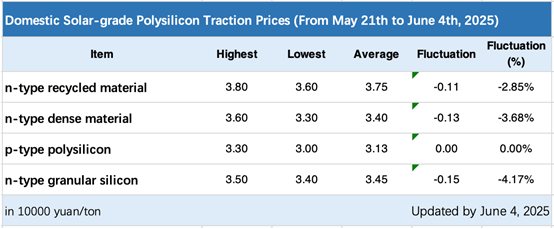

On 4 June, the China Silicon Industry Branch released its latest polysilicon price quotes.

While the price of p-type polysilicon remained stable compared with May’s report, the prices of all other n-type polysilicon series continued to decline, with the average price hitting a low of RMB34,500/ton (US$4,803).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The specific price performance is as follows:

-N-type recycled material: the transaction price ranges from RMB36,000-38,000/ton, with an average price of RMB37,500/ton, marking a 2.85% month-on-month decrease from the end-of-May price of RMB38,600 yuan/ton

-N-type granular silicon: the transaction price ranges from RMB34,000-35,000/ton, with an average price of RMB34,500/ton, which represents a 4.17% month-on-month decrease.

-P-type polysilicon: the transaction price ranges from RMB30,000-33,000 yuan/ton, with an average price of 31,300 yuan/ton, remaining unchanged month-on-month.

The Silicon Industry Branch attributed the recent decline in polysilicon prices chiefly to two factors: bulk sales by producers and downstream companies lowering their expectations for raw material procurement prices. With June orders gradually being confirmed, silicon producers have reluctantly made price concessions after weighing factors like order volumes and production costs, leading to an overall marginal price decline.

Following the conclusion of the recent rush to complete projects ahead of a major change in market rules, prices throughout the PV industry chain have further weakened. Notably, wafer prices have already fallen below the cash cost threshold of most wafer producers, pushing the majority of companies into losses. Consequently, downstream firms’ momentum to reduce silicon procurement prices remains strong, making it increasingly challenging for polysilicon producers to sustain price levels.

The Silicon Industry Branch’s analysis suggests that if prices continue to fall, more producers may accelerate production halts and maintenance measures to navigate extreme market conditions.

Data from the association shows that as of June, there are 11 active polysilicon producers in China, nearly all of which are operating at reduced capacity. In May 2025, China’s polysilicon output reached 101,600 metric tons, representing a 2.52% month-on-month increase.

On 5 June, the Silicon Industry Branch released its latest wafer price quotes:

-N-type G10L mono-crystalline wafers (182*183.75mm/130μm): the average transaction price is RMB0.95/piece, unchanged from the previous week

-N-type G12R mono-crystalline wafers (182*210mm/130μm): the average transaction price is RMB1.10/piece, unchanged from the previous week

-N-type G12 mono-crystalline wafers (210*210mm/130μm): the average transaction price is RMB1.30/piece, unchanged from the previous week.

Silicon Industry Branch data shows that the current overall capacity utilisation rate in the wafer industry is approximately 53%. Other findings include:

-Two leading companies maintain operating rates of 50% and 56% respectively.

-Integrated manufacturers operate at rates ranging from 54-80%.

-Other companies, including LONGi Green, TCL Zhonghuan, JA Solar, JinkoSolar, HY Solar and Gokin Solar, maintain capacity utilisation rates in the range of 54%-80%.

Cell prices have declined slightly, with mainstream prices in China now ranging from RMB0.25-0.26/W, a RMB0.01/W decrease from pre-Dragon Boat Festival levels. Module prices remain relatively stable, with mainstream prices in the range of RMB0.66-0.67/W.

According to Infolink’s price monitoring, during the week of 5 June, the selling price for n-type TOPCon bifacial modules in China ranged from RMB0.60-0.72/W, with bulk transaction prices settling at RMB0.67-0.68/W.

PERC bifacial module prices ranged from RMB0.6-0.7/W. HJT module prices are approximately in the range of RMB0.72-0.83 /W, with centralised project execution prices falling between RMB0.73 and 0.75 yuan/W.

Notably, the Silicon Industry Branch has recently added BC module price quotes for the Chinese market. According to the quotes, n-TBC modules currently have distributed project prices around RMB0.78-0.85/W, while centralised project prices are approximately RMB0.74-0.78/W.

These quoted prices exclude distributor or inventory sales prices.