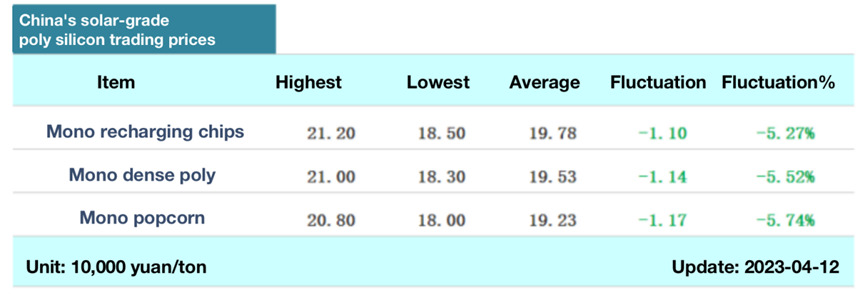

On April 12, the Silicon Industry Branch announced the latest solar-grade polysilicon prices, which were between RMB190-200/kg on average, with the lowest price set at RMB180/kg (US$26.2/kg).

Among different types of polysilicon, mono recharging chip prices ranged between RMB185-212/kg, with an average price of RMB197.8/kg, down by 5.72%.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Moreover, transaction prices for mono-grade dense polysilicon were between RMB183-210/kg, with an average price of RMB195.53/kg, down by 5.52%, while mono popcorn transaction price ranged between RMB180-208/kg, with an average price of RMB192.23/kg, dropping by 5.74%.

Silicon price has been declining recently, witnessing six consecutive drops in less than two days – down by more than RMB40 – and continued to fall this week.

The Silicon Industry Branch pointed out that the main reason lies in a balanced incremental supply and demand of silicon material due to synchronised growth in the output of silicon and wafers. Therefore inventory remained relatively flat, leaving the market no momentum to halt the declining trend.

Why has silicon price trend widened recently?

According to the Silicon Industry Branch, one of the reasons is due to the expansion of the downstream n-type market, including the switch of some n-type silicon demand back to China, which contributed to the increased price difference between n-type silicon and p-type silicon.

Another reason is due in part to the newly built production capacity which continues to ramp up and thus means the product quality is not quite stable. This leads to more supply of relatively lower quality silicon material in the market, which prices are very different from the mainstream market price.

It is worth noticing that wafer prices have been relatively stable despite the fluctuations in silicon prices, as shown in the chart below. Changes in silicon price did not affect wafer quotation as previously expected.

Since the beginning of February wafer prices for 210mm (G12) have been quite stable at an average price of RMB8.2 across the three research firms outlined above, whereas 182mm (M10) wafers latest price (for the week commencing on 10 April) ranged between RMB6.4-6.45.

On 6 April, TCL Zhonghuan announced its latest wafer prices, where 150μm 182mm wafers rose to RMB6.40/piece, while 210mm and 218.2mm wafers dropped to RMB8.05/piece and RMB8.69/piece and down by RMB0.15 and RMB0.16, respectively. As TCL Zhonghuan adjusted its wafer prices, large-scale 210mm wafers and cells gained a slight advantage in cost.