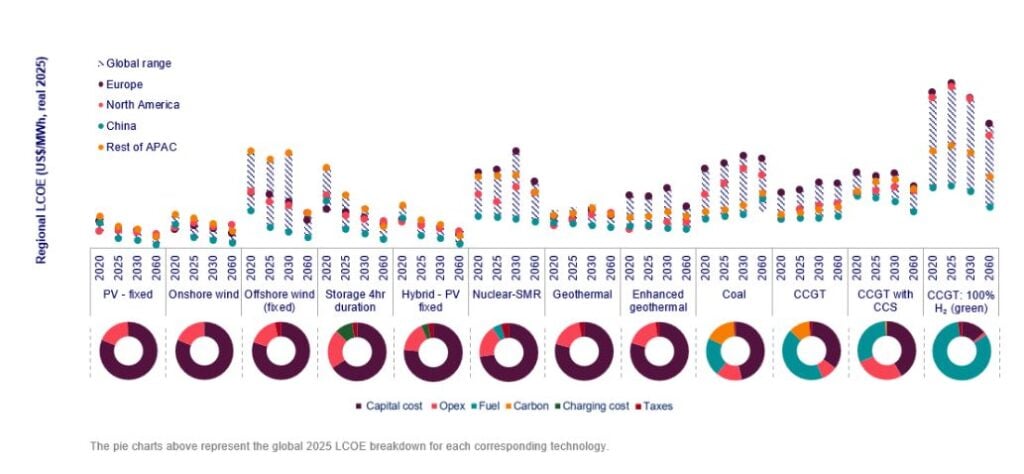

Solar PV technology has maintained its leading position as the most cost-competitive power generation source in 2025, according to analyst Wood Mackenzie.

The Middle East and Africa achieved the lowest levelised cost of electricity (LCOE) among regions in 2025, with an LCOE of US$37/MWh, while the LCOE of utility-scale solar PV in China reached US$27/MWh.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Wood Mackenzie forecasts continued improvements in module efficiency and supply chain stabilisation to drive further down the costs across all major regions.

In Asia-Pacific, the LCOE for utility-scale solar ranges from the US$27/MWh in China to Japan’s US$118/MWh. China also achieved the lowest LCOE for storage in 2025, as it maintained a competitive advantage in energy storage costs, according to WoodMac.

Moreover, hybrid solar-plus-storage projects have gained momentum in the region, according to Wood Mackenzie. This is due to the costs of batteries falling and an improvement in efficiency, with Australia stabilising solar through batteries and India pushing hybrid systems towards grid parity.

“The global energy transition is accelerating at an unprecedented pace, with renewable technologies achieving cost parity with conventional generation across all major markets.

“Our LCOE 2025 analysis reveals that solar PV and onshore wind have become the dominant low-cost options worldwide, whilst hybrid systems and battery storage are rapidly closing the competitiveness gap,” said Amhed Jameel Abdullah, senior research analyst at Wood Mackenzie.

In Europe, the LCOE for single-axis tracker solar PV declined by 10% in 2025, due to the module price decrease. Wood Mackenzie also forecasts a 49% decline by 2060 in commercial distributed solar LCOE, with Southern and Eastern European markets ranking highest in solar revenue surplus.

In terms of energy storage, the region will see the LCOE of 4-hour duration battery storage costs fall below US$100/MWh by 2026, while further dropping by 35% by 2060.

Furthermore, despite policy challenges, renewable technology costs in North America will decline to 2060. In the short term, US solar costs have increased due to the latest tariffs. Wood Mackenzie adds that advances in modules, inverters and tracker technologies will drive long-term prices down. Residential solar faces similar challenges in the short term due to the tariffs and Section 25D tax credits phasing out at the end of the year.

The average LCOE for renewables in Latin America has decreased by 23% between 2020 and 2024. This was motivated by improved performance and a 20% reduction in capital costs per kilowatt-hour. Commercial solar PV achieved the lowest average LCOE in the region, with single-axis solar PV delivering the most competitive utility-scale generation costs in 2025.

As more countries are implementing policies to support the deployment of energy storage, its LCOE is forecast to decrease by 24% by 2060 in Latin America.

Finally, in the Middle East and Africa, the LCOE of solar PV and wind continued to decrease in 2025, falling 6% to 10% year-on-year. The high levels of irradiation and robust net capacity factors ensure utility-scale solar PV has the lowest prices in the region, setting prices for other technologies, in particular in Saudi Arabia and the United Arab Emirates. By 2060, single-axis tracker PV costs are forecast to be around US$17/MWh. In those two countries, costs for energy storage are expected to decline 7% to 9% by 2034.