A decision by Russia’s Gazprom to stop supplying gas to Ørsted illustrates the need for the European Union (EU) to speed up renewables deployment, the CEO of the Danish energy company has said.

Gazprom Export has halted the supply of gas today to Ørsted because it has refused to pay in roubles, the Danish firm announced. “The situation underpins the need of the EU becoming independent of Russian gas by accelerating the build-out of renewable energy,” said Ørsted CEO Mads Nipper.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Ørsted said in a statement that it is under no obligation to pay Gazprom Export for gas supplies in roubles, and that it will continue to pay in euros.

There is no gas pipeline directly from Russia to Denmark, meaning Moscow will not be able to directly halt supplies to the country, according to Ørsted, which said it expects it will be possible to purchase gas on the European market.

Ørsted said in a statement on Monday: “We fully support the ambition of the Danish government and the EU to become independent of Russian gas and to fast-track the green transformation of EU’s energy sector, and we are ready to help accelerate the green build-out.”

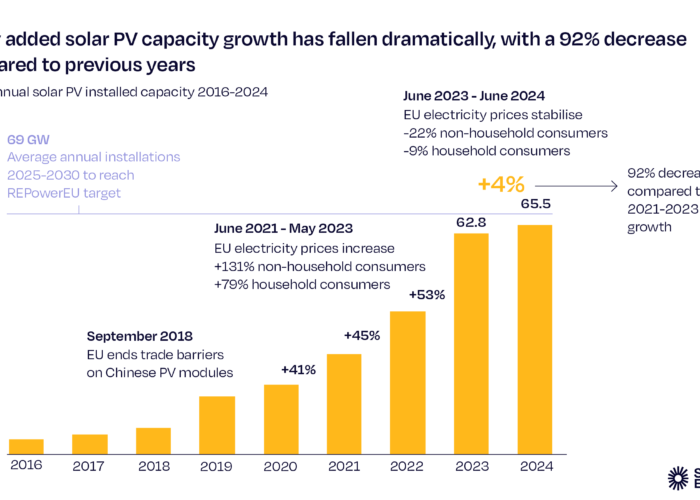

Following Moscow’s invasion of Ukraine, the European Commission published its REPowerEU plan last month, which details the EU’s strategy of becoming independent from Russian fossil fuels well before 2030.

A dedicated EU Solar Energy Strategy, released alongside REPowerEU, calls for the bloc to “radically step up a gear” and reach 740GWdc of deployed solar by 2030.

Research firm Wood Mackenzie warned earlier this week that REPowerEU could be thwarted by higher material and solar module costs as a “perfect storm” looms over the PV sector following the pandemic.