PV wafer and module manufacturer ReneSola reported first quarter 2016 results inline with guidance as the company continues to shift away from its OEM module business and focus on downstream PV power plant projects.

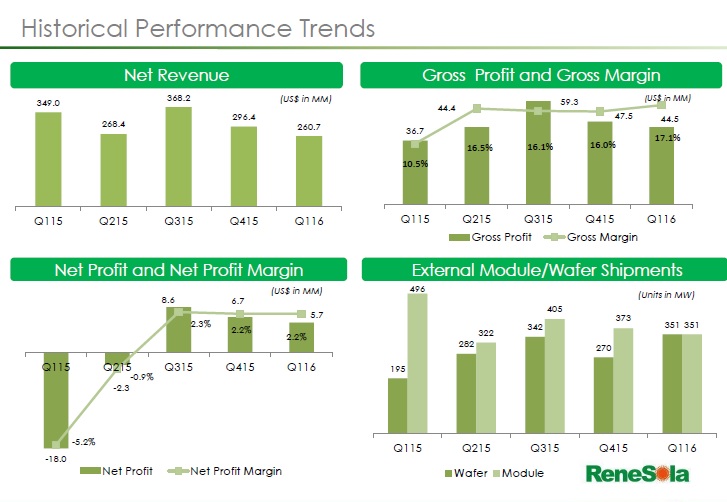

ReneSola reported almost a 30% increase in solar wafer shipments in the first quarter of 2016. Total wafer shipments were 351MW, up 29.8% quarter-on-quarter and up 79.9% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Total external module shipments were 350.7MW, representing a decrease of 6.0% from the previous quarter.

ReneSola reported first quarter revenue of $260.7 million, down 12.0% from the previous quarter. The company noted that the revenue decline reflected lower module ASP’s and lower module shipments to external customers, inline with its shift towards downstream project development.

Gross profit in the quarter was US$44.5 million, down 6.2% on the prior quarter. However, gross margin increased to 17.1% from 16.0% in the prior quarter, due to wafer margin improvement as ASP’s remained strong on overall industry tight supply.

Operating expenses were US$32.3 million in the first quarter of 2016, accounting for 12.4% of revenue, up from 10.3% in the prior quarter.

Operating income was US$12.2 million, compared to operating income of US$16.9 million in the previous quarter. Operating margin decreased sequentially to 4.7% from 5.7% in Q4 of 2015.

Renesola reported net income of US$5.7 million, compared to a net income of US$6.7 million in the previous quarter and a net loss of US$18.0 million in the prior year period.

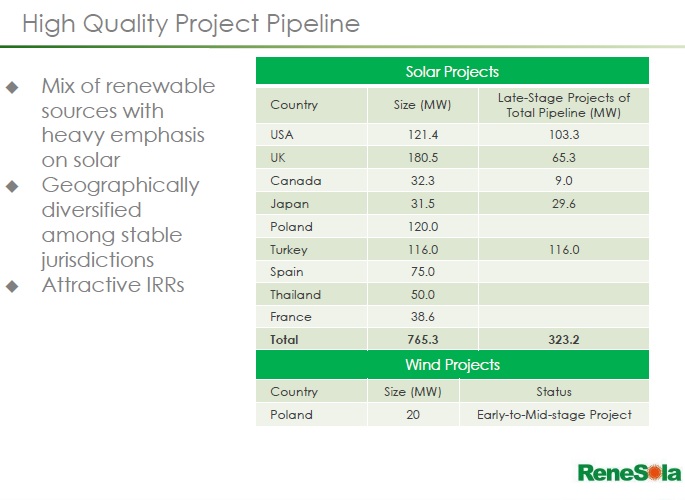

“The quarter played out largely as we had anticipated and was marked by solid growth in the downstream project pipeline, margin improvement, and in-line revenue performance. Despite somewhat negative sentiment in the solar industry during the quarter, we are executing on our strategy to remain a global leader across the solar value chain. We are profitable, with over 700 MW of project pipeline in various development stages, and a flourishing business in LED distribution. Our first quarter results demonstrated the continuation of the successful execution of the new strategy unveiled last year,” commented Xianshou Li, ReneSola's Chief Executive Officer.

Project pipeline update

ReneSola has been able to increase its PV project pipeline since the end of last year. The company noted that the pipeline stood at 785.3MW at different development stages at the end of the first quarter, compared to 641MW at year end.

The company noted that it had connected four utility-scale projects to the UK grid during the quarter with total capacity of approximately 20MW.

Renesola said it sold two projects in Bulgaria in the first quarter of 2016, representing a total of 9.7MW of generating capacity.

Guidance

Renesola said that it expected second quarter 2016 revenue to be in the range of US$280 million to US$290 million and gross margin to be approximately 18%.

The Company reiterated that it expected full-year 2016 revenue to be in the range of US$1.0 to US$1.2 billion, compared to US$1.28 billion in 2015, reflecting the continued reduction in emphasis on module sales.