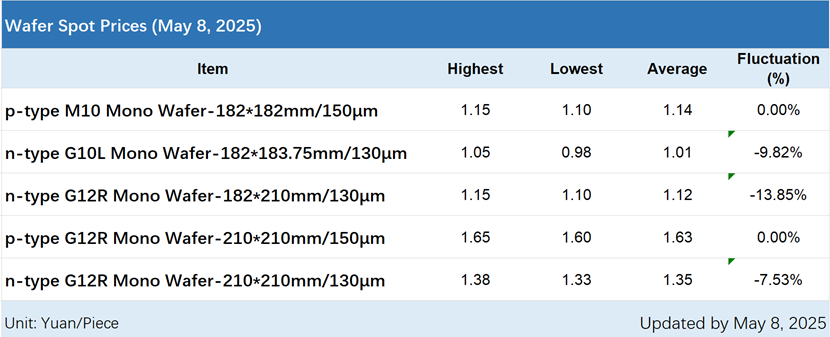

Data from the Silicon Industry Branch published this week (8 May) indicated that Chinese PV wafer prices have been under downward pressure and witnessed a significant decline, with the maximum drop reaching 13.85%.

Among them, the average transaction price of n-type G10L monocrystalline wafers (182*183.75mm/130μm) was RMB1.01/piece (US$0.14/piece), a week-on-week decrease of 9.82%; the average transaction price of n-type G12R monocrystalline wafers (182*210mm/130μm) was RMB1.12/piece, a week-on-week drop of 13.85%; while the average transaction price of n-type G12 monocrystalline wafers (210*210mm/130μm) was RMB1.35/piece, a week-on-week decline of 7.53%.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The Silicon Industry Branch indicated that market sentiment was bearish this week. As the downstream end-user demand has significantly weakened, prices declined across modules and cells. Negotiations between buyers and sellers in the wafer market intensified, and prices continued to drop.

Amid weakening end-user demand expectations, downstream players are seeking lower-priced orders to reduce procurement costs. With the buyer’s market currently holding dominance and some companies prioritising market share and cash flow, wafer prices continue their downward trend. Notably, n-type wafer prices have experienced a sharp decline.

Prices for p-type wafers remained stable, showing no week-on-week fluctuation. The Silicon Industry Branch explained that the minimal price change for p-type wafers was due to the current dominance of n-type products in the domestic market, while p-type wafers are primarily supplied to Southeast Asia as custom orders, with prices negotiated case by case. Due to the weak market trend, the operating rates in the wafer industry have decreased.

This week’s price statistics included data from 12 companies, including LONGi Green, TCL Zhonghuan, JA Solar, JinkoSolar, Solargiga, GokinSolar, HY Solar and Meike Solar.

Statistics show that the overall industry operating rate this week was between 55% and 58%. Two leading companies maintained operating rates of 56% and 58% respectively, while integrated companies operated at 60-80%, and others ranged between 55% and 80%.

As for cells and modules, their prices remained stable without significant fluctuations. According to InfoLink’s price monitoring data, the average prices of 183N, 210RN and 210N n-type cells this week fell to RMB0.265, RMB0.265 and RMB0.28/W respectively. The price ranges settled at RMB0.26-0.275, RMB0.26-0.27 and RMB0.28-0.285/W.

For TOPCon modules, new order prices have fallen to RMB0.65-0.66/W, with some small and medium-sized manufacturers offering even lower prices in the range of RMB0.63-0.65/W. The prices of 182mm PERC bifacial modules ranged from approximately RMB0.62 to RMB0.70/W.

HJT module prices are around RMB0.72-0.85/W, with centralised project prices settling between RMB0.72 and RMB0.75/W.

For BC (back contact) modules, N-TBC prices are currently distributed around RMB0.7-0.8/W, while centralised project prices are in the ranges of RMB0.74-0.75/W.

Looking ahead, the Silicon Industry Branch indicated that the weak end-user demand persists with no immediate signs of recovery, and that the cell/module prices still show signs of further decrease. If the cell and module prices stabilise in the near term, wafer prices may stop falling and become steady. However, if cell and module prices continue to decline amid prevailing market pessimism, wafer prices are likely to continue their downward trend.

Nevertheless, as current wafer prices have already breached some manufacturers’ thresholds, the room for further price declines is expected to be limited.