findings come from PV-Tech’s latest (May 2021) release of the PV Manufacturing & Technology Quarterly report, now configured to allow accurate tracking of the cell producers and n-type architectures currently setting the scene for the pending technology change in 3-5 years from now.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This article describes why this technology change is required, why the timing is right now, and how this will change the PV technology landscape going forward, as the industry moves towards TerraWatt level additions by the start of the 2030s.

First movers for n-type seeding the ground for market leaders

Currently, there is a group of about 20 companies ramping n-type lines nominally at the 500MW capacity level, typically in pilot-line mode. In many respects, these companies need to be considered the first real wave of n-type custodians.

Everyone is aware of n-type activities in the past from the likes of Sanyo (latterly by Panasonic), SunPower (the legacy variant entity), and others such as LG Electronics and Yingli Green. However, these efforts could be considered as ‘too early’ and not targeted at the mainstream utility-scale. Heroic in R&D: less impactful on profitability and longevity.

The correct time to push the n-type button was when the industry had flipped to p-type mono, not when the industry was dominated by p-type multi. P-type had to be the learning curve in getting the industry weaned off low-tech multi casting furnaces. And this essentially explains why the time is right today (with multi basically gone for all purposes) to set out how to move n-type production to the several hundred-gigawatt level by the end of this decade.

Therefore, existing n-type capacity – and the new players – can be regarded as the early front-runners in the pre-ramp phase that will exist over the next 2-3 years, before the expectation of the major technology explosion to the higher efficiency substrates.

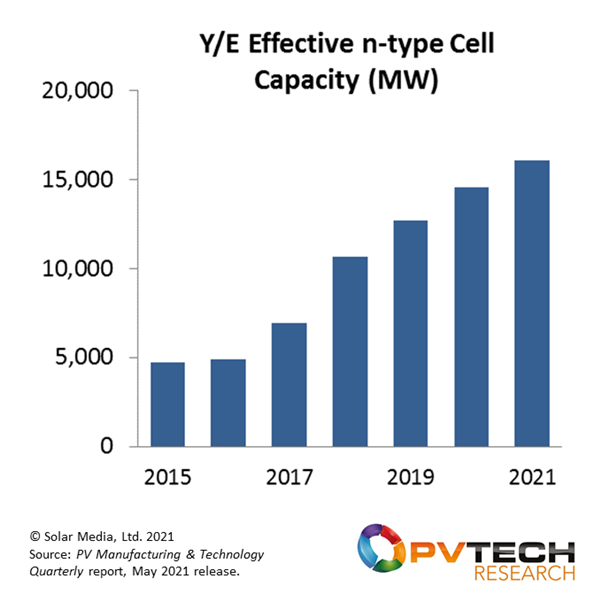

The graphic below shows that effective (useful) n-type cell capacity will exceed 15GW by the end of this year, about three times the year-end 2016 levels. It should be remembered also that a large part of the legacy n-type capacity (making up the 2016 number) has been taken offline, implying that over 10GW of new n-type cell capacity will have been added in just a few years, by year-end 2021.

While the growth trajectory looks impressive, in the graph above, it is still a drop in the ocean compared to the 250GW-plus of p-type mono PERC capacity today. Again, this backs up the early-mover status of the n-type capacity today. However, the expectation is that the companies active now will pave the way for others to follow, once initial learning on gigawatt-scale ramping is done. And at this point – likely towards the end of 2023 – the fun should all start!

Several hundred gigawatts of n-type production – when?

Our current forecast is pointing at 2024 being the key year for n-type, with this year – and most of 2022-2023 – setting the stage for what will follow. The four-year period from 2024 to 2027 will then be the technology-change years, and by 2028, n-type options will look very much like p-mono PERC does today.

The graphic below shows this forecast, where p-mono PERC market-share can be viewed largely as the transition phase between p-multi and n-mono.

Of course, there are many risks and uncertainties forecasting technology almost 10 years out, including in particular when (not to mention ‘if’) a major technology shift will happen. However, there are now many indicators that things are being set up nicely for n-type to finally become the industry standard.

Today, all eyes are on the early movers, and which of the major industry players will be first (likely in 2024) to build new 10-20GW of n-type cell factories. If the industry does end up hitting the terawatt level of production by the early 2030s, there is going to be a massive amount of new capacity needed over the next 10 years. In this case, focus will be on new 10-20GW facilities, not working out how to retrofit a few hundred megawatts of legacy p-mono PERC cell lines.

New focus for the PV Manufacturing & Technology Quarterly report

For the past five years, the PV Manufacturing & Technology Quarterly report has been the leading market research report to the PV industry, tracking bottom-up technology trends across the entire manufacturing value-chain, through to global module shipment analysis.

During almost this entire period, the task has been tracking accurately the p-multi to p-mono PERC technology shift. With this now complete, the report will now focus on the n-type shift, looking carefully at the companies driving change in the short-term. For the above forecast to come to fruition, a handful of the 20-plus players today must succeed. Many will not, but a few have to show that the door is open for others. From a PV technology understanding standpoint, this is the only game in town now.

To learn how to subscribe to the data and findings, please complete details on the hyperlink here: PV Manufacturing & Technology Quarterly report.