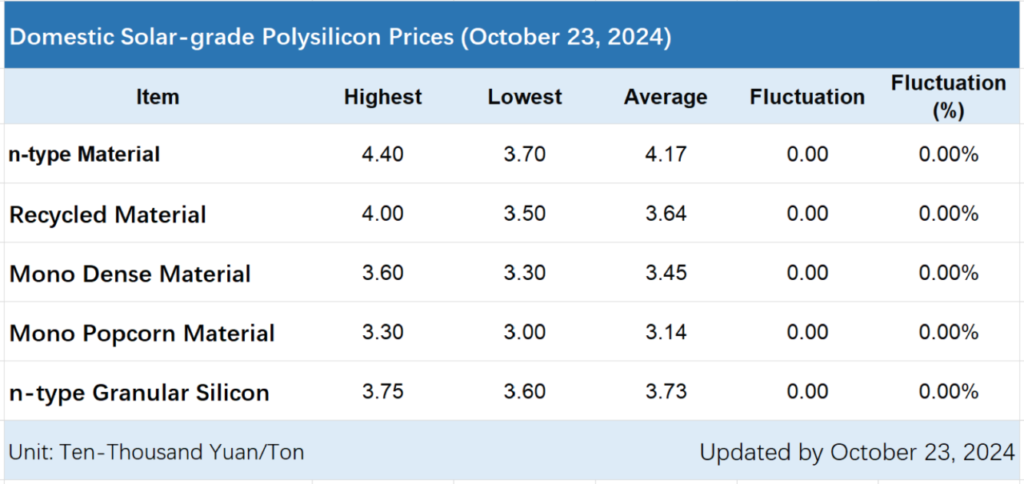

The latest figures from the Silicon Branch of the China Nonferrous Metals Industry Association showed that polysilicon prices have remained flat.

Among them, the trading price of n-type rod silicon remained at RMB37,000-44,000/ton (US$5,191-6,174) averaging at RMB41,700/ton. The trading price of p-type mono-dense material remained at RMB33,000-36,000/ton, averaging at RMB34,500/ton. The trading price of n-type granular silicon remained at RMB36,000-37,500/ton, averaging at RMB37,300/ton.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The trading volume of polysilicon this week was extremely low. The Silicon Industry Branch said that only three companies had a small number of transactions for n-type rod silicon, very few companies traded a certain amount of popcorn coral material, while the rest faced great pressure in order signature. Overall, the price of new orders was essentially stable, with only a slight reduction for some inventory orders, which had a limited impact on the average market price.

Looking ahead, Infolink, another analyst firm, pointed out that the spot inventory of polysilicon on the supply end had continued to rise. Even though the vast majority of companies had lowered their production rates and output, the inventory backlog continued to grow. It is expected that there will still be a decision to be made on whether to reduce production more significantly in the mid-to-late fourth quarter.

According to data from China Customs, polysilicon imports in September 2024 amounted to 2,556.3 tons, down 43.60% month-on-month. The average import price was US$26.68/kg, up 11.54% month-on-month, which was in line with the domestic spot polysilicon price. The polysilicon exports in September were 4,572.3 tons, an increase of 13.10% month-on-month, and the average export price was US$ 8.41/kg, a decrease of 15.22% month-on-month.

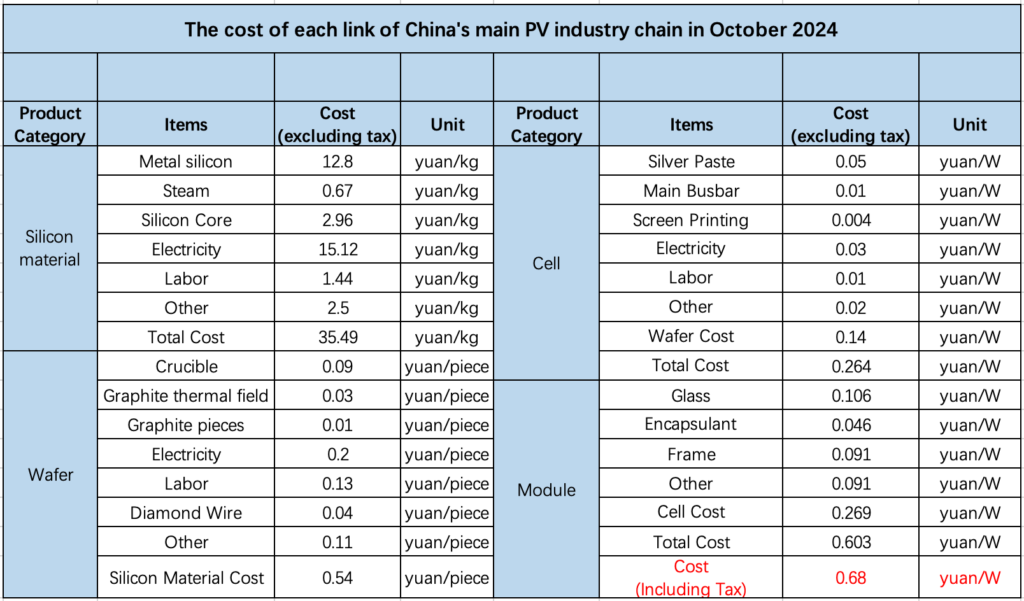

CPIA calls for RMB0.68/watt minimum price for PV modules

Meanwhile, as the upstream silicon prices have stabilised, the downstream module segment, which has been continuously declining, has also seen new developments recently.

On 18 October, the China PV Industry Association (CPIA) released a document outlining a minimum bidding price for modules, in an attempt to curb fierce domestic competition on pricing. It declared that any bids below this minimum threshold would be considered illegal. CPIA calculates in detail the cash cost of n-type 182 glass-glass modules from integrated companies, which stands at RMB0.68/watt.

CPIA said that RMB0.68/watt had been calculated as the lowest module production cost for PV manufacturers to ensure module quality. Bidding below cost is suspected of being illegal.

It is reported that CPIA also organised a symposium against “involution”, where 16 companies, including Tongwei, LONGi, JA Solar, Jinko, Trina Solar and Canadian Solar, reached a consensus on “preventing involution-style vicious competition”.

After the consensus on “anti-vicious competition” was reached, on 22 October, in the latest annual bidding for 1.35GW of China Energy Conservation and Environmental Protection Group (CECEP) PV modules, the bidding price reportedly rose significantly, except for the quotes of two individual manufacturers, which were slightly lower than the

association’s suggested bottom price of RMB0.68/watt. The majority of the quotes from bidding companies were above or equal to RMB0.68/watt.

Judging from the bidding price increase, the “floor price” call from CPIA appears to be effective, but its effects remain to be seen in the long run.

According to Infolink’s price monitoring, module prices have recently started to stalemate, with some manufacturers planning to increase their quotations by 2-3 cents. However, the actual trading price has not yet been realised.

Infolink said that whether the price can be successfully raised still depends on the improvement of market demand and the manufacturers’ strategy. The manufacturers consciously adjusted the output from October to November, and the supply of mainstream TOPCon products was tight.

According to Infolink’s latest price data, the module trading price of China’s centralised PV projects in the week of October 24 still moved down, with the average price falling to between RMB0.64-0.68/watt. The price of distributed projects was stalemated, falling to between RMB0.68-0.73/watt. In general, the average price was still close to RMB0.68-0.7/watt, and the price of 182 PERC glass-glass modules was about RMB0.65-0.76/watt.