While this show was undoubtedly low key compared to previous years where around 70,000 annual visitors attended, PV Expo, Battery Japan, the International Smart Grid Expo and the other co-located events that took place still had much to offer.

In the first part of this blog, I reflected on the measures taken – in compliance with strict World Health Organisation (WHO) guidelines – that allowed Smart Energy Week to take place in Tokyo just before the end of February.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

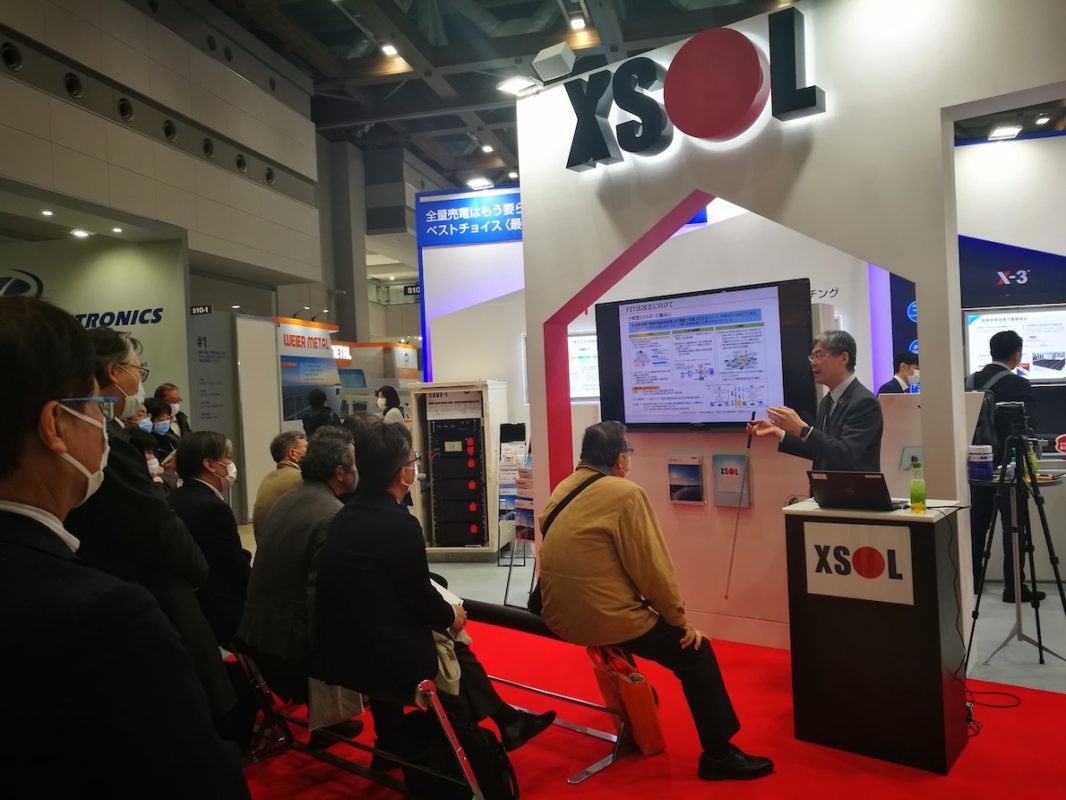

In this second part, we will talk about some of the companies preparing for business in the solar market in post-feed in tariff (FiT) Japan and the close links with energy storage that this market is strongly expected to rely on. This blog was compiled from a blending of interviews conducted after the show as well as during.

‘Repowering’ and climbing up the learning curve

‘Repowering’ was a big buzzword for many of the companies we have spoken to around the Japanese PV market. Basically, with feed-in tariffs (FiTs) very high in the early days of their post-Fukushima introduction, a huge opportunity for developing power plants existed in tandem with an industry still at the low end of its learning curve.

Japanese EPC and O&M provider AfterFIT is among many companies targeting the ‘repowering’ market, in other words, taking already-developed solar farms that were not executed with the leanest cost reduction measures in mind or the highest yields possible and showing their owners and asset managers how they can get the most out of these existing sites.

Nana Shibata, a representative of the company’s engineering division, said that many solar farm owners and even developers are still learning how to select equipment and use their land. AfterFIT has executed its own solar farm research projects in various conditions and types of land to this end and has its own dedicated team of O&M engineers – as opposed to hiring contractors, which many other companies have done. New inverters can add 12% yield, improving cabling configuration can add 10%, taking old panels and replacing them with new bifacial panels can make up to 12.5% improvement, and so on: it all adds up.

Conversely, many expensive panel-cleaning solutions are on offer, including robotic cleaners, which look impressive on an exhibition hall floor, but only offer a 2-3% improvement on yield in some circumstances.

It’s not only in Japan that ‘repowering’ could be a big slice of the PV market. A recent report from IHS Markit showed that the market for replacement inverters could represent an opportunity greater than 8.7GW this year alone. With Japan’s FiT having been introduced eight years ago, replacement inverters for many solar farms will be a going concern even for projects that were fitted with best-in class equipment at the time.

Grid-scale batteries still on the way

Analyst Izumi Kaizuka at Tokyo-headquartered think tank RTS Corporation said in a recent interview that Japan’s industry is learning fast and that cost reductions will not only be necessary but eminently possible for the market going forwards.

Another area where cost reduction is still seen as a necessity is in large-scale battery energy storage. While the country expects to see its offshore wind market finally take off in the coming years, held back for some time due to technical constraints such as the deep seas around Japan, using batteries to store curtailed energy in bulk is not an economically viable option.

Toru Kumagai, country manager in Japan for K2 Management, a multinational technical consulting services company with experience developing wind and other renewable projects in territories including Northern Europe and Asia, said batteries are still “very expensive” and require big companies with large portfolios of assets under development to take on the costs.

Hydrogen and large-scale redox flow battery storage could be the answer for large-scale renewables plants, Kumagai said, although he acknowledged that for balancing local grids and community microgrids, lithium-ion could work, especially due to Japan’s need to import fossil fuels continually. While Japan is on a cost reduction trajectory for hydrogen in particular, targeting specific costs by 2030, batteries will also have a bright future in the next four to five years, however.

Distributed ESS the focus for NEC until large-scale market opens up

Ancillary services and grid-balancing opportunities such as a Balancing Mechanism and Capacity Market are still on their way in Japan. The country’s policymakers are known to be risk averse and are collecting data on everything from grid-scale battery pilot projects and virtual power plants (VPPs) for trials that began two to three years ago.

NEC Corporation, one of the more prolific Japan-headquartered energy storage system (ESS) providers, is known in international markets for its GSS product range (‘Grid-Scale Storage’).

“We do not have much large GSS opportunity here in Japan. We are now focusing on the DSS market rather than GSS,” Seichi Iida, vice president for Asia-Pacific sales at NEC Corporation’s energy solutions: ESS division, said.

Targeting industrial and commercial users such as factories, commercial buildings, supermarkets and so on, the latest all-in-one iteration of NEC’s DSS ”mid-sized storage solution” went on the market in early 2019 and goes from 90kWh to 540kWh capacities and is currently only available in Japan.

The distributed systems are also in use in those VPP pilots around the country and are targeting four main applications:

- Peak shaving – reducing electricity costs by reducing the amount of power drawn from the grid at peak times

- Backup power- resiliency against natural disasters including tsunamis and earthquakes

- VPP demonstration purposes

- Self-consumption of onsite generated solar energy, which Seichi Iida and his colleague, Ryota ‘Michi’ Michino said is “probably the main application” for customers at the moment.

“A lot of people are trying to make money from PV generation and selling that to power companies but the feed-in tariff will soon end. So now, it’s better to use that energy themselves, so they need to have energy storage solutions when they have additional power [generation] installed and they can use that themselves,” Seichi Iida of NEC Corporation said.

Building a PV-plus-battery business ecosystem

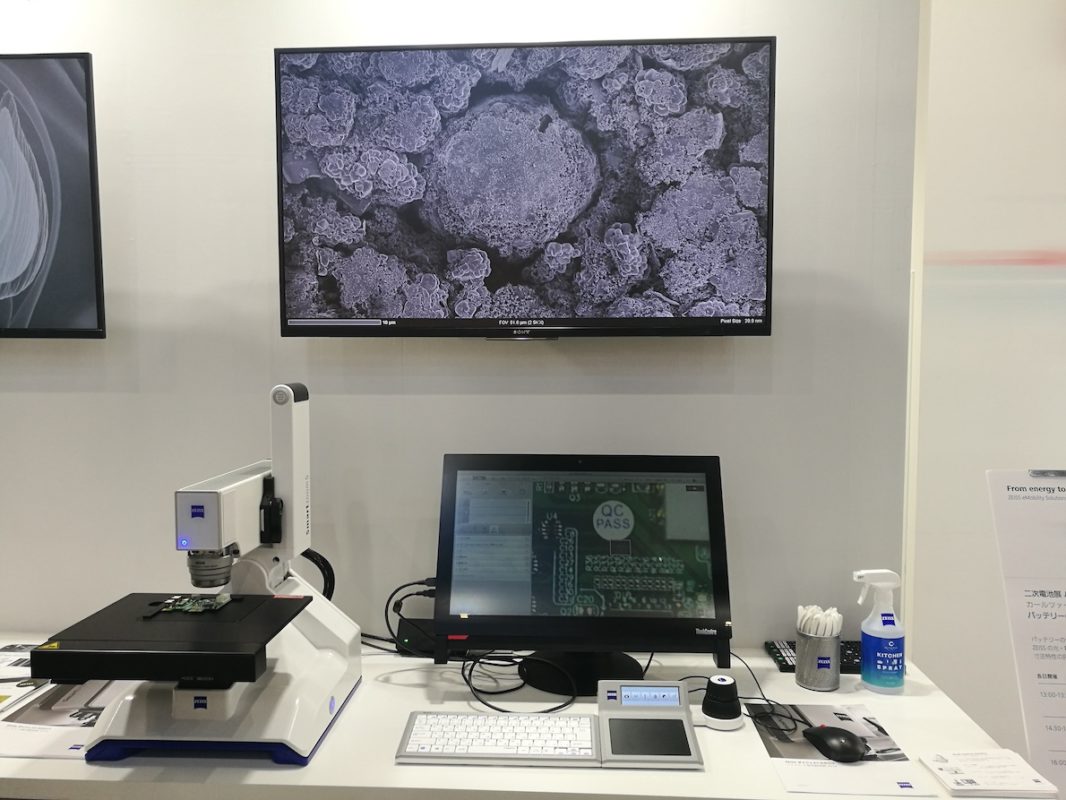

We also saw that while Japan is not a huge manufacturer domestically of lithium batteries compared to neighbours China and South Korea – although Sony is a supplier to Sonnen internationally and lithium-ion batteries in part originated from Osaka in West Japan – it is developing a connected ecosystem for testing and verifying lithium-ion batteries.

As mentioned, the country’s policymakers and regulators always want to see as much hard data as possible around safety and economic viability. This is why, despite the electricity market including retail, undergoing a process of liberalisation, real changes have been gradual in their implementation.

Sharing Energy, a Japanese company which has partnered with Australian energy trading technology company Power Ledger, is offering customers no-money-down solar systems for their houses. Sharing is also among those seeking to aggregate household PV systems with battery storage into virtual power plants and for peer-to-peer energy trading (P2P), but business development head Kaz Iguchi says that the barriers remain high – not dissimilarly to when the likes of Sonnen started doing the same sort of thing in Germany.

The sale of energy back to the grid from batteries (bi-directional power flow) is currently prohibited, while the Balancing Mechanism and Capacity Markets, set to open up in the next couple of years in Japan require around 5MW of capacity to be available for participation. Iguchi of Sharing Energy said that the latter will be a question of continued customer acquisition, while the regulatory space will hopefully begin to catch up to today’s technical developments the more data government departments like the Ministry of Economy, Trade and Industry (METI) are able to collect. Regional utility (and grid) giant TEPCO recently trialled bi-directional power flows with its own renewable energy retail subsidiary, TRENDE.

Perhaps, however, the biggest barrier to renewable energy in Japan is a lack of awareness on climate change issues. With two million rooftop solar systems already sold to households, there is a perception that environmentally aware citizens have already bought in to the solar evolution of the power grid, while the diminishing rates of the feed-in tariff (FiT) are less of a compelling proposition for more economically-driven purchases.

Kaz Iguchi and others said that along with ongoing cost reduction efforts, which must be aggressive, clever business models including third party ownership and ‘zero yen’ installation models have to be found so that the attractiveness of solar and storage can remain high even without premium kilowatt-hour payments.