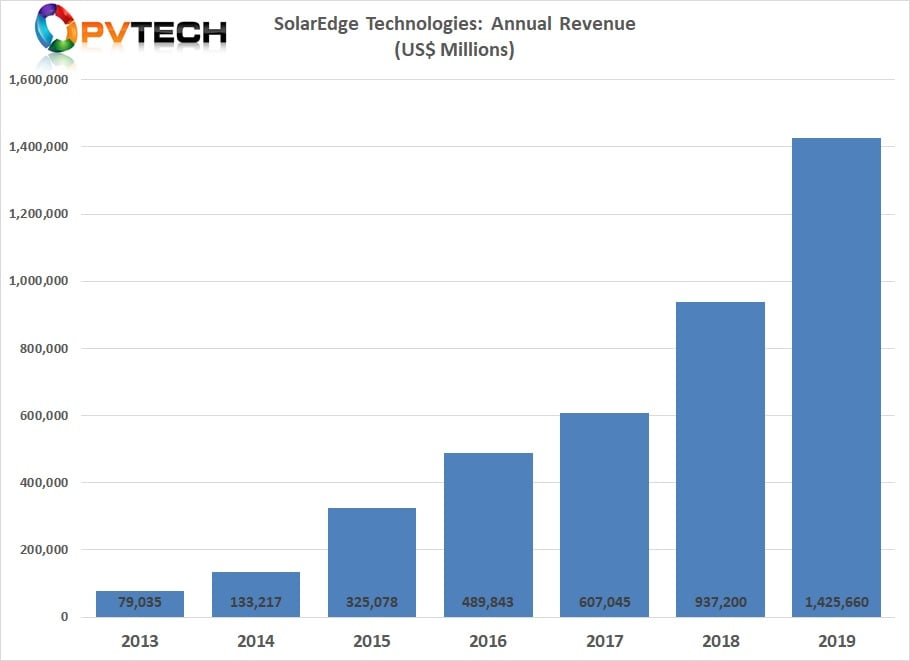

Major PV inverter manufacturer, SolarEdge Technologies has reported a second consecutive year of over 50% revenue growth as quarterly and annual sales continued to break company records.

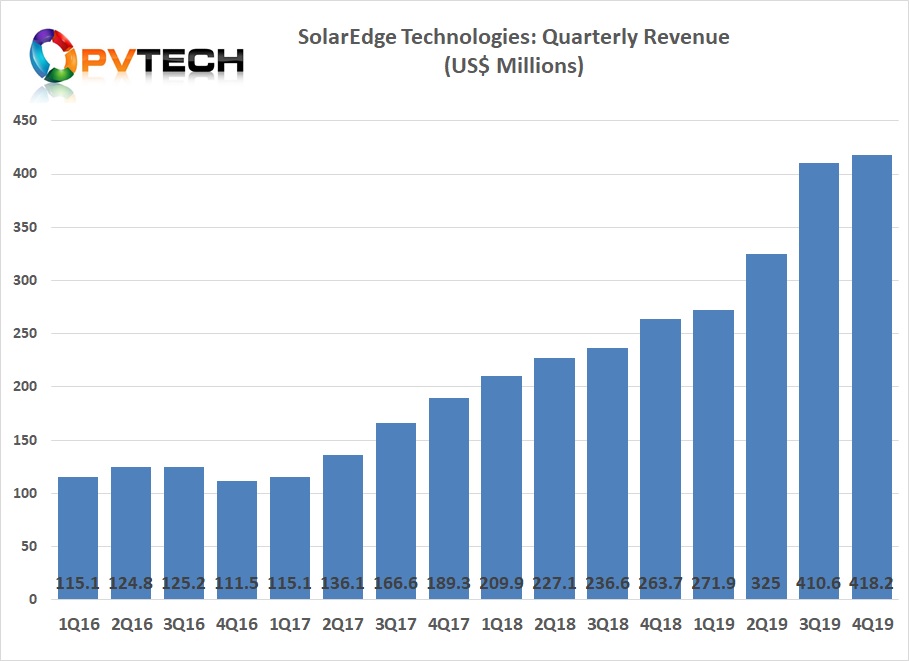

SolarEdge reported record revenue of US$418 million in the fourth quarter of 2019, up 2% from US$410.6 million in the prior quarter and up 59% from US$263.7 million in the same quarter last year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Revenues related to the solar business were $389.0 million, up slightly from US$387.8 million in the previous quarter and up 60% from US$243.4 million in the prior year quarter.

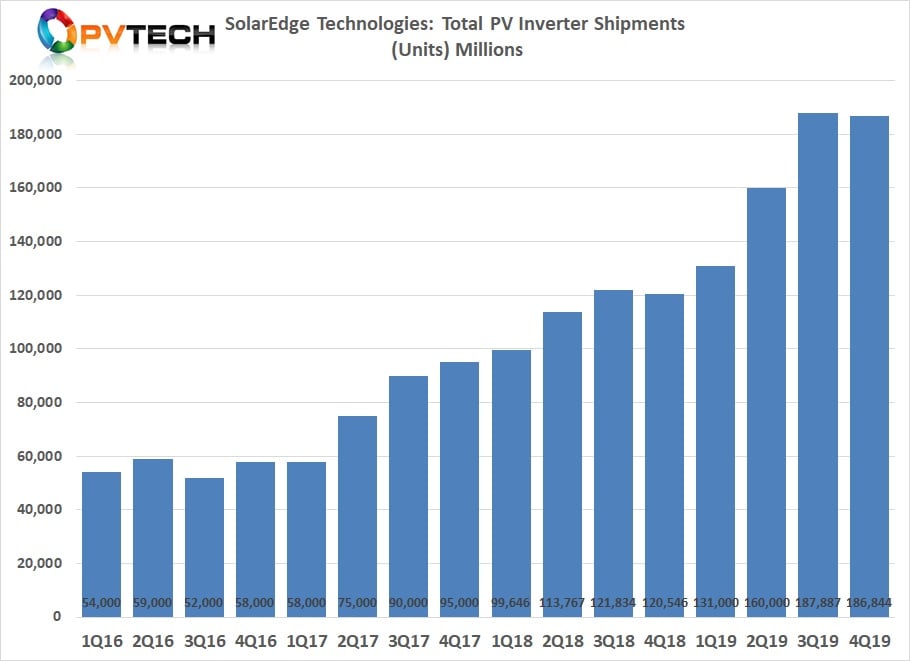

Fourth quarter unit shipments of PV inverters topped 186k, seasonally down slightly form over 187K in the previous quarter.

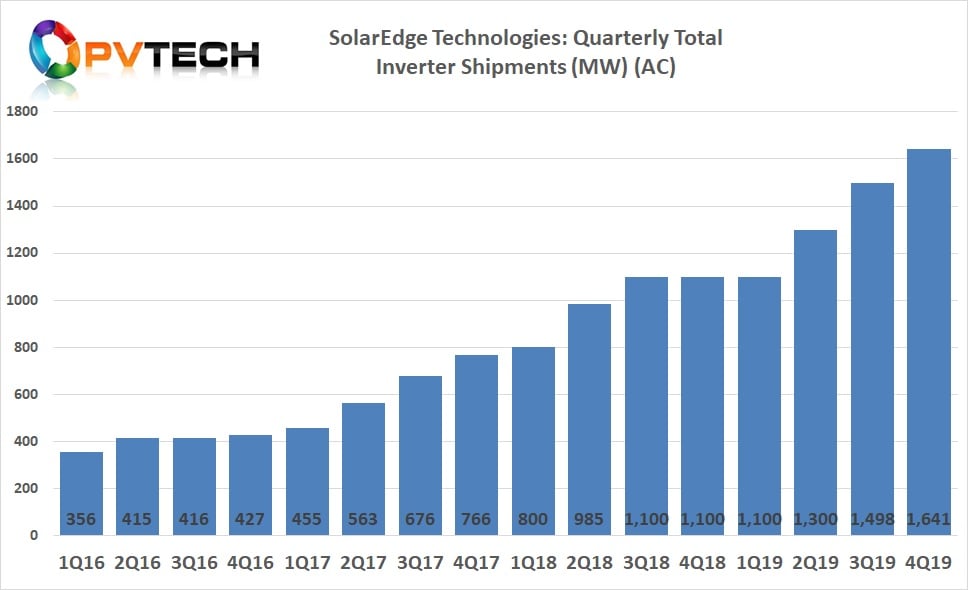

The company shipped over 1.6GW (AC) of nameplate inverters in the reporting quarter with continued heavy weighting (766MW) to the North American market, compared to European shipments of 620MW.

A key product shipment increase had been in the C&I sector, accounting for over 700MW in the fourth quarter of 2019, compared to 543MW in the previous quarter, a new record for the company.

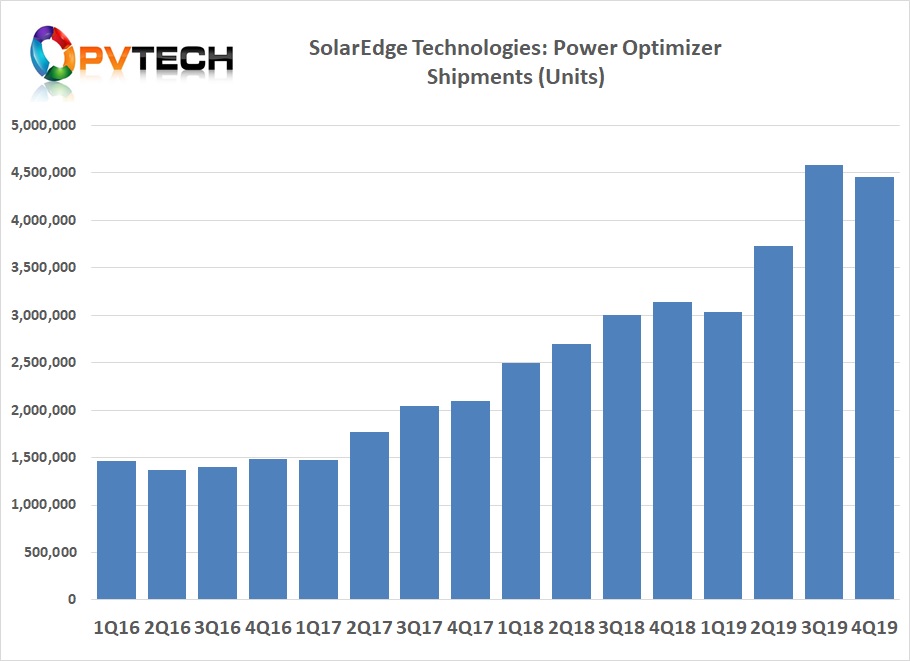

Shipments of power optimizers stood at over 4.4 million, down from over 4.5 million in the third quarter of 2019.

On a geographical basis, US solar revenue was US$236.6 million, accounting for 60.8% of total solar revenue.

Europe accounted for US$118.9 million of revenue in the reporting period, accounting for 30.6%, of the total. SolarEdge also noted that in relation to its top 10 solar customers, they represented 64.4% solar revenues, down slightly from the previous quarter.

Full year financials

SolarEdge reported full-year 2019 record revenue of US$1.43 billion, up 52% from US$937 million in the prior year. Revenues related to its solar business were US$1.34 billion, a 46% increase compared to 2018.

GAAP gross margin was 33.6%, down from 34.1% in the prior year.

Growth momentum

Although there were signs of revenue growth slowing from the third quarter of 2019, SolarEdge guided first quarter of 2020 revenue to be within the range of US$425 million to US$440 million, strongly indicating continued growth momentum, despite continued production ramps, component shortages and supply chain disruptions from the coronavirus.

The company had noted in its fourth quarter earnings call that it was experiencing record C&I product shipments and noted this was expected to continue to increase by a further 20% to 30% in the first quarter of 2020.

Another area of recent growth is in shipments of storage-compatible inverters, according to the company, which increased almost 60%, quarter-on-quarter. Battery storage capacity was fully-utilized and sold out, according to the company.