The pricing dynamics within the photovoltaic industry chain are witnessing a split, with noticeable drops in polysilicon and wafer prices. The dip in wafer prices, in particular, is becoming more pronounced. Conversely, there’s a rising trend in module prices month over month.

As of 14 March, the Silicon Industry Branch of China Nonferrous Metals Industry Association disclosed its latest price monitoring update, highlighting a significant downturn in wafer prices this week.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to the data, the average selling price for M10 mono silicon wafers (182mm/150μm) has fallen to RMB1.95 (US$0.27) per piece, marking a week-on-week decrease of 4.88%. N-type mono silicon wafers (182mm/130μm) saw their average selling price drop to RMB1.87 per piece, with a 4.10% reduction from the previous week. The price for G12 mono silicon wafers (210 mm/150μm) settled at RMB2.74 per piece, decreasing by 2.14% from last week.

The Silicon Industry Branch attributed this significant price drop to irrational market behaviours amid inventory reduction efforts. The current price levels suggest that wafers across various sizes are entering a period of cyclical losses, with n-type wafers experiencing relatively more severe losses due to a significant temporary oversupply.

In response, wafer manufacturers have begun scaling back production. One specialised company has already reduced its output, and two others are planning to cut back significantly.

Infolink has reported a pessimistic outlook in the wafer segment. While polysilicon prices have remained stable for the time being, the cost of materials for n-type crystal growth remains high due to order fulfilment issues. Simultaneously, wafer inventories continue to pile up, leading to a price collapse and putting the overall profitability under scrutiny.

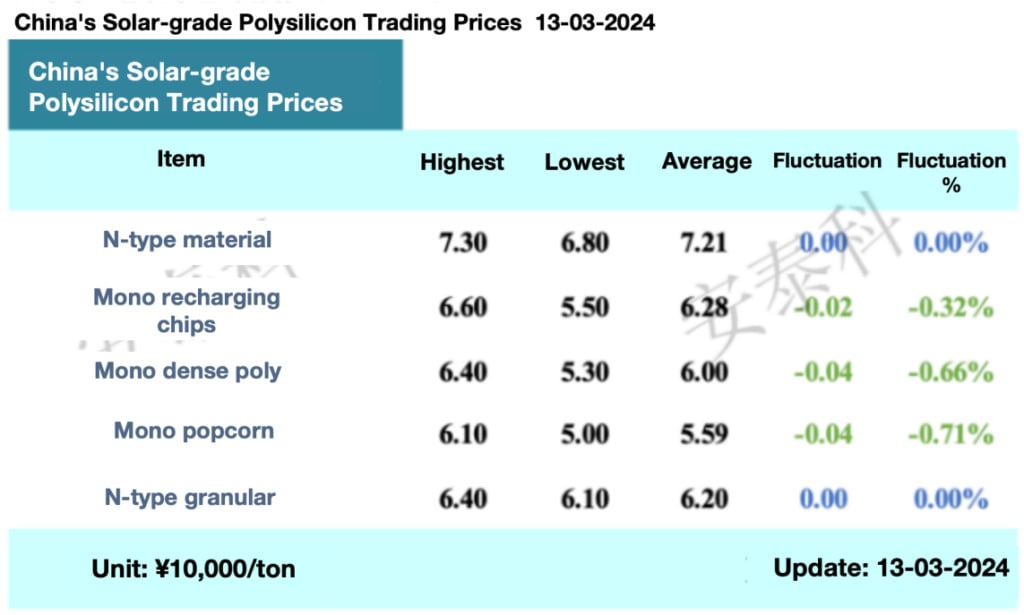

On the polysilicon front, there’s a slight downtrend in prices. The transaction range for mono-dense poly material is currently RMB52,000-64,000 per ton, with an average selling price of RMB60,000 per ton, showing a slight dip of 0.66%.

Only a handful of companies have finalised their orders for the month, leaving others with surplus capacity. Despite a strong inclination to maintain prices, the intense price competition has led to a temporary stall in new orders.

Cell prices find stability, modules tend to inch upwards

Conversely, the cell and module segments are showing a different trend. Cell prices have found a stable footing, and there’s an upward adjustment in module prices.

Per Infolink’s latest data, the price range for p-type M10 cells is between RMB0.38-0.40 per watt, with G12-sized cells maintaining a price range of RMB0.37-0.39 per watt.

In the n-type cell category, TOPCon (M10) cells have held steady, with an average price hovering around RMB0.46-0.47 per watt. Manufacturers producing ultra-high-efficiency n-type cells have seen transactions at RMB0.48 per watt. The price gap between TOPCon and PERC cells is maintained between RMB 0.08-0.09 per watt. High-efficiency HJT (G12) cells have seen prices between RMB0.6-0.7 per watt.

Recent centralised procurement activities by state-owned enterprises for modules indicate a bid price range from RMB0.82 per watt to RMB1.3 per watt, showing a relaxation from January and February prices.

On 14 March, the bidding for the Three Gorges Group’s 2024 centralised procurement of PV modules (first batch) saw participation from 34 module companies. The bids ranged from a low of RMB0.795 per watt to a high of RMB1.003 per watt.

Infolink’s price monitoring for this week pegs PERC double-glass modules at RMB0.85-0.9 per watt, TOPCon modules at RMB0.88-0.96 per watt, and HJT modules at a stable RMB1.04-1.25 per watt.

The firm notes that module manufacturers are still testing the waters with price hikes, with some low-priced orders being fulfilled below RMB0.85. The divergent strategies among module manufacturers complicate overall price increases. As such, the outlook for March remains largely stable, with a slight uptick in the lower price range.