Solar balance of system (BOS) solutions provider Shoals Technologies saw its Q3 revenues increase 14% year-over-year, but said this rise was less than expected as some customers changed product specifications or delayed shipments due to supply chain issues.

Having reached Q3 2021 revenues of US$59.8 million, Shoals is now forecasting this to fall to US$40 – 50 million in the fourth quarter as the US company revealed several projects it is supplying have been delayed to accommodate design updates due to panel changes or unavailable components, leading it to shift some expected Q4 revenues into Q1 2022.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“The key challenge to our growth is the current supply chain environment,” said Shoals CEO Jason Whitaker, adding that the firm’s customers are still contending with these issues, resulting in fluid delivery schedules as customers make frequent changes, both in terms of product specifications and when they want products on site.

Nonetheless, Shoals has not had to cancel any orders and the form factor of its projects is said to have limited the impact of shipping and logistics shortages on its operations.

Whitaker said the company views the current supply chain conditions as temporary. “We have seen an extraordinary amount of disruption in the global supply chains, but it is clear to us that the market is slowly beginning to normalise. Suppliers are adapting, customers are adapting, logistics providers are adapting,” he said in a conference call with investors.

Shoals ended Q3 with a backlog and awarded orders of US$270.7 million, a new record for the company and an increase of 101% and 35% compared to the same time last year and June 2021 respectively, reflecting demand for its products from US-based customers.

Q3 adjusted EBITDA was US$16.9 million, down 15% on the prior-year period, while gross margin decreased to 36.4% from 39.3% in Q3 2020, partly due to lower-margin components representing a larger share of the product mix.

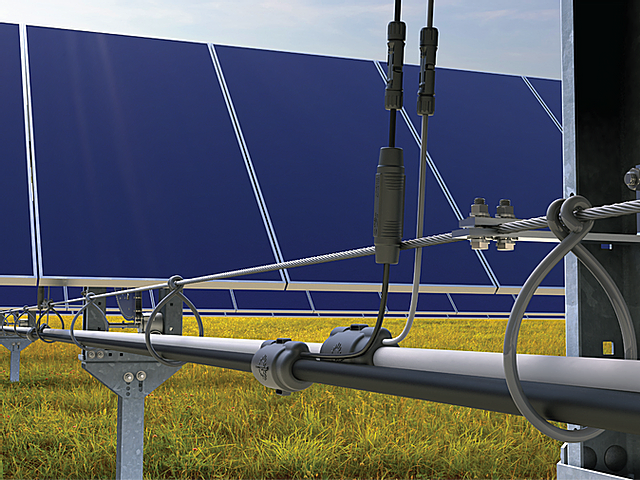

Whitaker said that since the beginning of the year, the number of solar EPCs and developers that use its Big Lead Assembly solution – which combines cable assemblies, combiner boxes and fusing into a single product – has more than quadrupled and there are an additional 12 customers that are currently transitioning to its system.

“We are not just taking a bigger slice of the pie we are in, we are growing the size of the pie available to us by broadening our product portfolio,” Whitaker said. This has been done organically through new product introductions such as wire management solutions and inorganically through the acquisition of ConnectPV, a California-based provider of solar and storage electrical BOS products.

Representing Shoals’ first acquisition, the deal closed in Q3 and is expected to give the company access to additional customers, while bringing it new products targeted specifically to energy storage.

Beyond the weak Q4 guidance, Q1 2022 revenues are expected to be in the range of US$71 – $76 million, a significant jump on the US$45.6 million posted in this year’s first quarter.

Conference call transcript from the Motley Fool.