In the first week of 2024, a number of Chinese PV companies published their first quotes of the year for PV products.

On 3 and 4 January, the Silicon Industry Branch (SIB) of China Nonferrous Metals Industry Association released the latest polysilicon and silicon chip prices. In terms of silicon materials, the n-type price remained relatively stable this week, while the difference in price between n-type and p-type products continued to widen.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

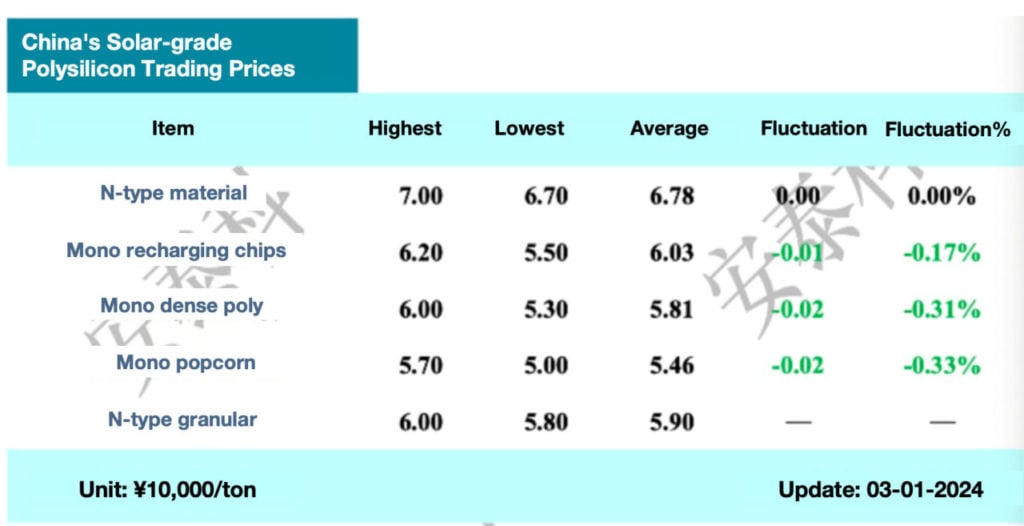

Specifically, the price range of n-type silicon material this week was RMB67,000-70,000/US ton, with the average at RMB67,800 /US ton, which remained flat compared with the previous quarter. The price range of mono dense poly was RMB56,000-60,000/US ton, with the average at RMB58,100/US ton, down 0.31% from the previous quarter; n-type granular silicon trading prices ranged between RMB58,000-60,000/US ton, with the average at RMB59,000 /US ton.

Stable n-type prices

It is worth noting that this week, the SIB added a new section of “n-type granular silicon,” which will be updated weekly to summarise the transaction price trend of granular silicon for producing n-type products.

SIB data shows that the price of n-type silicon material is temporarily stable this week, mainly because the rate of n-type silicon wafer production was stabilised, with some p-type silicon wafer production capacity converted to n-type.

N-type silicon material production can be fully consumed, while p-type is relatively oversupplied, and a decline in downstream p-type silicon wafer production had a significant adverse impact on its price.

At present, high-priced p-type silicon material is more often used to make n-type products, and its price level can be maintained. While the rest of the p-type silicon material prices continued to dip, and with the release of more newly-built capacity, p-type inventories may continue to accumulate.

Industry analysts pointed out that while the price differentiation trend of mono dense poly in China continues, and the price of n-type ingot pulling blocks remains flat. Meanwhile, the price of other mono dense poly material, of lower quality and during new capacity ramp-up, has slowly dropped. The supply of granular silicon is relatively concentrated, with transparent quotes and steadily growing supply.

Compared to the stable pricing of silicon materials, silicon wafer prices continued to decline in the first week of 2024.

Transaction prices fall

Data from the SIB shows that the average transaction price of M10 wafers fell to RMB1.9 /piece, a week-on-week decrease of 1.04%; the average price of n-type wafers dropped to RMB2.10/piece, down 3.67% week-on-week; and the average price for G12 wafers declined to RMB3.00/piece, a 0.66% week-on-week decrease.

The SIB stated that, according to the latest production plans of various companies, silicon wafer output in January 2024 is expected to be around 50GW, a month-on-month decrease of about 16%.The reduction is mainly due to companies lowering their production load. Currently, leading specialised companies are maintaining relatively high operational loads and awaiting further adjustments, but the pace of this cycle may slow down.

Regarding the production of silicon wafers, Taiwan-based consultancy firm InfoLink notes that although most manufacturers have revised down their production plans for January, the scale of the reduction is still insufficient to significantly impact the overall price trend, with the current market atmosphere remaining subdued.

Looking ahead to 2024, it is expected that the price trend of silicon wafers will not see a significant counter-trend rise. Production will continue to be influenced by manufacturers’ operational activities, and specific fluctuations will need to be monitored for further production adjustments before the Spring Festival on 10 February.

Slump in order intake and reduced module production

In the module segment, InfoLink states that the order intake rate for modules in January 2024 is relatively low compared to previous months. Module manufacturers, both major and small to medium-sized, are showing a trend of reduced production, with domestic manufacturing scheduling around 40-41GW, a decline of about 14% compared to the production of approximately 47-48GW in December 2023.

The outlook for orders in February 2024 is still unclear, but given the fewer days in the month, a downward trend in production scheduling is anticipated.

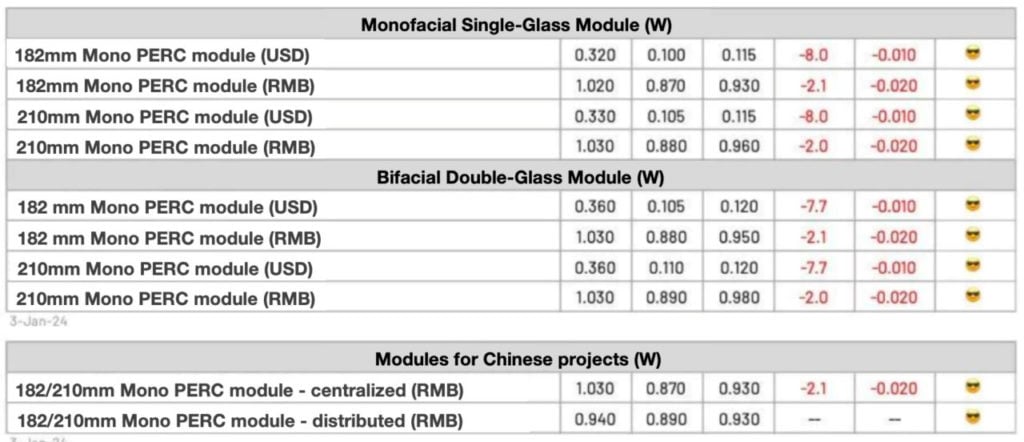

According to price monitoring, this week the price for 182 passivated emitter and rear contact (PERC) modules per watt in executed orders was around RMB0.88-1.03. The price for 210 PERC monofacial modules in ground-mounted projects also saw a downward trend, dropping to about RMB0.89-1.03 /watt.

The closely-watched prices for tunnel oxide passivated contact (TOPCon) modules, with the commencement of new order deliveries, have slightly declined under the influence of spot prices, to about RMB0.88-1.05 /watt. The spot transaction price is around RMB0.9-0.95 /watt, while orders signed earlier were completed at prices ranging from RMB0.98-1.05/watt, indicating significant price differentiation.