The Philippines’ solar and energy storage trade body has warned that diplomatic tensions with China could disrupt the Philippine solar industry and threaten both energy supply and jobs.

The Philippine Solar and Storage Energy Alliance (PSSEA) has sent a letter to Senators Pia Cayetano and Win Gatchalian in the Philippine government, warning that a recent “intense exchange of words” between the Chinese embassy and Philippine officials risks undermining solar PV supply chains, according to Philippine industry media outlet Power Philippines.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The letter reportedly said that if tensions escalate or continue between the countries, energy security, sector jobs and government revenues tied to solar projects are at risk. It cited data from the Department of Energy (DOE), which said the solar sector generated around 203,000 jobs from 2009-2022 and will account for 10,000 jobs a year until 2030, as well as the risk of power shortages as the country looks to use solar to avoid blackouts in the Mindanao and Visayas islands.

Chinese-Philippine relations have been strained in recent times, largely surrounding the Philippines’ strategic alignment with the US and flashpoints in the South China Sea. But like many countries, the Philippines relies almost entirely on China for its solar and energy storage components and supply.

“China is our primary source of solar modules, mounting structures, inverters, batteries, and other balance-of-system components,” the letter read, “It provides the lifeline of the solar business.”

Disruptions to these trade routes could cause project delays, increase costs and imperil the Philippines’ renewable energy deployment targets. Solar PV, and increasingly energy storage, have become key parts of the Philippines’ energy mix. In November, the government awarded 6GW of solar PV capacity and around 1GW of solar-plus-storage in its Green Energy Auction Program, and in October, our sister site Energy-storage.news spoke to Tetchi Capellan, founder of the PSSEA, who said that energy storage was becoming “indispensable” in the Philippines.

“We respectfully ask that our national leaders take into account the negative impact that a strained relationship with China will bring to the families and jobs of those who depend on the solar industry”, the letter reportedly said. PV Tech has contacted PSSEA for further comment on the story.

Reliance on Chinese solar

China’s dominance in solar PV and energy storage manufacturing is well-established, and countries around the world have made efforts to establish alternative supply chains, with varying success.

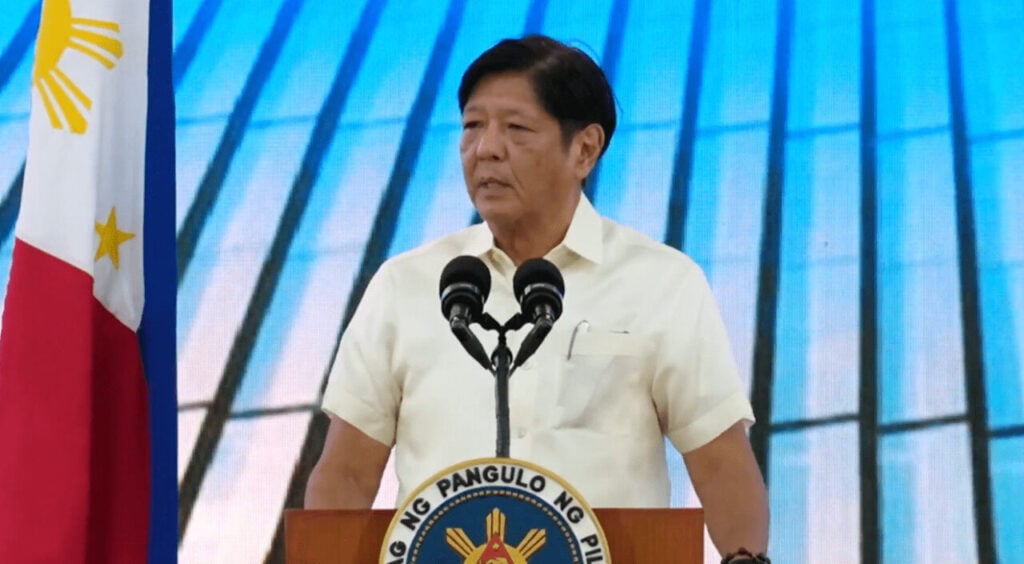

While the issue for the Philippines is specific to its relationship with China and perhaps linked to a rift between its President and Vice President over Chinese relations, among other things, it illustrates the vulnerabilities in the global solar supply chain.

Chinese companies dominate the supply of solar modules and inverters into Europe, according to data from PV wholesale platform Sun.store, and have done so for a long time. The EU is introducing measures to reduce reliance on single dominant suppliers or those that pose security risks under its Net Zero Industry Act (NZIA) and revised Cybersecurity Act (CSA), but those will currently apply only to a portion of publicly tendered projects.

PV Tech reported today from the Solar Finance and Investment summit in London, where developers said that while EU procurement policies are “extremely positive” in intent, they are yet to translate to projects “on the ground”. One panellist said: “The reality is that with modules and batteries there is a singular point of failure: we all get it from China.”

This warning from the PSSEA, headed up by solar pioneer and veteran Tetchi Capellan, will perhaps illustrate the continuing risk of relying on a single point of origin for the majority of solar supply, particularly as the technology becomes increasingly essential to life in Europe and elsewhere.