Brazil has unveiled the tariff ceilings solar players will face as they compete for the first time in the so-called new generation tender, opening up a new avenue of government support.

PV bids for 20-year supply deals at the A-6 auction of 18 October will start at BRL209/MWh (around US$52/MWh), energy regulator ANEEL revealed in a statement this week.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Solar’s ceiling tariff is more competitive than that faced by hydro (BRL285/MWh) and thermal (BRL292/MWh) bidders for A-6 contracts, but slightly higher than wind’s BRL189/MWh.

PV players have displayed significant appetite for a tender they were barred from until this year, tabling in June 29.7GW of all 100GW-plus bids recorded across all energy sources.

Those reaping A-6 contracts will have six years to ensure projects are deployed and pumping energy into the grid, with the supply deals set to cover the 2025-2044 period.

Solar’s first go at A-6 auctions follows its record-low average tariffs of BRL67.48/MWh (around US$17.5/MWh) at the renewable-only A-4 tender, lauded as a global milestone.

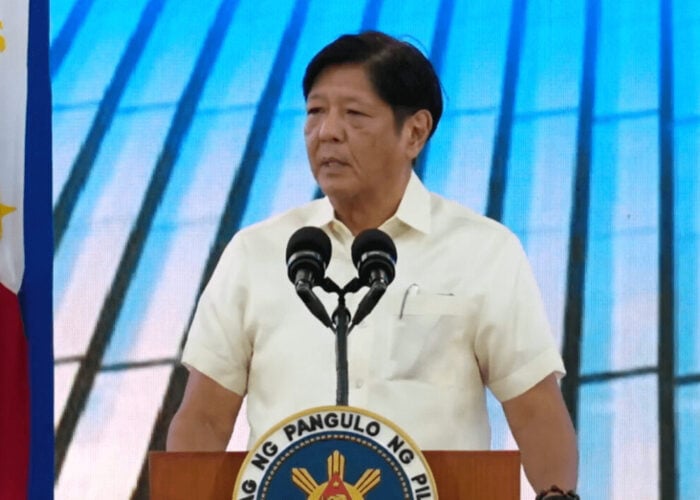

Local PV operators have attributed the A-6 inclusion to a policy shift brought about by the rise to power of controversial president Jair Bolsonaro, who has personally steered major solar schemes.

Speaking to PV Tech for a recent feature, Rodrigo Sauaia, CEO of Brazilian PV body ABSOLAR, said: “There may be scepticism with climate policy but [Bolsonaro’s] is a liberal government interested in efficiency and competitiveness.”

“They’ve come to office with an open mind, to hear what is actually going on and act based on technical knowledge, not political influence,” Sauaia argued, adding that the government opted to include solar in the A-6 auctions because the move would slash tariffs for end consumers.

Having doubled installed capacity to 2GW-plus last year, Brazilian PV is poised for further growth as major utility-scale schemes – including Enel's 608MW São Gonçalo solar complex – progress through various development stages.

The feature examining the opportunities and risks of Brazilian and Mexican PV was part of PV Tech Power's Volume 20, which you can subscribe to here

The prospects and challenges of Latin American solar and storage will take centre stage at Solar Media's Energy Storage Latin America, to be held in Colombia on 28-29 April 2020.