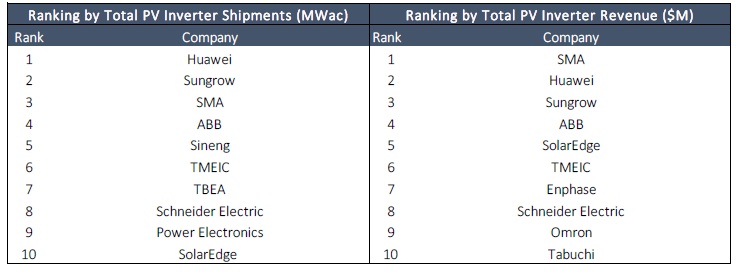

Major PV inverter manufacturer SMA Solar Technology continues to lose market share by shipments, according to the latest research report from GTM Research.

SMA Solar was ranked third largest PV inverter manufacturer in 2015, the first time it has dropped from leading the market.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Two China-based inverter suppliers, Huawei and Sungrow finally surpassed SMA Solar in 2015, primarily due to their strong leadership position in the largest market, China, while SMA Solar’s presence remains limited via its China-based subsidiary Zeversolar.

Separately, SMA Solar posted full-year 2015 financial results with revenue as expected of close to €1 billion (€999.6 million) retaining its leadership position from a revenue perspective. Huawei and Sungrow were ranked behind SMA Solar on revenue by GTM Research.

SMA Solar said that it sold a total output of 7.3GW of PV inverters in 2015, a 43.7% increase over the prior year when inverter output totalled 5.1GW. However, due to well known inverter ASP declines, SMA Solar reported only a 24% increase in annual revenue.

The situation is unlikely to change in 2016. SMA Solar guided revenue of €950 million to €1,050 million, around 5% growth on the high-end of guidance. The company did not highlight shipment guidance to support the revenue forecast.

Key markets for SMA Solar in 2015 were the US, UK, Japan and Australia with utility-scale central PV inverters being the dominant product, accounting for €416 million of total sales, followed by flat residential sales of €253 million and commercial sector inverter sales of €207 million. Service sector sales fell slightly to €116 million from €132 million in 2014.

However, despite strong utility-scale central inverter sales in the US and UK in 2015, GTM Research noted an important shift in product selection in this sector.

Scott Moskowitz, an analyst with GTM Research said, “Huawei has upended the notion that string inverters would be used in place of central inverters in small and progressively larger utility projects. The company has committed to a fully string inverter portfolio, employing their devices in some of the largest solar power plants in the world.”

Another key shift with the utility-scale market is the migration to 1,500V central inverters that reduce the LCOE of PV power plants.

According to GTM Research, General Electric gained significant market share in 2015, climbing ten ranking spots to number twelve, due to growth in shipments of its 1,500V central inverters and was the first to introduce this type of inverter, heavily used by the likes of First Solar and Belectric.

The market research firm also noted that the overall PV inverter market was becoming increasingly consolidated, with the top ten inverter vendors accounting for 75% of global shipments in 2015, up from 69% in 2014.

The rankings were said to reflect the makeup of the global market as the top nine vendors were comprised entirely of companies with strong utility-scale product offerings in the major solar markets.