Despite “breakthrough” renewables growth across Southeast and Eastern Europe, the Caucasus and Central Asia in recent years, more needs to be done to boost deployment and reduce the region’s reliance on Russian energy imports.

That is the findings of the United Nations Economic Commission for Europe’s (UNECE) report, prepared in conjunction with Renewable Energy Policy Network for the 21st Century (REN21), that looked at the status of renewables in 18 countries in the region, including Russia.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It argued that the war in Ukraine will act as a catalyst and will likely boost the long-term prospects for renewable energy development in these countries as they seek to become less dependent on Russian energy imports. But that this will also require strong policy signals, greater investment and the buildout of domestic supply chains.

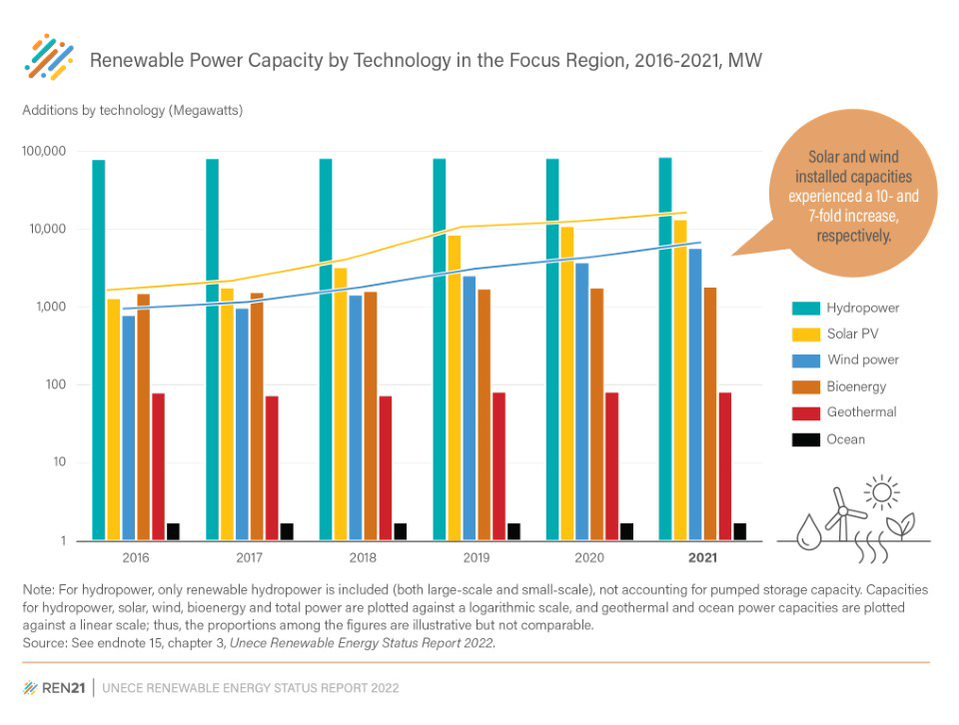

The report showed how, between 2017 and 2021, the countries it analysed added more than 20GW of renewable power, to reach a total installed capacity of more than 100GW.

For the first time, this growth was driven mainly by solar PV (58%) and wind power (25%) additions. The region’s wind power capacity grew more than sevenfold and solar PV capacity by more than 10 between 2017 and 2021.

Ukraine installed the most solar PV and wind power capacity during this period (8.3GW), followed by Kazakhstan (3.7GW) and Russia (3.5GW).

These three countries all ranked among the world’s top 30 countries for renewable energy investment in 2019, with Ukraine ranking 17th (US$3.4 billion), Russian 20th (US$2.3 billion) and Kazakhstan 28th (US$0.8 billion).

All of this, however, was before Russia’s invasion of Ukraine in February 2022. According to the report, the Russian invasion has knocked out 90% of Ukraine’s wind power and 30% of its solar power capacity as of June, representing around a quarter of the total wind capacity and a fifth of the solar capacity in the region.

“The Russian invasion of Ukraine and its spill-over effect on neighbouring countries is undermining renewable energy generation in the short term. At the same time, it has shed new light on the benefits of a rapid energy transition and could bring a surge in renewable installations in the region,” said Rana Adib, REN21’s executive director.

Despite the previously mentioned “breakthrough progress” in renewables – deployment is still below levels required under the Paris Agreement, however – the countries included in the report continue to depend heavily on fossil fuel sources and rely on a limited number of energy exporters, especially Russia.

Of those included in the study, 13 of the 18 countries are highly dependent on energy imports, with four of them – Armenia, Belarus, Georgia and Moldova – importing more than 70% of their total primary energy supply. “Renewables could help countries diversify their energy supply and protect against fluctuating natural gas and oil prices,” said the report.

“Renewable energy growth in the region through 2021 was driven mainly by favourable policies and by the falling costs of renewable energy technologies – but now, energy security is absolutely at the forefront. Moving away from fossil fuel has never been as vital for the region,” said Adib.

In order to do this, the report – which you can read in full here – argued that countries in the region need to invest in domestic renewable supply chains, “untapped” distributed energy resources and transmission infrastructure.

Key to this will be ramping up investment in renewables in a relatively poor part of the world. In 2016, renewable energy investment in the region fell to US$2.7 billion before returning to the 2013 level of US$7.2 billion in 2018, representing around 2.2% of the global total. In comparison, the European Union (EU) invested US$55 billion in renewables in 2018.

“To ensure a low-carbon future with stable energy costs, countries need to commit today to a renewables-based energy system. This can be achieved through policy implementation, long-term funding to grow domestic supply chains and stronger regional co-operation,” said said UNECE Executive Secretary Olga Algayerova.

“Scaling up renewables investment is crucial to strengthen energy security and affordability in light of the energy and financial shocks related to the conflict in Ukraine,” added Algayerova.

The following countries were considered in the report: Albania, Armenia, Azerbaijan, Belarus, Bosnia and Herzegovina, Georgia, Kazakhstan, Kosovo, the Kyrgyz Republic, Moldova, Montenegro, North Macedonia, the Russian Federation, Serbia, Tajikistan, Turkmenistan, Ukraine and Uzbekistan