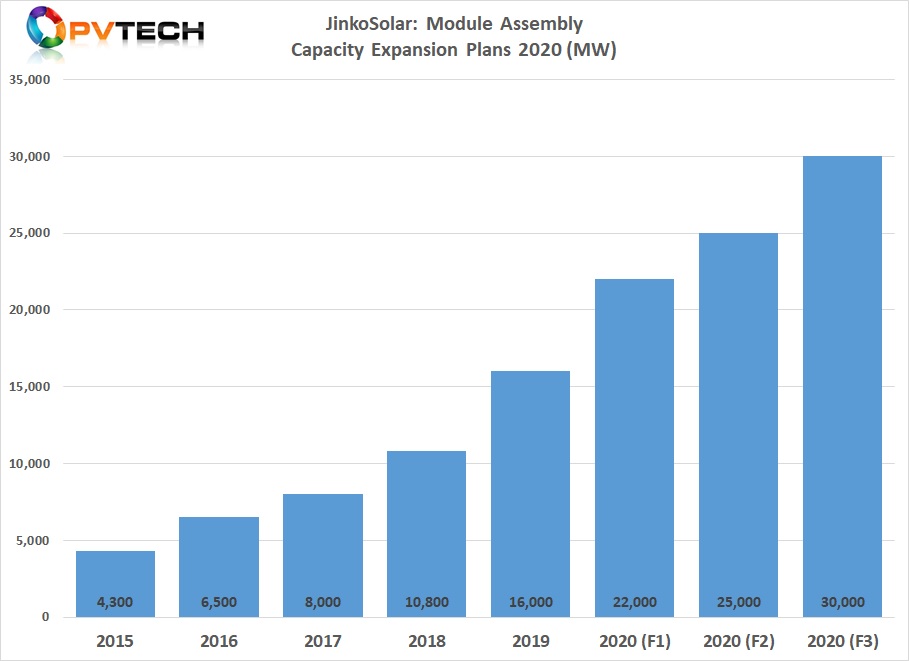

Leading ‘Solar Module Super League’ (SMSL) member JinkoSolar has made a major revision to its PV module assembly capacity expansion plans for 2020, intending to nearly double its nameplate assembly capacity to a new goal of 30GW by the end of 2020.

Having ended 2019 with an assembly capacity of 16GW, today Jinko confirmed plans to increase that capacity by 90% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

JinkoSolar’s initial plans were to take module assembly capacity from 16GW at the end of 2019 to 22GW but revised that plan in the first quarter of 2020 to 25GW by the end of the year. In reporting second quarter financial results today (23 September 2020), JinkoSolar said it had actually reached the 25GW target by the end of June 2020, equating to a significant expansion of 9GW in just the first six months of the year.

Based on PV Tech’s ongoing tracking of new capacity expansions, new reports in the first quarter of 2020, regarding the Shangrao Economic and Technological Development Zone (SETD) Shangrao City, Jiangxi Province and the headquarters for JinkoSolar as well as a major cell and module assembly location, noted the company was to spend around RMB 14.5 billion (US$2.12 billion) on a major new expansion.

The project would include 10GW of ingot/wafer production, 10GW of solar cell production and 10GW of module assembly production, as well as a new R&D facility. Construction was expected to start at the end of Q1 2020 and be completed by the end of 2020, reaching full capacity across each production category in 2021. JinkoSolar has not publically announced these plans.

Key market demand drivers

Despite the impact on demand of COVID-19, JinkoSolar has retained its initial module shipment guidance of 18GW to 20GW for 2020. Not unexpectedly, the SMSL member had yet to provide shipment guidance for 2021 but the actual module assembly capacity, coupled with the latest expansion plans, indicate the company expects a significant increase in bookings and overall demand next year.

In its Q2 earnings call Kangping Chen, CEO of JinkoSolar noted, “The overall recovery in the overseas markets remains supportive with some regions experiencing surprising growth in the mid and long-term. Looking back to the last two phases of China's five-year plan, the actual completion rate of PV projects has significantly exceeded expectations. With the withdrawal of market subsidies, industry drivers have undergone fundamental changes. China’s PV installation capacity had entered into a period of steady growth momentum, which increases the probability of accelerated growth over the next five years. Solar energy has become one of the most cost efficient power sources around the world, and we expect new technology in energy storage to usher in a new era of rapid development for the sector and the new growth to be the PV energy storage industry.

“Given that the original target of 15% of non-fossil energy consumption in 2020 has already been exceeded, the Chinese government is currently drafting its 14th Five-Year Plan to amend the original target to 20% of non-fossil energy consumption by 2030,” added Gener Miao, chief marketing officer at JinkoSolar in the earnings call. “In the next five years, average annual installations in the Chinese market will most likely reach 60 gigawatts.”

Chen also noted that due to the demand growth expected in 2021, JinkoSolar was already evaluating another wave of capacity expansions that would be across ingot/wafer, solar cell and module assembly.

Asset light manufacturing strategy

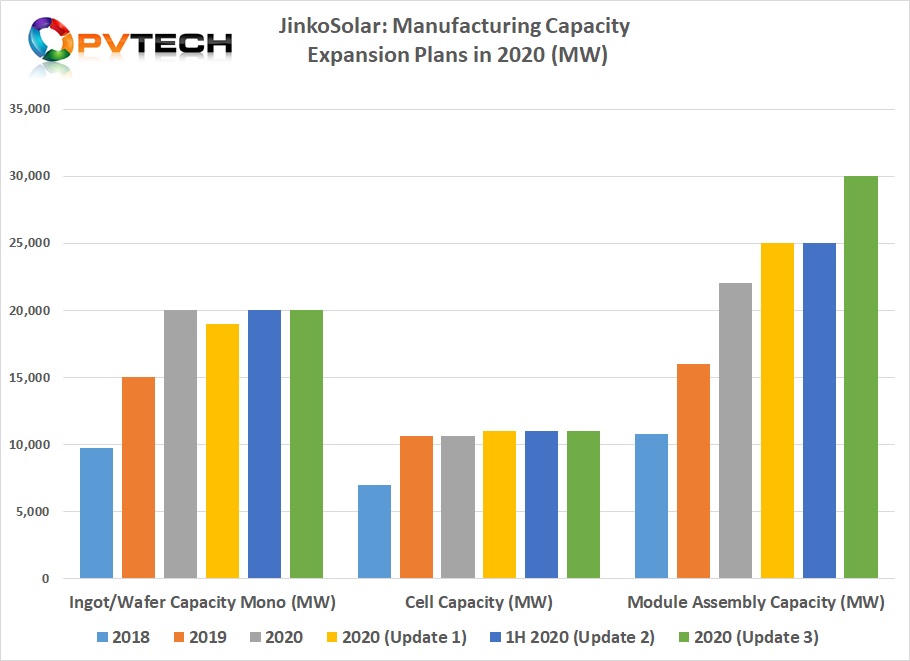

In keeping with its unbalanced manufacturing capacity in which in-house mono-wafer and module assembly nameplate capacity is significantly higher than solar cell capacity, JinkoSolar is able to limit capital expenditures and R&D expense.

In 2019, JinkoSolar’s capex was at a recent peak of US$589.9 million as it more than doubled in-house mono ingot/wafer capacity to 20GW, increased solar cell capacity by 3.6GW to 10.6GW and module assembly capacity increased by 5.2GW to reach 16GW.

The manufacturer had previously guided capex for 2020 to be around US$350 million, the lowest in the last three years. As shown in the chart below, the capex in 2020 has clearly focused on module assembly capacity expansions with solar cell capacity static at 11GW and just 1GW added to company’s ingot/wafer capacity.

With the latest round of module assembly capacity expansions, JinkoSolar has become increasingly dependent on major merchant cell producers such as Tongwei and Aiko Solar. The production imbalance is at a new high, hence JinkoSolar’s commentary that the next wave of expansions would include solar cells.

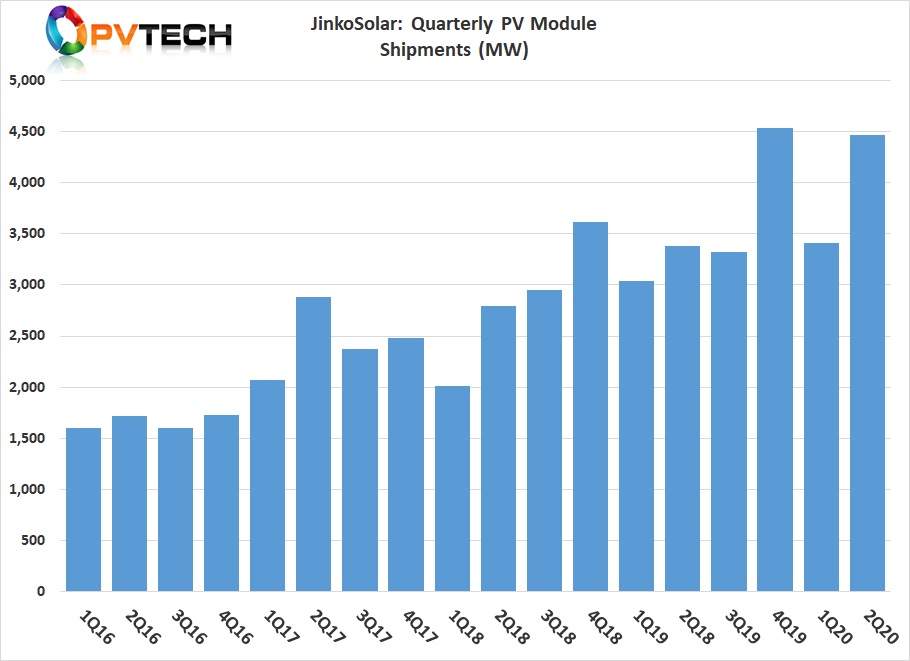

Module shipments

JinkoSolar reported second quarter PV module shipments of 4,469MW, which were within guidance range of 4.2GW to 4.5GW. This was an increase of 31.0% from 3,411MW shipped in the first quarter of 2020 and an increase of 32% from 3,386MW shipped in the second quarter of 2019.

Backing-up its large global sales footprint, JinkoSolar noted that it shipped modules to a total of 91 countries in the second quarter of 2020. The major markets were Asia Pacific, North America, China and the Europe, Management noted that these regions would remain the major destinations for shipments in the second half of the year.

The company guided third quarter module shipment to be in the range of 5GW to 5.3GW. Should JinkoSolar meet the high-end of shipment guidance the company would need to ship around 6.8GW in the fourth quarter of 2020 to meet the high-end of its annual shipment guidance.

JinkoSolar also noted in the earnings call that it expected global solar installations to reach around 120GW in 2020.

Financials

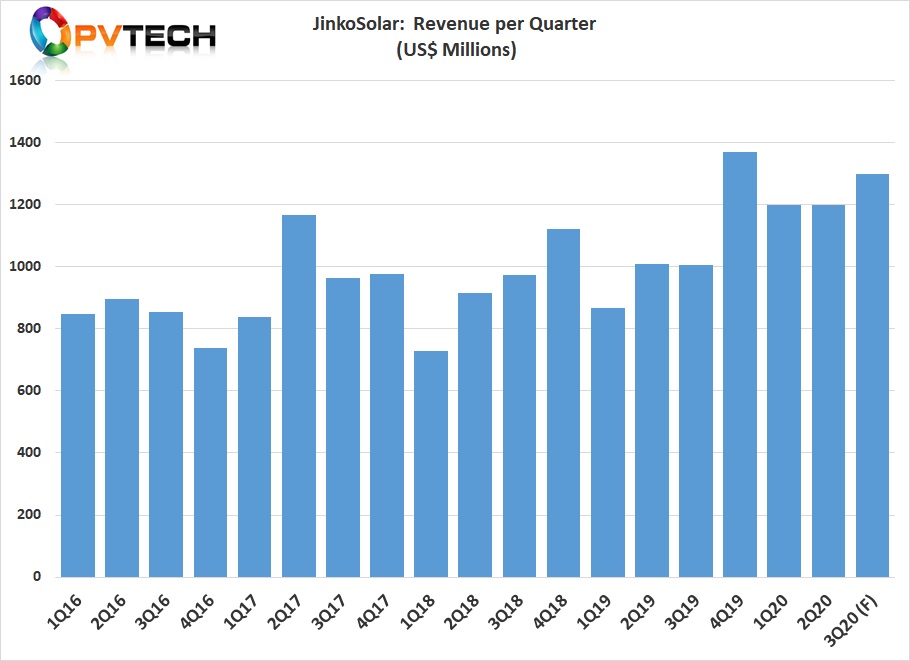

JinkoSolar reported second quarter revenue of US$1.20 billion, a decrease of 0.4% from the first quarter of 2020 but an increase of 22.2% from US$1.01 billion in the second quarter of 2019. Despite shipment growth, revenue flatlined in the first half of 2020, due primarily to a decline in the average selling price of solar modules.

The company guided third quarter revenue to be in the range of US$1.22 billion to US$1.30 billion, despite the higher guided shipments.

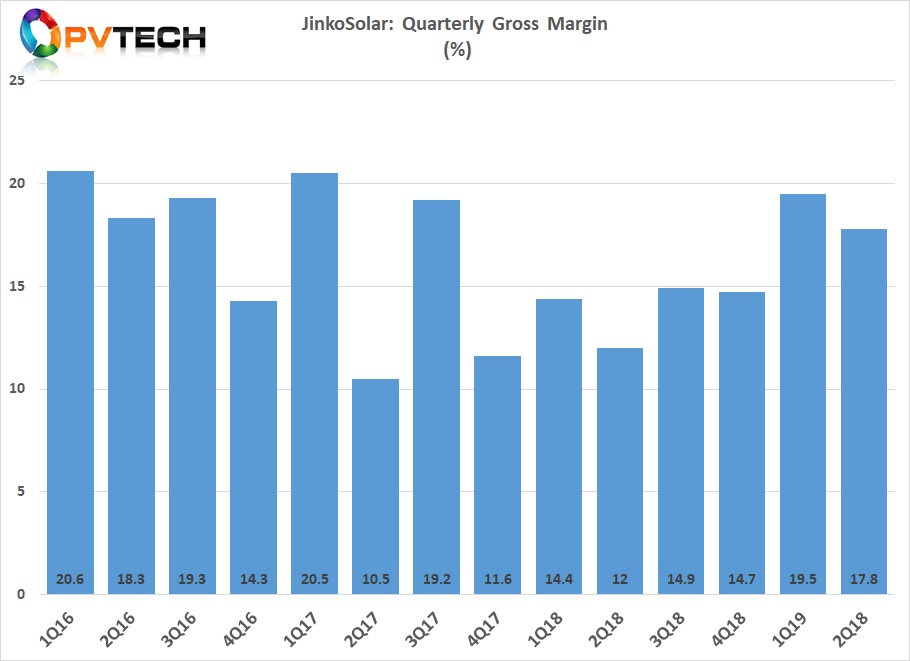

Gross profit in the second quarter of 2020 was US$214.1 million, compared to US$234.0 million in the first quarter of 2020. Gross margin was 17.9% in the second quarter of 2020, compared with 19.5% in the first quarter of 2020.

Gross margin for the third quarter is expected to be between 17% and 19%. The lower margins were mainly due to declining module ASPs.