Indian independent power producer (IPP) ReNew Power posted a 25.6% jump in revenue for the first nine months of the fiscal year 2022 (FY22) compared with the same period in the 2021 fiscal year, while its net losses soared as a result of its August IPO on the NASDAQ.

ReNew’s total revenue for the first nine months of FY22 was INR51,581 million (US$693 million), an increase of 25.6% on the same period in the FY21. The company said the growth was down to an increase in generation capacity and higher wind Plant Load Factor (PLF) as a result of improved wind resources. The PLF for its solar assets remained much the same as last year (22% vs 22.3%).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company’s net loss for the first nine months of FY22 increased substantially, however, as a result of its NASDAQ listing in August 2021. Net losses reached INR12,573 million (US$169 million) compared with INR4,093 million (US$55 million) in FY21.

ReNew said the figure included INR13,158 million (US$177 million) of charges “related to listing on Nasdaq Stock Market, issuance of share warrants, listing related share-based payments and others.”

Other expenses, such as operations and maintenance and general administration, were also up 30% from the first nine months of FY21 to INR6,495 million (US$87 million).

Meanwhile, in Q3 FY22 the developer commissioned 769MW of solar and added 260MW of solar assets via acquisitions. For the first three quarters of FY22, it commissioned 1,325MW of solar capacity.

As of December 31, 2021, its total portfolio consisted of 10,331 MW, including 7.4 GW of commissioned capacity (3,749 MW wind, 3,592 MW solar, and 99 MW hydro) and 2.9 GW committed.

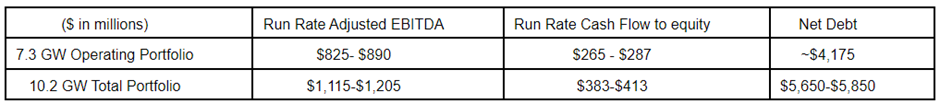

ReNew is reaffirming its run rate adjusted EBITDA of between US$825 to US$890 million as well as its cash flow to equity and net debt guidance for its current operating portfolio of 7.3 GW and total portfolio of 10.2 GW (see table below).