Venture capital firm Pacific Channel has launched Fund V, a dedicated renewable energy development fund, targeting 10GW of solar, wind and energy storage in New Zealand.

Launched earlier this week, Fund V aims to accelerate the country’s transition to clean energy through strategic investments in large-scale renewable energy projects. The fund will primarily support the continued development of developer Kākāriki’s portfolio of wind, solar and storage infrastructure projects across the country.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Kākāriki is a joint venture between Energy Estate, Elemental Group, Regener8 Power, and Tāmata Hauhā. The platform’s approach involves close coordination with state-owned company Transpower, distribution networks and regional stakeholders to ensure projects are optimised for demand, minimise environmental impact, and can attract the international investment needed for implementation.

The first phase of Kākāriki’s portfolio comprises 4GW of wind and solar capacity, complemented by 2.3GW of energy storage.

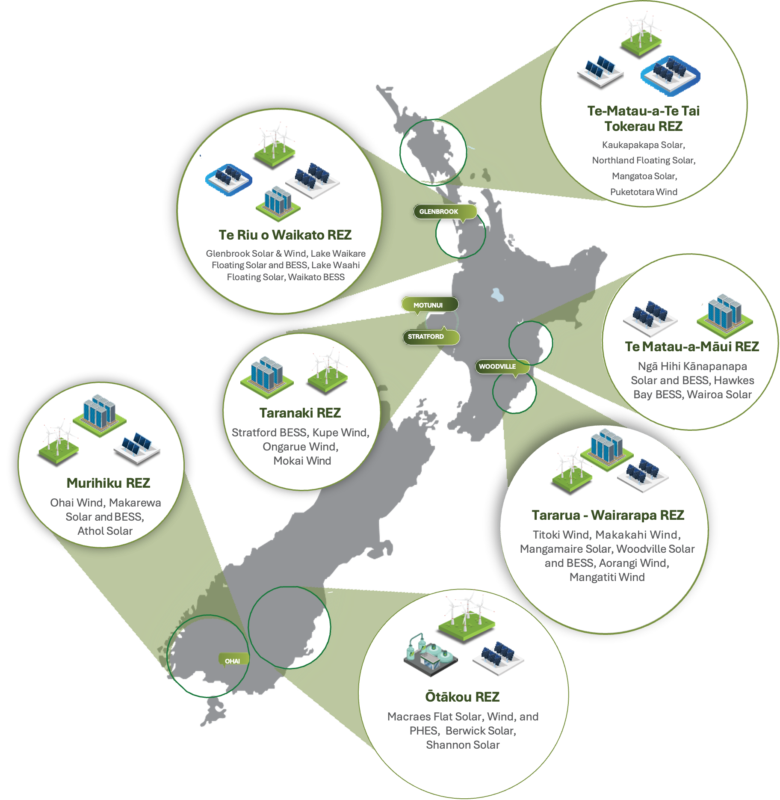

The total pipeline exceeds 10GW across New Zealand’s North and South Islands, providing geographic and technological diversity that enhances grid resilience. Several of these have been pooled into Renewable Energy Zones (REZ), which are prominent in the Australian market and pool together several technologies to create the modern-day equivalent of a power station.

According to Pacific Channel, the fund will provide seed capital for Kākāriki’s existing portfolio of seven wind, solar, and storage projects currently under development. It plans to invest in up to 18 additional projects in the broader pipeline.

Pacific Channel partner Richard Pinfold said the portfolio’s scale is designed to help catalyse a sixfold increase in New Zealand’s renewable energy generation.

“Generating six times current levels will not only secure affordable energy for homes and businesses, it also creates opportunities to electrify transport, industry and buildings, grow exports through surplus embodied energy products and attract new energy-intensive industries,” Pinfold said.

New Zealand’s ‘energy crisis’ and an opportunity for solar PV

New Zealand already generates approximately 80% of its electricity from renewable energy sources, primarily hydropower, geothermal and wind. However, the country faces challenges in meeting growing electricity demand while phasing out fossil fuels across its economy.

This was exhibited with the energy crisis that struck the nation last year. Indeed, the New Zealand energy sector was sent into turmoil with wholesale pricing spikes due to a shortage of gas, low rain, and inflows into the country’s vast hydropower network.

Despite the negatives associated with the “energy crisis”, it has prompted further support for renewable energy and energy storage technologies to help diversify the country’s energy supplies.

Sarah Gillies, chief executive of the Electricity Authority, spoke with PV Tech Premium about the energy crisis last year, stating that more investment is needed to support and stabilise New Zealand’s electricity system, and the next 12-24 months will “continue to be challenging.”

“We need more investment in generation and to harness opportunities from new technologies and demand response to keep the lights on at an affordable price. Looking ahead, we continue to need a combination of fuels and the supply,” Gillies said.

Pacific Channel’s Fund V showcases this diversification strategy, with its focus on solar particularly noteworthy. Solar PV has historically played a smaller role in New Zealand’s renewable energy mix compared to other technologies.

Fund V will also help attract international investment due to its status as an Acceptable Managed Fund for the Active Investor Plus (AIP) visa. This means it has been officially assessed and approved by New Zealand Trade and Enterprise (NZTE) or Invest NZ as meeting specific eligibility criteria for foreign investors seeking residency in New Zealand through the investment pathway.

The designation of Pacific Channel’s Fund V as an Acceptable Managed Fund means that foreign investors can include investments in this fund as part of their qualifying investment for the Active Investor Plus visa. This could potentially accelerate capital flows into New Zealand’s renewable energy sector.