As the solar industry has grown from a 50GW market to 100GW in just a few years, the desire to have differentiated production has increased, especially for companies entering the market or repositioning strategies.

Having a product offering that is either higher efficiency or lower cost is always a good way to extract funds to build new manufacturing capacity, and the solar industry has seen plenty of efforts in this regard.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Sadly, most attempts to do this in the past have failed, characterized by the equipment-supply-chain driven turn-key a:Si phase and the days when new entrants were arriving in the industry like there was no tomorrow, and many venture capitalists were left to count the losses.

During the past 2-3 years, the focus has returned to n-type cell variants, and this has been accompanied by no shortage of marketing fervour and aspirational claims. However, when we unpick the facts from the fiction, and track the reality of production, we can see definite upward trends that will surely sustain excitement and investment levels going forward.

For the first time, this article reveals exactly how much n-type production is coming from this segment of the PV industry, further categorizing this into the three sub-categories of n-type technology: back-contact, heterojunction, and all-others.

The underlying data comes from analysis compiled by our in-house research team at PV-Tech, and is available within our PV Manufacturing & Technology Quarterly report releases.

What this all means for n-type module availability – and related panel performance, quality, reliability and company/technology due-diligence for utility-scale solar – forms part of our pending PV ModuleTech 2018 conference in Penang, Malaysia, on 23-24 October 2018.

Why n-type?

For users of solar panels, talking about minority carrier lifetimes or surface recombination velocities – or indeed anything that sounds more like physics than return-on-investment – is largely misplaced.

Of course it is important to understand the physics, especially if you are pushing the boundaries in terms of advanced cell processing, but when it comes down to developers and EPCs, the arguments for n-type can be summed up better as follows.

n-type solar cell substrates are intrinsically higher performing. Cell efficiencies are well above the industry-standard of recent years (p-type multi), and as a result, panel powers (like for like panel sizes, at STC) offer gains of many tens of Watts. This clearly offers space-related benefits which translate positively to any LCOE calculation based on reduced system capex/BoS-costs.

Additionally, n-type offers vastly superior elevated temperature performance, compared to all p-type options (both mono and multi). Here n-type shares temperature-dependent power coefficients with thin-film panels, such as First Solar’s. Considering especially that utility-scale solar plants (and indeed almost any solar panels under direct sunlight) generally perform at temperatures well above STC conditions, there is an argument for every comparison of solar panels to be done at 70 degrees.

n-type substrates are also less prone to various degradation mechanisms, which – given manufacturing quality, testing and repeatability – translates directly into reliability and lifetime performance (return-on-investment).

The above issues are not new by any means. However, it is interesting to see many of the new n-type entrants in the past few years trying to explain these clearly, while at the same time seeking to ramp new production lines and understand simply how to get production lines to targeted efficiencies, yields and distribution goals.

Until now, the only issues holding back n-type being the mainstream choice in the solar industry have been production levels (trending in the 5% of annual demand ballpark) and manufacturing costs (including wafer availability). As such, this explains why everyone in the solar industry needs to keep a close eye on n-type companies, investments and expansion plans, and is fundamentally behind the long-term view held by many that n-type market-share gains will only increase year-by-year for quite some time.

Why can’t n-type benefit from economy-of-scale seen by p-type?

Currently, the PV industry is basking in the glory of having moved p-type multi solar cells from 3 to 5 busbars, in adding a passivation layer to the rear side of p-type mono cells (the PERC cell), and in driving down production costs to allow selling a module at 35c/W with small (positive) gross margins.

However, the p-type community – though a combination of the above and other less-publicized issues – has collectively taken p-type cell efficiencies from 15-18% to 18-21% over a five-year period, representing a phase in the industry that is one of the most productive and helpful to developers and EPCs.

At this point, one should point out that previous estimates (mainly from the research community or early adopters) of where p-type performance could max-out in mass production have largely been exceeded. Indeed, at our PV CellTech 2018 meeting back in March, leading multi-GW p-type cell manufacturers were each showing roadmaps to take p-type mono average cell efficiencies to 22-23% within the next couple of years.

I recall at PV CellTech asking none other than Prof. Martin Green of UNSW what had surprised him most about the current cell performance levels seen in a 100-GW-scale PV industry, and one of the replies was based around the fact that nobody had imagined the performance gains that could be attributed from mass-production learning.

Therefore, the obvious question to ask is: what is possible from n-type production, if it was to scale to 10GW or 100GW? Currently, performance levels of n-type (especially IBC and HJT) are industry-leading, but how much more is out there compared to the GW-max seen at any one producer today? Of course, should IBC/HJT (or hybrid variants thereof) move to this level of production, then by default the industry will have addressed the supply and cost challenges that exist today.

So, one should perhaps not look too closely at the decreasing delta between p-type mono PERC (at the 30GW+ production level, and with a cost structure heavily blended with p-type multi output) and n-type cells, as the comparison is not on a level playing field. The question should be: how do these cell concepts compare when each has tens of GW production across 5-10 key producers?

In the meantime, let’s return now to n-type growth within the industry today.

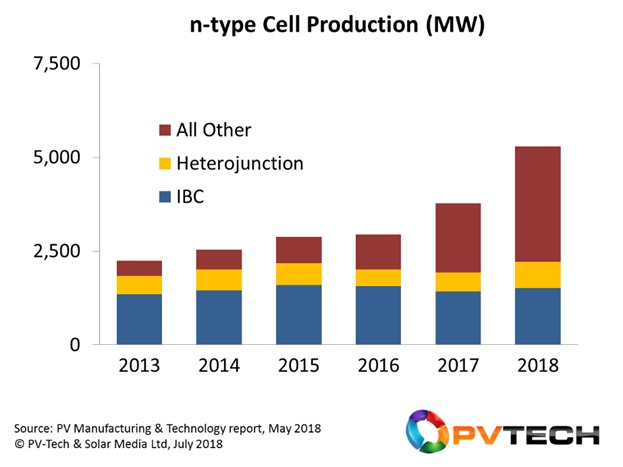

From 2GW to 5GW annual production in five years

Until a few years ago, the PV industry had just a few companies making n-type solar panels, with efforts spread across three ‘different’ approaches: back-contacted solar cells (or interdigitated back contact, IBC), front-contacted with doped/intrinsic thin a-Si (passivation) layers (heterojunction), and n-type designs that are more analogous to regular p-type solar cell processing but have rear passivation/diffusion.

SunPower is well-known for being the proponent of IBC cells, benchmarking premium performance levels across all n-type (and everything else) on the market. IBC processed cells remain market-leading today by some margin.

Panasonic inherited Sanyo’s heterojunction facilities in Japan and Malaysia, and for some time was the only company offering this technology. As I will discuss below in the article, other companies have now entered this segment of n-type solar manufacturing.

Heterojunction (or HJT) performance has slightly lower performance levels, compared to IBC, but offers higher powers than other n-type variants. The strengths of HJT can also be blended back-contacting of course, but as yet this is R&D only, and not close to mass production.

The ‘other n-type’ grouping has seen some pilot-line activity in the past, but saw its first real efforts to move into mass production about 10 years ago, when Yingli Green Energy ramped up several production lines through a technology-transfer with European research institute ECN (the ‘Panda’ offering from Yingli). During the past few years however, this technology class has seen the greatest level of competition, in particular arising from the success of LG Electronics in South Korea, and subsequently spreading across several new companies located in China.

The net result of the new capital investments has seen the number of (meaningful) n-type cell producers grow to approximately 20, with many others engaged at the R&D level also, or working with research institutes on collaborative projects. Consequently, global cell production of n-type has grown from the 2GW-level in 2013 to what is projected to be more than 5GW this year. This is shown in the figure below:

LG Electronics became leading n-type producer by MW in 2017

Almost under the radar, and without any great fanfare, LG Electronics likely moved into the leading position in the PV industry sometime during 2017, producing more n-type capacity than any other company. Much of this has arisen from the company’s aggressive capacity expansions in South Korea during the past couple of years, stimulated by the US market in a pre-Section-201 world.

When looking more closely at LG Electronics’s specific process flow for its n-type cells, one can see some other trends that are characterizing the n-type segment as a whole, many of which have not found compatibility with mainstream p-type cell production.

Currently, with the exception of a few Chinese new-entrants, all n-type producers have some form of differentiation, ranging from the likes of SunPower (whose lines are entirely in-house IP-owned) to LG Electronics (multi-wires and ion implanting) to others that may have bifaciality as standard or (like SunPower) have worked out how to use wafers below 120 microns thick. This segment is also the first to use thin wafers and have copper (not silver) for electrical collection.

n-type benefits from European/Western equipment suppliers

A large part of the growth success of n-type production in the past few years can be tracked directly to the involvement of equipment suppliers, with many of the leading European companies having process knowledge exceeding the customer base they are serving: Meyer Burger, INDEOtec, SCHMID, Von Ardenne, Singulus, Tempress/Amtech. Japanese know-how – courtesy of legacy engagement with Sanyo in Japan – has somewhat permeated out of companies such as ULVAC and Sumitomo Heavy Industries and exists in various forms through affiliated or licenced partnering companies in Asia today. Companies previously selling PCV/PECVD tools for a:Si deposition (ULVAC, Applied Materials, Jusung) are obviously placed to have an impact also.

Walking around many of the new n-type lines in operation today across Asia and Europe will likely feature equipment from many of the above companies. The n-type segment (in particular for HJT and all-others including n-PERT/bifacial variants) is yet to consolidate around a standardized process flow however, and is still one that Chinese tool suppliers believe they can address should multi-GW be added from 2019 onwards during the next phase of n-type expansions.

Removing wafer availability concerns

Previously, n-type production was seen to have certain limitations, in particular from being reliant on mono ingot pulling which until recent years had been relatively niche. Indeed, had it not been for LONGi and Zhonghuan, it could be argued that this same limitation would apply, with 5-inch wafers for n-type cell production being in short-supply and priced 15-20% above regular wafer offerings from the likes of GCL-Poly.

However, all this changed with the expansions from LONGi and Zhonghuan making mono pulling a 10-20GW company-operations, and taking production costs to levels that previous wafer suppliers in Asia could never have reached (for any mono wafers, not just for n-type cell production).

Almost overnight, mono wafer supply has become commoditized, and one could almost argue today that wafer-supply to n-type is a net-positive, not a stumbling block. Currently, wafer supply for n-type producers is mainly available on-demand, with a decision on number of pullers using boron or phosphorous dopants. The supply of wafers for n-type cell production is not likely to go into over-supply in the near future, but given the hunger for leading Chinese mono wafer suppliers to dominate the market, one can conclude also that should a few additional GW of n-type be produced even in 2019, the supply-chain will meet this demand from China.

Heterojunction still the front-runner for most new entrants

While the graphic above may not suggest it, HJT is where the focus is today for much of the new investments into n-type across China, Taiwan and Europe/Russia. Many of these companies are ramping new lines now, and success here will show more clearly in production data going forward, and less so when looking at the 2013-2018 window.

The drivers are varied. For many of the Chinese companies, having a panel with ‘Panasonic-type’ quality/performance is clearly something many would love to have today, and there remains a belief that if they can match cell efficiencies in mass production, then they can address the Achilles-heel for Panasonic and Sanyo in the past: production cost.

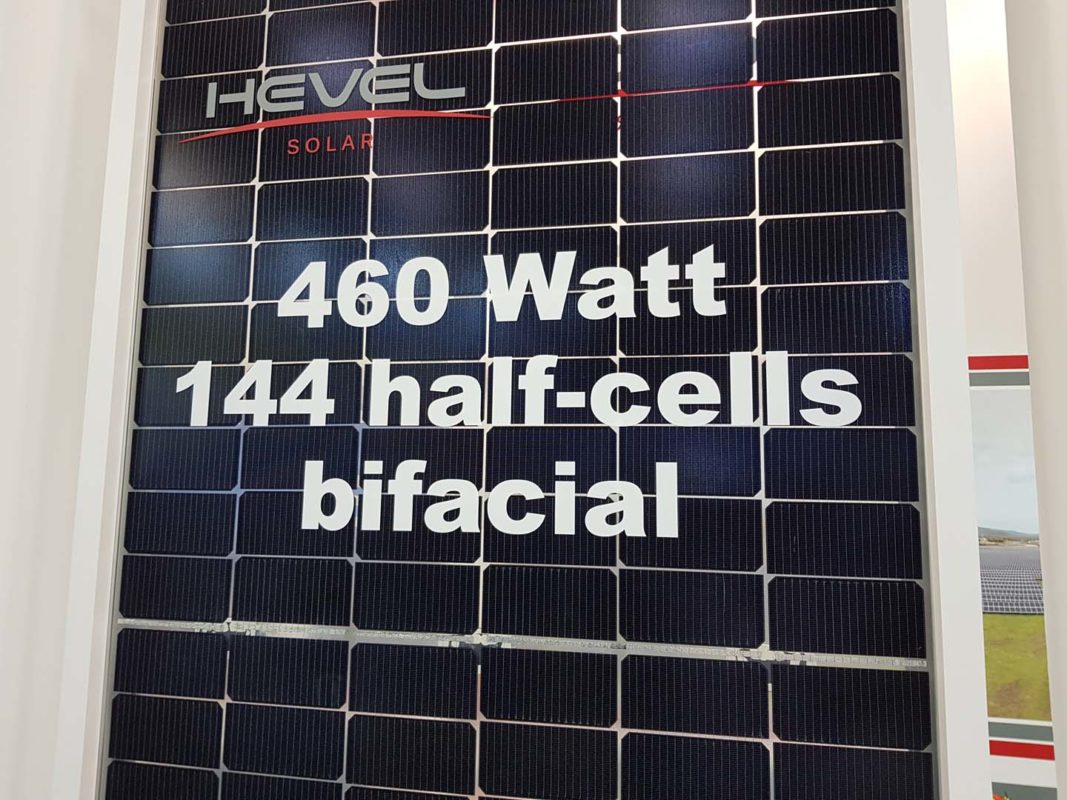

For others, the move to HJT may be as simple as needing to repurpose legacy a-Si investments (e.g. Hevel Solar, 3Sun/Enel) and seeing HJT as the natural c-Si based path.

With the strong R&D being undertaken by tool suppliers such as Meyer Burger and INDEOtec, the prospects for HJT moving to multi-GW scale with a competitive cost structure are good.

PV ModuleTech and PV CellTech remain the go-to check-points for n-type

For the past few years at PV CellTech, we have focused on the plans for new cell production for n-type capacity, as especially HJT variants. This has proved invaluable in providing a glimpse at what may come through in mass production 2-3 years out, at which point most of the downstream community have real choices to make based on new module suppliers and technologies.

While this captures much of the reasoning behind the PV CellTech event, PV ModuleTech looks at how this impacts on module supply today, in terms of company strengths, product quality, and bankability. As such, this year’s PV ModuleTech 2018 event in Penang (23-24 October 2018) will be a great place for global developers and EPCs to understand exactly what the supply of n-type modules will look like in 2018.

For many, it will be simply keeping track of a module technology that could impact on their solar strategies from 2020 onwards. For others, it offers immediate benefits, assuming selection of module supplier and technologies meet necessary due-diligence and bankability requirements.

For more details on how to attend PV ModuleTech 2018, please follow this link.