Looking back over 2024, it has not been an easy year for China’s PV companies. The industry was plagued with unfavourable conditions such as overcapacity, falling prices, and intensified performance pressure.

Especially in the polysilicon sector, prices have fallen significantly since the beginning of the year along a steep downward curve, and many polysilicon companies are operating at a loss. This end-of-year review examines the survival status of polysilicon companies through the lens of prices.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Prices trending downwards

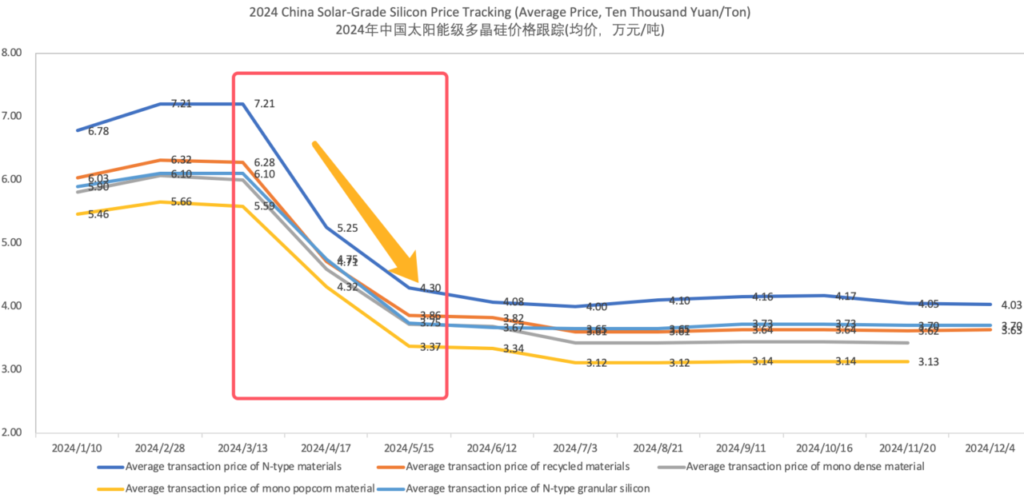

Since the beginning of this year, polysilicon prices have remained in depression and continued to decline. According to data from the Silicon Industry Branch (as shown in Figure 1), the highest price of polysilicon reached nearly RMB72,100/ton (US$9,923) during January and February. Starting from mid-March, there was a significant price drop, with all types of silicon, except for n-type, falling to below RMB50,000/ton on average.

Entering May, the price of n-type polysilicon also declined, dropping to RMB43,000/ton, and the average price of other types of silicon fell to below RMB40,000/ton, reaching a new historic low.

Regarding this steep downward curve, SMM chief analyst Shi Zhenwei said that the main reason was that some leading companies started up significant new production capacities at the beginning of this year, leading to a noticeable oversupply in the industry and a consequent decline in polysilicon prices from Q2.

By August, the polysilicon market had improved to some extent, with prices slightly rising. Particularly after the concentrated order-signing in mid-September, the mainstream contracting price of major polysilicon manufacturers slightly rebounded to around RMB41,700/ton.

However, in November, due to the lack of fundamental improvement in the overall supply-demand situation in the PV industry, the price stagnated and then fell again. In the first week of December, polysilicon prices dropped once again.

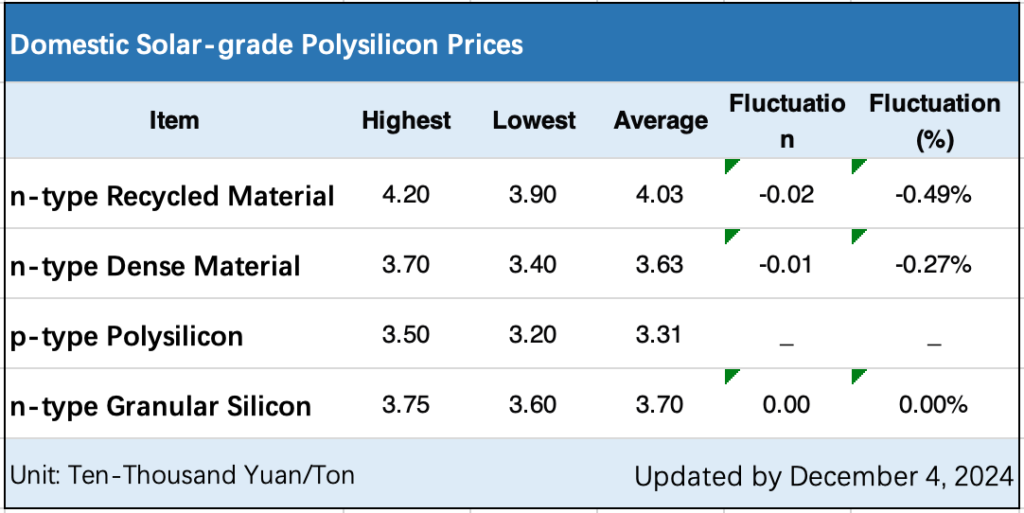

According to the polysilicon quotes of the Silicon Industry Branch on 4 December, the prices of various types of polysilicon have been slightly adjusted downwards compared to the prices at the end of November.

The latest quotes from the Silicon Industry Branch indicate that the transaction price of recycled n-type polysilicon this week was RMB39,000-42,000 yuan/ton, averaging at RMB40,300/ton, down 0.49% month-on-month. The transaction price of n-type granular silicon remained at RMB36,000-37,500/ton, averaging at RMB37,000/ton. The transaction price of p-type polysilicon was RMB30,000-35,000/ton, averaging at RMB33,000/ton.

According to statistics released by the China PV Industry Association (CPIA) on 5 December, from January to October 2024, China’s polysilicon prices have dropped by more than 35%, wafer prices have dropped by more than 45% and cell and module prices have dropped by more than 25%.

The significant decrease in polysilicon prices has led to a considerable change in silicon’s cost proportion among auxiliary PV module materials, causing it to fall out of the top three, ranking behind aluminium frame, glass and silver paste, all of which now have a higher cost proportion than silicon.

According to Guojin Securities’ latest report, the cost proportion of PV module auxiliary materials has significantly changed. Aluminium frame has become the single raw material with the highest cost proportion, accounting for 14%, followed by glass (13%) and silver paste (12%). Silicon has dropped to fourth place, accounting for only 9.9%.

Polysilicon companies are all in the red, what is the price outlook?

Affected by the decline in polysilicon price, the current average selling price of polysilicon has fallen below the cash cost of all producers. As a result, Q3 financial reporting shows that leading polysilicon companies such as Tongwei, Daqo and GCL-Tech have all suffered losses to varying degrees, and some companies have experienced their first losses since going public. The outlook for the whole year of 2024 is not optimistic.

According to the Silicon Industry Branch, as of now, almost all polysilicon companies are in maintenance or load reduction. In November 2024, the domestic polysilicon output was 133,000 tons, a slight decrease from the previous month. In November, polysilicon companies lowered their operating loads, and the impact of the reduction was mainly reflected in December. China’s polysilicon output is expected to fall to 105,000 tonnes in December, a drop of more than 20%.

Polysilicon companies are under continuous performance pressure, and the question of when they can get out of the trough has attracted much attention. How can they judge the price trend of polysilicon? What conditions are needed for a price rebound?

Yan Ke, secretary of the board of directors of Tongwei, pointed out that in the short term, the downstream wafer segment has sufficient polysilicon inventory in hand, with the production scheduling declining month-on-month. The overall transaction sentiment in the polysilicon market is relatively weak. However, considering that the polysilicon price has already bottomed out, there is limited downward space for prices. The price is expected to stabilise in the short term. Looking ahead, the polysilicon destocking will be one of the necessary conditions for a price rebound, and industry self-discipline actions are also expected to accelerate this process. If downstream installation demand can increase in sync with the peak season, the resistance to polysilicon price rebound will be smaller.

As for the production schedule, Yan Ke said that in December, the southwest region will enter a dry period, and power prices will rise month-on-month, reaching an annual high. Considering that the current polysilicon price is still at the bottom, the company is studying a production reduction plan and will dynamically adjust its production schedule according to market conditions. It will arrange the production schedule according to the most economical method.

A report from Haitong Securities indicates that, from the perspective of supply-demand, overcapacity, restrictions on power grids and storage infrastructure and the intervention of non-market factors are the main reasons for the industry to continue to remain at the bottom in this cycle. The agency expects that as the top enterprises take the initiative to adjust, the trend of production reduction will become increasingly apparent, which may have a positive impact on the industry’s improvement.

The Silicon Industry Branch also stated that at present, the bottom of various polysilicon prices has gradually become clear in this round of the low-price cycle, and leading companies are expected to take the lead to break through.

It is noted that although the industry is still in a downturn, the losses of top companies such as Tongwei have been reduced quarter-on-quarter due to their scale and cost advantages. For instance, compared to a loss of over RMB2 billion in Q2, Tongwei’s loss in Q3 was significantly reduced to RMB800 million, showing some improvement.